- Canada

- /

- Metals and Mining

- /

- TSXV:ALDE

TSX Penny Stocks To Monitor In May 2025

Reviewed by Simply Wall St

The Canadian market has recently reached new all-time highs, demonstrating resilience amid global economic uncertainties. For investors looking to explore beyond the large-cap realm, penny stocks offer intriguing opportunities. While the term "penny stock" may seem outdated, it still signifies smaller or emerging companies that can provide significant value when supported by strong financials and growth potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.80 | CA$79.91M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.44 | CA$91.82M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.38 | CA$136.04M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.07 | CA$537.5M | ✅ 4 ⚠️ 2 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.78 | CA$447.75M | ✅ 3 ⚠️ 2 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.65 | CA$3.6M | ✅ 2 ⚠️ 5 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.60 | CA$539.88M | ✅ 3 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.61 | CA$132.47M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.45 | CA$12.89M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.39 | CA$52.9M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 902 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Amerigo Resources (TSX:ARG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amerigo Resources Ltd., operating through its subsidiary Minera Valle Central S.A., focuses on the production of copper and molybdenum concentrates in Chile, with a market cap of CA$283.88 million.

Operations: The company generates its revenue primarily from the production of copper concentrates under a tolling agreement with DET, amounting to $192.03 million.

Market Cap: CA$283.88M

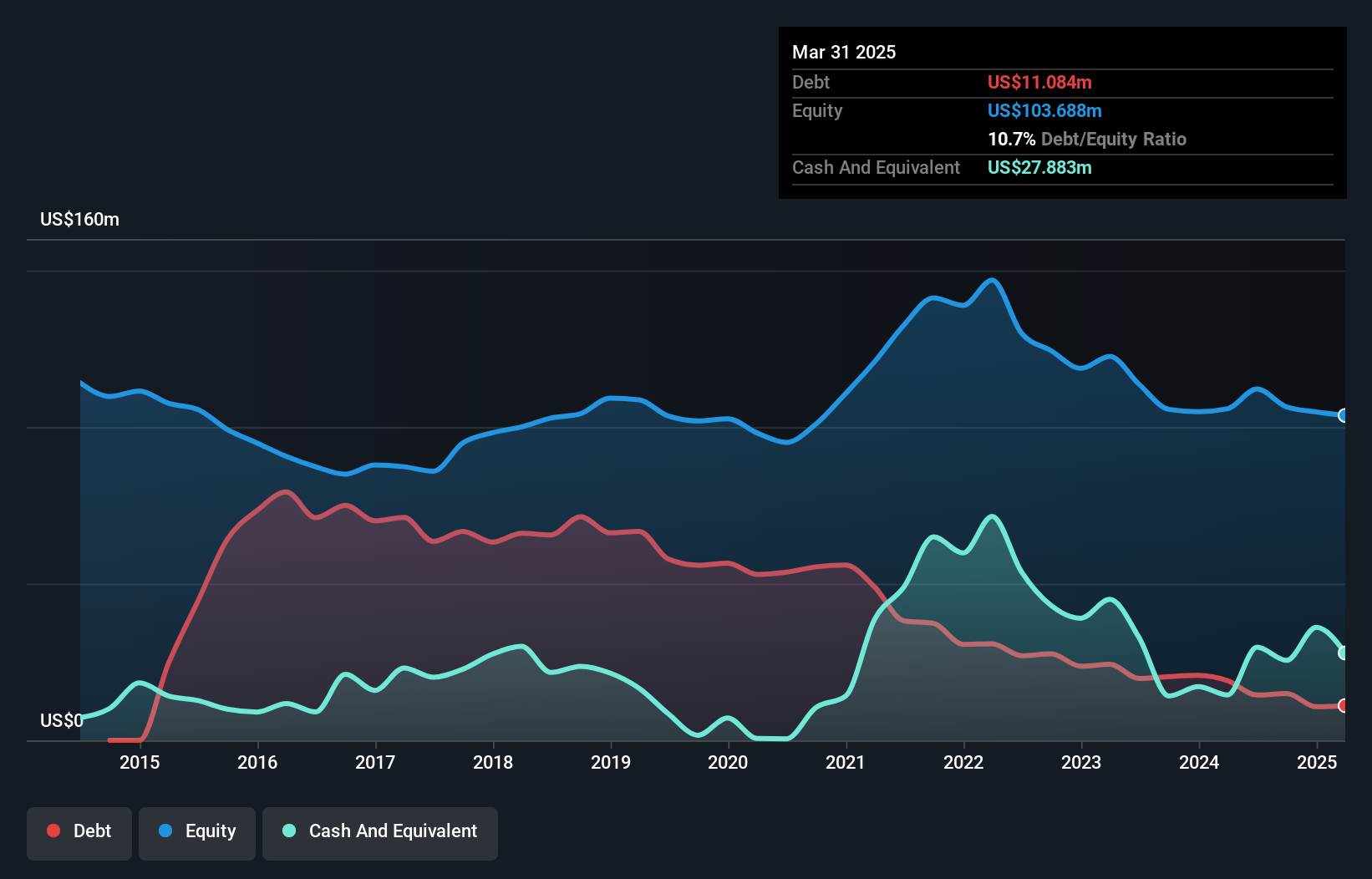

