- Canada

- /

- Metals and Mining

- /

- TSXV:AFM

We Ran A Stock Scan For Earnings Growth And Alphamin Resources (CVE:AFM) Passed With Ease

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Alphamin Resources (CVE:AFM). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Alphamin Resources with the means to add long-term value to shareholders.

Our analysis indicates that AFM is potentially undervalued!

How Fast Is Alphamin Resources Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. Which is why EPS growth is looked upon so favourably. It's an outstanding feat for Alphamin Resources to have grown EPS from US$0.021 to US$0.086 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

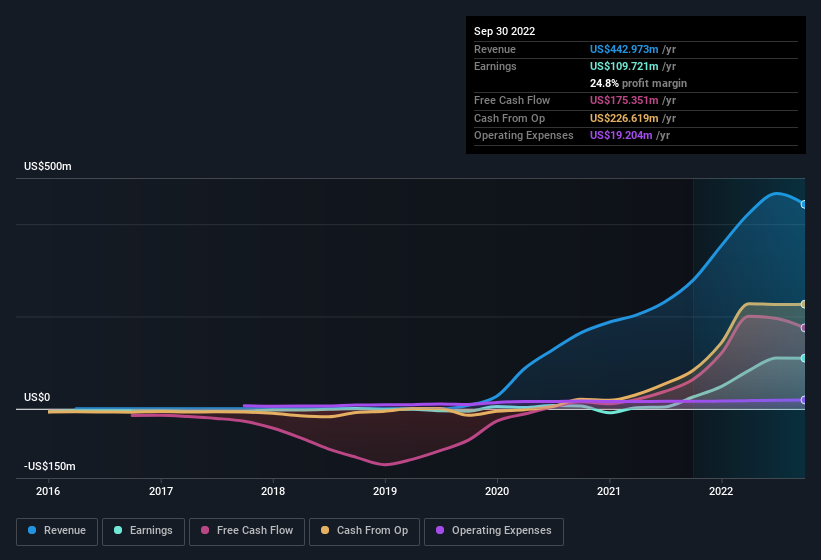

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Alphamin Resources is growing revenues, and EBIT margins improved by 13.3 percentage points to 55%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Alphamin Resources' balance sheet strength, before getting too excited.

Are Alphamin Resources Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Alphamin Resources shares, in the last year. So it's definitely nice that Independent Director Brendon Jones bought US$52k worth of shares at an average price of around US$0.64. It seems that at least one insider is prepared to show the market there is potential within Alphamin Resources.

Recent insider purchases of Alphamin Resources stock is not the only way management has kept the interests of the general public shareholders in mind. Specifically, the CEO is paid quite reasonably for a company of this size. For companies with market capitalisations between US$400m and US$1.6b, like Alphamin Resources, the median CEO pay is around US$1.5m.

Alphamin Resources' CEO took home a total compensation package of US$635k in the year prior to December 2021. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Alphamin Resources To Your Watchlist?

Alphamin Resources' earnings per share growth have been climbing higher at an appreciable rate. Better yet, we can observe insider buying and the chief executive pay looks reasonable. It could be that Alphamin Resources is at an inflection point, given the EPS growth. If these have piqued your interest, then this stock surely warrants a spot on your watchlist. We don't want to rain on the parade too much, but we did also find 2 warning signs for Alphamin Resources that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Alphamin Resources, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:AFM

Alphamin Resources

Engages in the production and sale of tin concentrate.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives