- Canada

- /

- Metals and Mining

- /

- TSXV:AGD

If You Had Bought Antioquia Gold (CVE:AGD) Stock Three Years Ago, You'd Be Sitting On A 70% Loss, Today

Investing in stocks inevitably means buying into some companies that perform poorly. But long term Antioquia Gold Inc. (CVE:AGD) shareholders have had a particularly rough ride in the last three year. Regrettably, they have had to cope with a 70% drop in the share price over that period. The good news is that the stock is up 20% in the last week.

See our latest analysis for Antioquia Gold

We don't think Antioquia Gold's revenue of CA$1,484,473 is enough to establish significant demand. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that Antioquia Gold will find or develop a valuable new mine before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Some Antioquia Gold investors have already had a taste of the bitterness stocks like this can leave in the mouth.

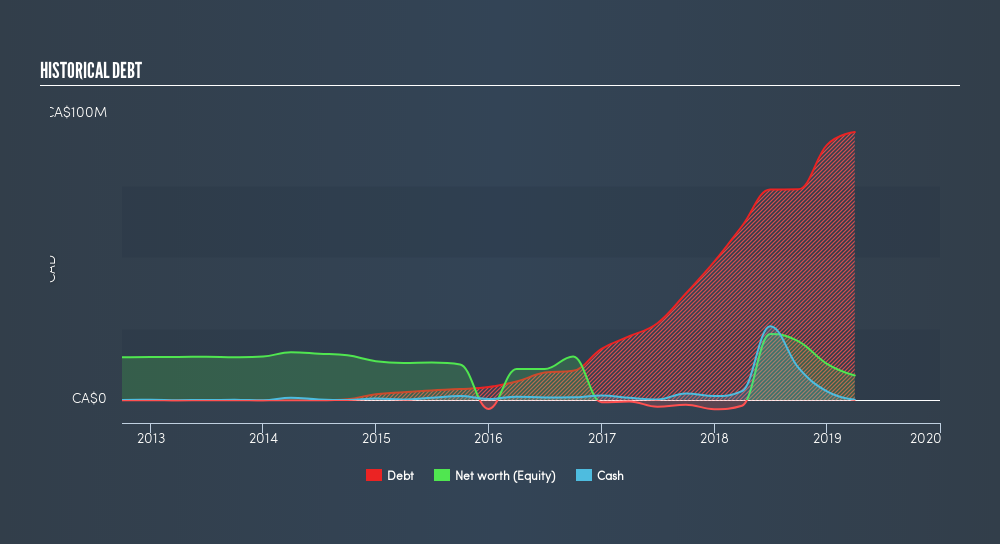

Antioquia Gold had liabilities exceeding cash by CA$104,749,998 when it last reported in March 2019, according to our data. That puts it in the highest risk category, according to our analysis. But since the share price has dived -33% per year, over 3 years, it looks like some investors think it's time to abandon ship, so to speak. You can click on the image below to see (in greater detail) how Antioquia Gold's cash levels have changed over time.

Of course, the truth is that it is hard to value companies without much revenue or profit. Would it bother you if insiders were selling the stock? It would bother me, that's for sure. You can click here to see if there are insiders selling.

A Different Perspective

Antioquia Gold shareholders are down 14% for the year, but the market itself is up 0.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 3.7%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSXV:AGD

Antioquia Gold

Engages in the exploration, evaluation, and mining of gold resource properties in Colombia.

Slightly overvalued with weak fundamentals.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion