The Canadian market has shown resilience, bolstered by easing monetary policies and strong performance in key sectors like financials and materials. Amid these positive trends, penny stocks remain a relevant investment area for those looking to explore opportunities beyond established companies. While the term 'penny stock' might seem outdated, it still points to smaller or newer companies that can offer significant value when backed by solid financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.35 | CA$157.09M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.68 | CA$280.2M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.43 | CA$12.46M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.35 | CA$112.45M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$565.76M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.21 | CA$347.6M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$210.78M | ★★★★★☆ |

| Silvercorp Metals (TSX:SVM) | CA$4.39 | CA$981.2M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.155 | CA$5.03M | ★★★★★★ |

Click here to see the full list of 916 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

SOL Global Investments (CNSX:SOL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SOL Global Investments Corp. is a private equity firm focusing on growth capital for small and mid-sized businesses, with a market cap of CA$11.98 million.

Operations: The company's revenue segment includes Pharmaceuticals, which reported CA$-38.51 million.

Market Cap: CA$11.98M

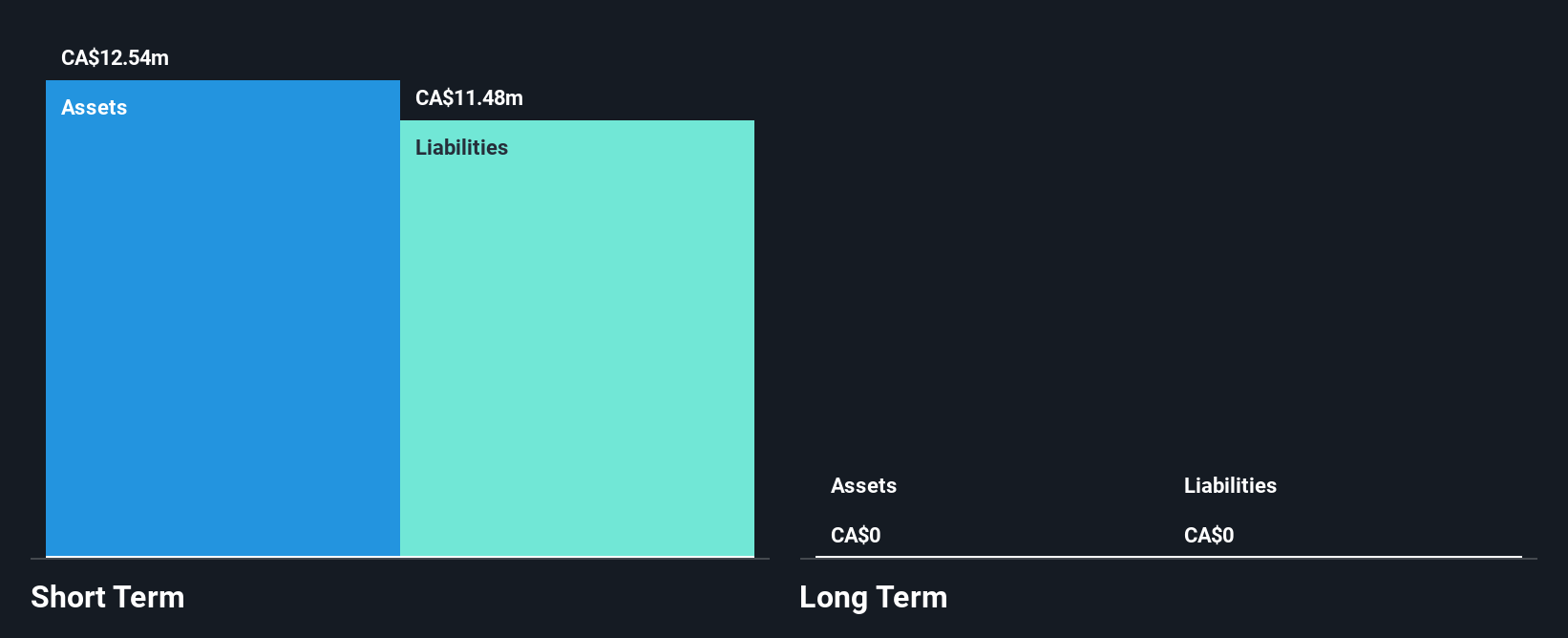

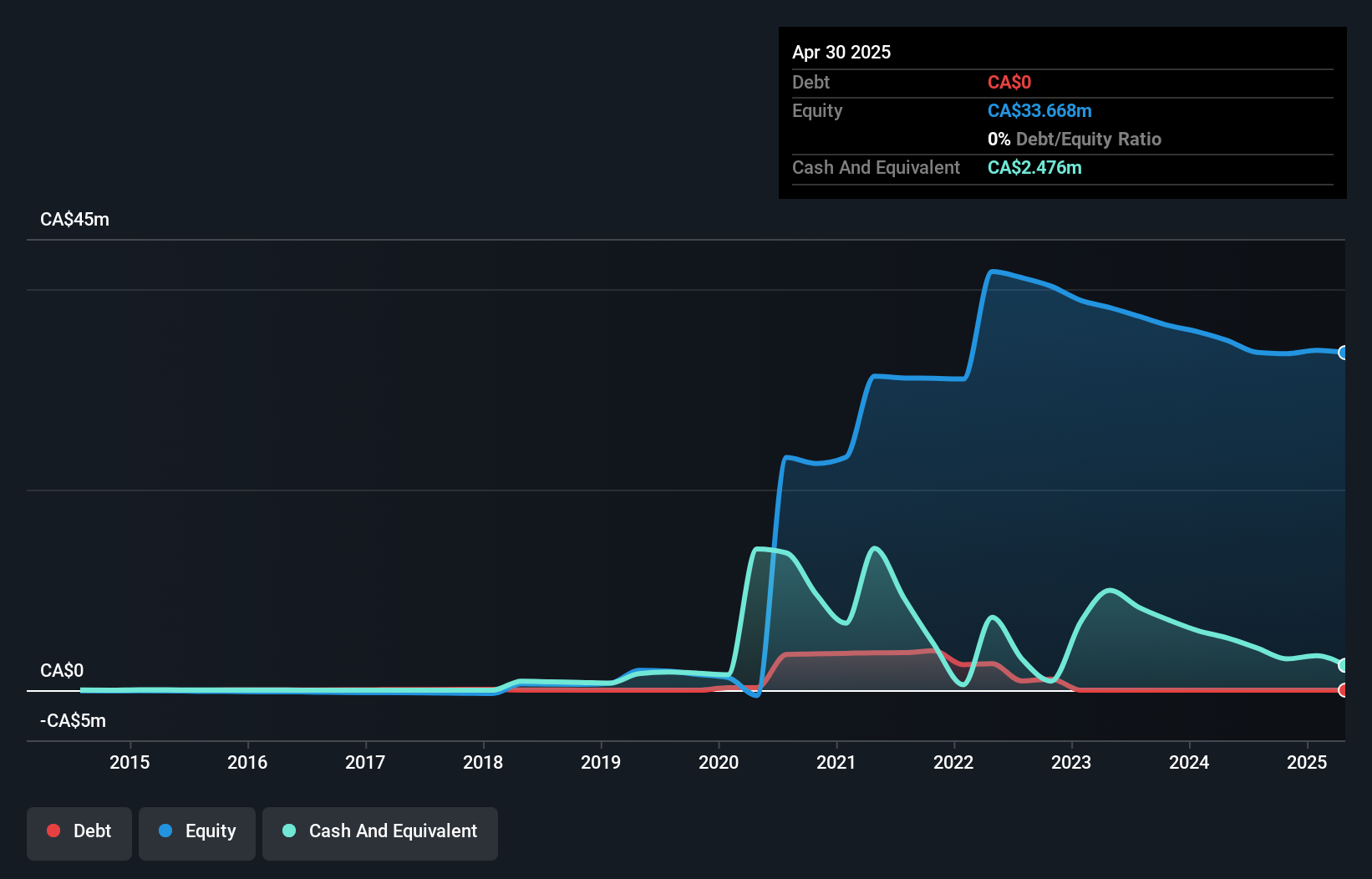

SOL Global Investments Corp., with a market cap of CA$11.98 million, is pre-revenue and unprofitable, reporting a net loss of CA$2.99 million for Q3 2024. Despite high volatility and negative return on equity, the company has more cash than debt and sufficient short-term assets to cover liabilities. Recent private placements raised CA$3.6 million through the issuance of units priced at CA$0.2 each, including warrants exercisable at CA$0.3 per share over two years, reflecting efforts to bolster financial stability amidst ongoing challenges in achieving profitability or significant revenue growth.

- Click here and access our complete financial health analysis report to understand the dynamics of SOL Global Investments.

- Gain insights into SOL Global Investments' past trends and performance with our report on the company's historical track record.

Clean Air Metals (TSXV:AIR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Clean Air Metals Inc. is a Canadian exploration company focused on identifying, acquiring, exploring, and developing mineral properties, with a market cap of CA$12.78 million.

Operations: Clean Air Metals Inc. does not currently report any revenue segments.

