It is not uncommon to see companies perform well in the years after insiders buy shares. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So we'll take a look at whether insiders have been buying or selling shares in Aranjin Resources Ltd. (CVE:ARJN).

Do Insider Transactions Matter?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, rules govern insider transactions, and certain disclosures are required.

Insider transactions are not the most important thing when it comes to long-term investing. But it is perfectly logical to keep tabs on what insiders are doing. For example, a Harvard University study found that 'insider purchases earn abnormal returns of more than 6% per year'.

View our latest analysis for Aranjin Resources

The Last 12 Months Of Insider Transactions At Aranjin Resources

The Chairman Matthew Western Wood made the biggest insider purchase in the last 12 months. That single transaction was for CA$151k worth of shares at a price of CA$0.10 each. So it's clear an insider wanted to buy, even at a higher price than the current share price (being CA$0.04). It's very possible they regret the purchase, but it's more likely they are bullish about the company. To us, it's very important to consider the price insiders pay for shares. As a general rule, we feel more positive about a stock if insiders have bought shares at above current prices, because that suggests they viewed the stock as good value, even at a higher price.

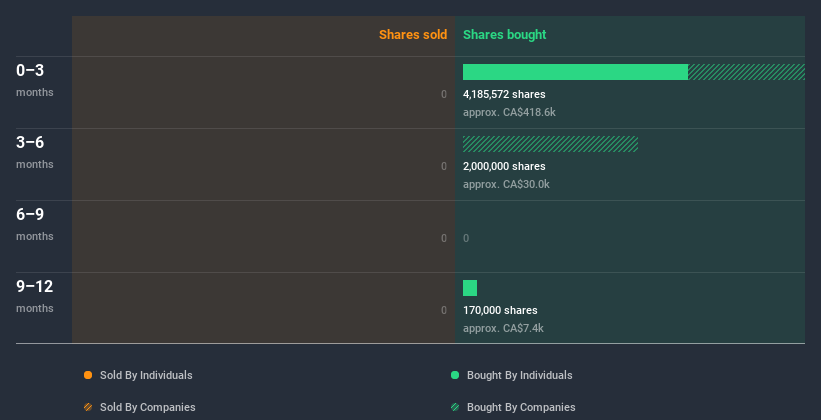

Aranjin Resources insiders may have bought shares in the last year, but they didn't sell any. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

There are always plenty of stocks that insiders are buying. So if that suits your style you could check each stock one by one or you could take a look at this free list of companies. (Hint: insiders have been buying them).

Insiders at Aranjin Resources Have Bought Stock Recently

It's good to see that Aranjin Resources insiders have made notable investments in the company's shares. Overall, two insiders shelled out CA$257k for shares in the company -- and none sold. This could be interpreted as suggesting a positive outlook.

Insider Ownership of Aranjin Resources

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. We usually like to see fairly high levels of insider ownership. Insiders own 11% of Aranjin Resources shares, worth about CA$921k, according to our data. But they may have an indirect interest through a corporate structure that we haven't picked up on. We do generally prefer see higher levels of insider ownership.

So What Do The Aranjin Resources Insider Transactions Indicate?

It is good to see recent purchasing. We also take confidence from the longer term picture of insider transactions. However, we note that the company didn't make a profit over the last twelve months, which makes us cautious. On this analysis the only slight negative we see is the fairly low (overall) insider ownership; their transactions suggest that they are quite positive on Aranjin Resources stock. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. You'd be interested to know, that we found 5 warning signs for Aranjin Resources and we suggest you have a look.

Of course Aranjin Resources may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade Aranjin Resources, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Trinity One Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSXV:TOM

Trinity One Metals

Engages in the exploration, development, and acquisition of mineral properties in Mongolia and Australia.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026