Amerigo Resources Ltd. has shown resilience as a penny stock with a market cap of CA$283.88 million, achieving profitability in the past year. The company reported Q1 2025 sales of US$44.18 million and net income of US$3.3 million, despite slight declines from the previous year. Amerigo's interest payments are well-covered by EBIT, and its debt is effectively managed with operating cash flow coverage at 515%. While short-term liabilities exceed assets slightly, long-term liabilities are covered by short-term assets. The board and management team bring significant experience, supporting strategic stability amid insider selling concerns over recent months.

- Get an in-depth perspective on Amerigo Resources' performance by reading our balance sheet health report here.

- Assess Amerigo Resources' future earnings estimates with our detailed growth reports.

Calibre Mining (TSX:CXB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Calibre Mining Corp., along with its subsidiaries, is involved in the exploration, development, and mining of gold properties and has a market cap of CA$2.48 billion.

Operations: The company generates revenue primarily from its operations in the United States, amounting to $84.05 million.

Market Cap: CA$2.48B

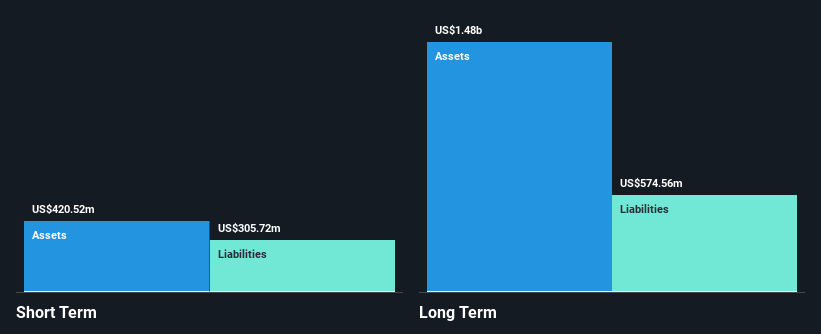

Calibre Mining Corp., with a market cap of CA$2.48 billion, has shown significant growth in its recent earnings report, posting Q1 2025 sales of US$202.62 million and net income of US$22.6 million, reversing a loss from the previous year. The company's debt is well-managed with satisfactory coverage by operating cash flow, though short-term assets do not cover long-term liabilities fully. Calibre's board and management are experienced, providing stability during its merger process with Equinox Gold Corp., which has been approved by shareholders and awaits final regulatory approvals for completion by Q2 2025's end.

- Jump into the full analysis health report here for a deeper understanding of Calibre Mining.

- Explore Calibre Mining's analyst forecasts in our growth report.

Aldebaran Resources (TSXV:ALDE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aldebaran Resources Inc. is involved in the acquisition, exploration, and evaluation of mineral properties in Canada and Argentina, with a market cap of CA$265.07 million.

Operations: There are no reported revenue segments for the company.