Market Cap: CA$12.78M

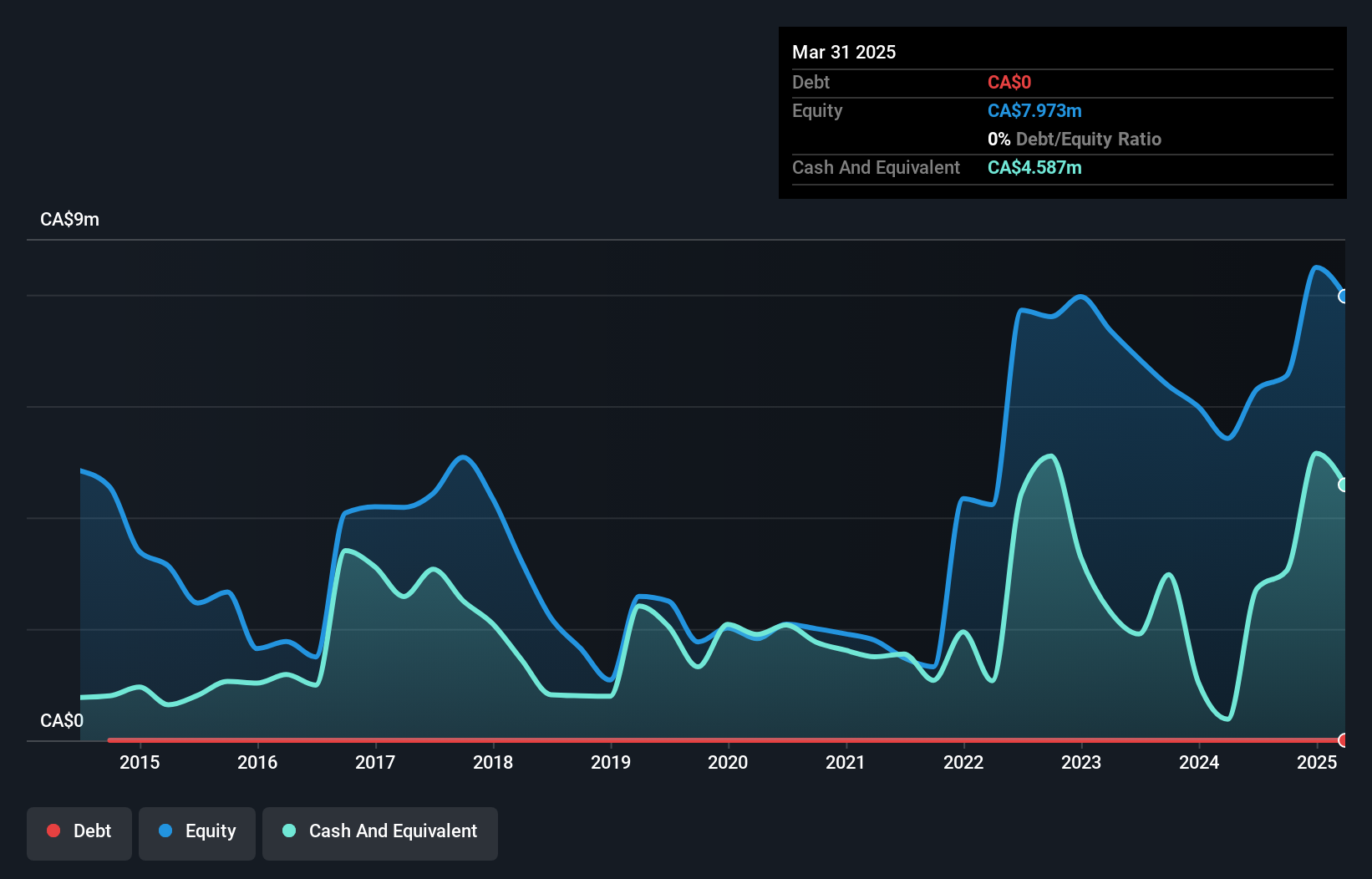

Clean Air Metals Inc., with a market cap of CA$12.78 million, is a pre-revenue exploration company focusing on its Thunder Bay North Project. Recent announcements highlight promising survey results suggesting potential extensions of high-grade mineralization at the Escape conduit. Despite being debt-free and having short-term assets exceeding liabilities, the company faces challenges with less than a year of cash runway and increased share dilution over the past year. Management's limited experience and heightened stock volatility present additional risks, but ongoing exploration efforts aim to enhance resource estimates and develop high-grade mining strategies.

- Navigate through the intricacies of Clean Air Metals with our comprehensive balance sheet health report here.

- Understand Clean Air Metals' track record by examining our performance history report.

Lara Exploration (TSXV:LRA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lara Exploration Ltd., with a market cap of CA$69.21 million, is involved in the acquisition, exploration, development, and evaluation of mineral properties in Brazil, Peru, and Chile through its subsidiaries.

Operations: Lara Exploration Ltd. does not report any revenue segments.

Market Cap: CA$69.21M

Lara Exploration Ltd., with a market cap of CA$69.21 million, is a pre-revenue company engaged in mineral exploration in South America. Recent earnings showed improvement, with net income reported for the third quarter and nine months ending September 2024. The company's Planalto Copper-Gold Project in Brazil has revealed significant mineral resources, indicating potential for future development. However, Lara faces financial challenges with less than a year of cash runway and recent shareholder dilution. Despite being debt-free and having experienced management and board members, its unprofitability poses risks to investors seeking stability.

- Jump into the full analysis health report here for a deeper understanding of Lara Exploration.

- Evaluate Lara Exploration's historical performance by accessing our past performance report.

Where To Now?

- Explore the 916 names from our TSX Penny Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:SOL

SOL Global Investments

A private equity firm specializing in growth capital to small and mid-sized businesses.

Excellent balance sheet moderate.

Market Insights

Community Narratives