- Canada

- /

- Metals and Mining

- /

- TSXV:ALM

Such Is Life: How Alliance Mining (CVE:ALM) Shareholders Saw Their Shares Drop 70%

Generally speaking long term investing is the way to go. But along the way some stocks are going to perform badly. Zooming in on an example, the Alliance Mining Corp. (CVE:ALM) share price dropped 70% in the last half decade. We certainly feel for shareholders who bought near the top. And it's not just long term holders hurting, because the stock is down 70% in the last year.

See our latest analysis for Alliance Mining

Alliance Mining hasn't yet reported any revenue yet, so it's as much a business idea as a business. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, investors may be hoping that Alliance Mining finds some valuable resources, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some Alliance Mining investors have already had a taste of the bitterness stocks like this can leave in the mouth.

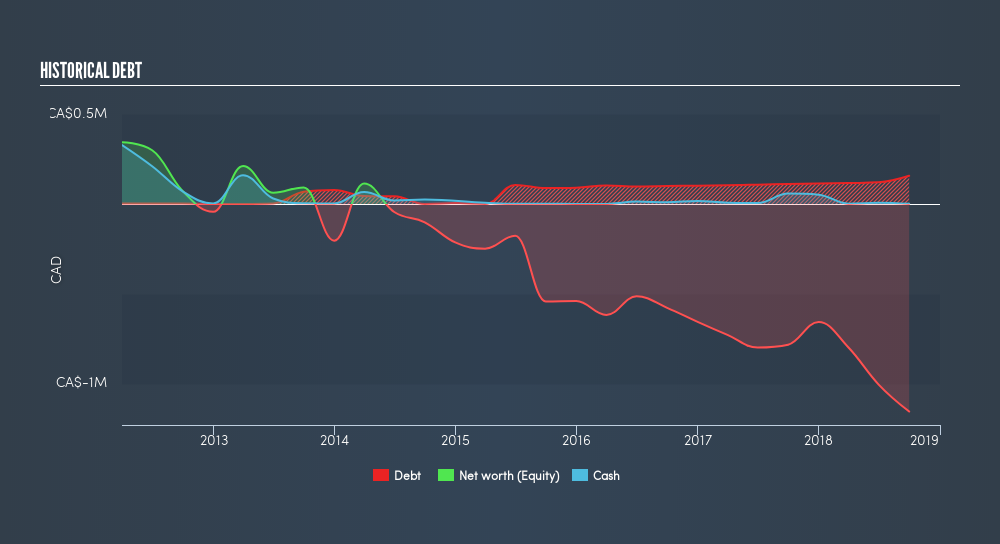

Alliance Mining had net debt of CA$1,158,199 when it last reported in September 2018, according to our data. That makes it extremely high risk, in our view. But with the share price diving 21% per year, over 5 years, it's probably fair to say that some shareholders no longer believe the company will succeed. The image belows shows how Alliance Mining's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. What if insiders are ditching the stock hand over fist? I would feel more nervous about the company if that were so. You can click here to see if there are insiders selling.

A Different Perspective

Alliance Mining shareholders are down 70% for the year, but the market itself is up 2.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 21% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before spending more time on Alliance Mining it might be wise to click here to see if insiders have been buying or selling shares.

For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSXV:ALM

Alliance Mining

Engages in the acquisition, exploration, and development of mineral properties in Canada.

Moderate with weak fundamentals.

Market Insights

Community Narratives