Market Cap: CA$265.07M

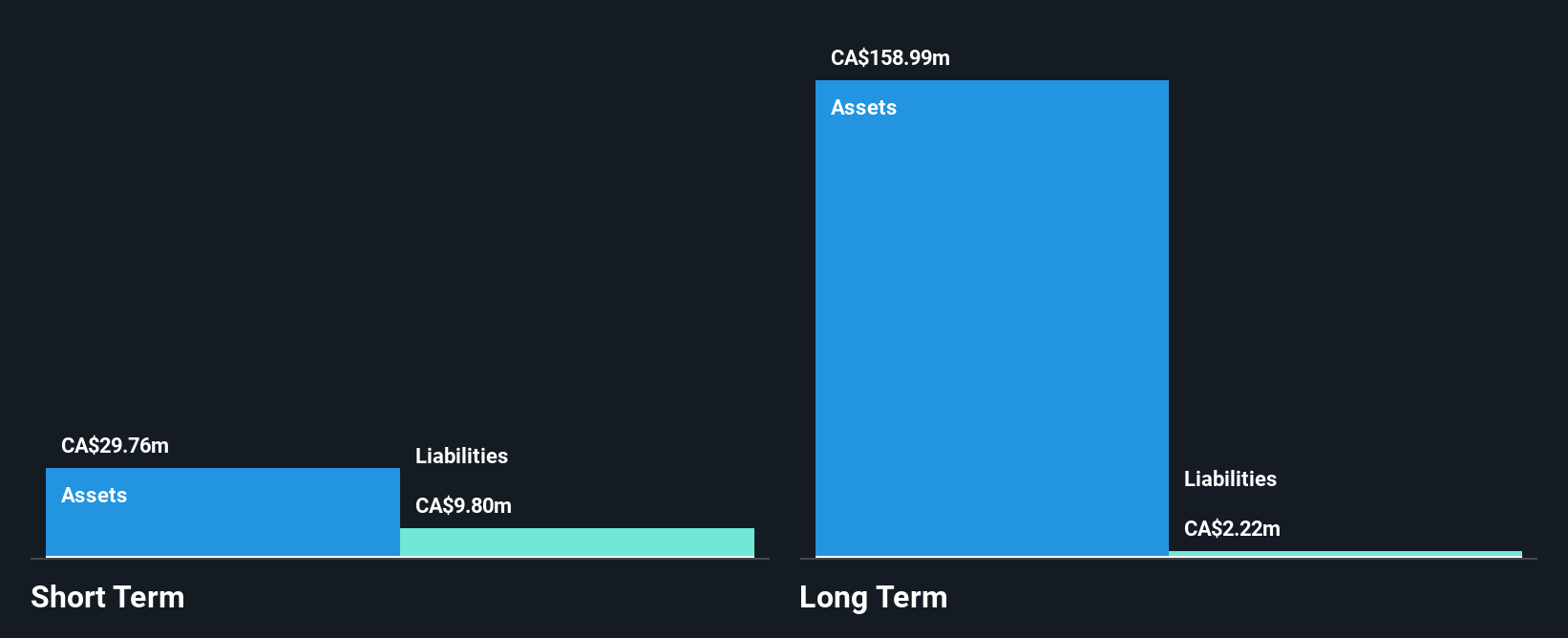

Aldebaran Resources, with a market cap of CA$265.07 million, is pre-revenue and focuses on mineral exploration in Canada and Argentina. The company recently expanded its interest in the Altar project to 80%, transitioning it into a joint venture. Despite lacking revenue, Aldebaran's short-term assets of CA$14.3 million cover both short- and long-term liabilities effectively, supported by an experienced management team with an average tenure of 6.9 years. Analysts suggest potential stock price growth, though the company's low return on equity reflects ongoing challenges typical for pre-revenue entities in the mining sector.

- Click to explore a detailed breakdown of our findings in Aldebaran Resources' financial health report.

- Learn about Aldebaran Resources' historical performance here.

Where To Now?

- Investigate our full lineup of 902 TSX Penny Stocks right here.

- Seeking Other Investments? Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ALDE

Aldebaran Resources

Engages in the acquisition, exploration, and evaluation of mineral properties in Canada and Argentina.

Excellent balance sheet and fair value.

Market Insights

Community Narratives