As Canadian large-cap stocks reach new all-time highs amidst global market volatility, investors are increasingly turning their attention to the potential of smaller, lesser-known companies within the Canadian market. In this landscape of persistent inflation and economic uncertainty, identifying stocks with strong fundamentals and growth potential can be key to uncovering hidden opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 4.02% | 13.46% | 16.81% | ★★★★★★ |

| Yellow Pages | NA | -11.43% | -17.61% | ★★★★★★ |

| Pinetree Capital | 0.20% | 63.68% | 65.79% | ★★★★★★ |

| Majestic Gold | NA | 11.96% | 12.21% | ★★★★★★ |

| Itafos | 25.35% | 11.11% | 49.69% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 9.16% | 15.11% | ★★★★★★ |

| Mako Mining | 8.59% | 38.81% | 59.80% | ★★★★★☆ |

| Corby Spirit and Wine | 57.06% | 9.84% | -5.44% | ★★★★☆☆ |

| Genesis Land Development | 48.16% | 31.08% | 55.45% | ★★★★☆☆ |

| Dundee | 2.02% | -35.84% | 57.20% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Computer Modelling Group (TSX:CMG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Computer Modelling Group Ltd. is a software and consulting technology company focused on developing and licensing reservoir simulation and seismic interpretation software, with a market cap of CA$676.83 million.

Operations: Computer Modelling Group generates revenue primarily through the licensing of its reservoir simulation and seismic interpretation software. The company reports a net profit margin of 33%, reflecting its ability to convert a significant portion of its revenue into profit.

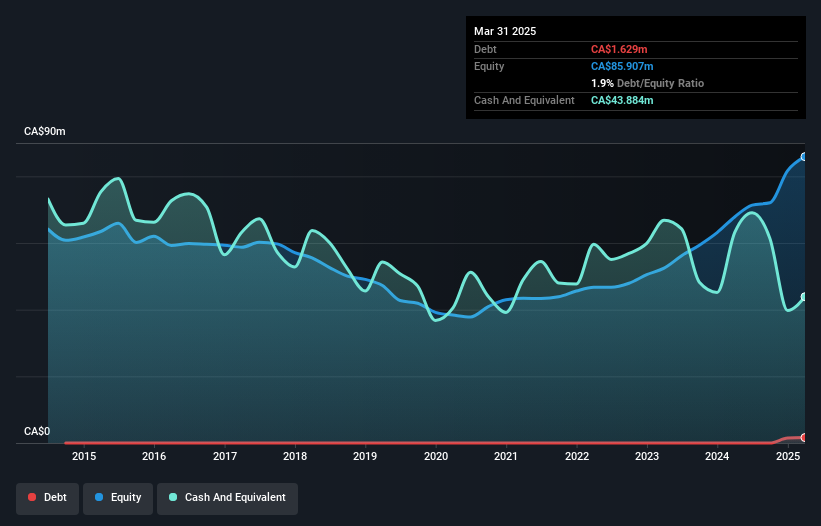

Computer Modelling Group, a smaller player in the software industry, shows some intriguing financial dynamics. Over the past year, its earnings growth of 1.3% lagged behind the industry's 29.3%. However, it trades at 9.5% below its estimated fair value and boasts high-quality earnings with a debt-to-equity ratio rising to 1.8% over five years. Despite net income dropping to C$22 million from C$26 million last year, sales climbed to C$129 million from C$109 million previously. A recent dividend of C$0.05 per share indicates confidence in cash flow stability amidst these mixed results.

- Dive into the specifics of Computer Modelling Group here with our thorough health report.

Gain insights into Computer Modelling Group's past trends and performance with our Past report.

Alphamin Resources (TSXV:AFM)

Simply Wall St Value Rating: ★★★★★★

Overview: Alphamin Resources Corp., along with its subsidiaries, focuses on the production and sale of tin concentrate, with a market capitalization of approximately CA$1.20 billion.

Operations: Alphamin Resources generates revenue primarily from the production and sale of tin concentrate, reporting $539.16 million from its Bisie Tin Mine.

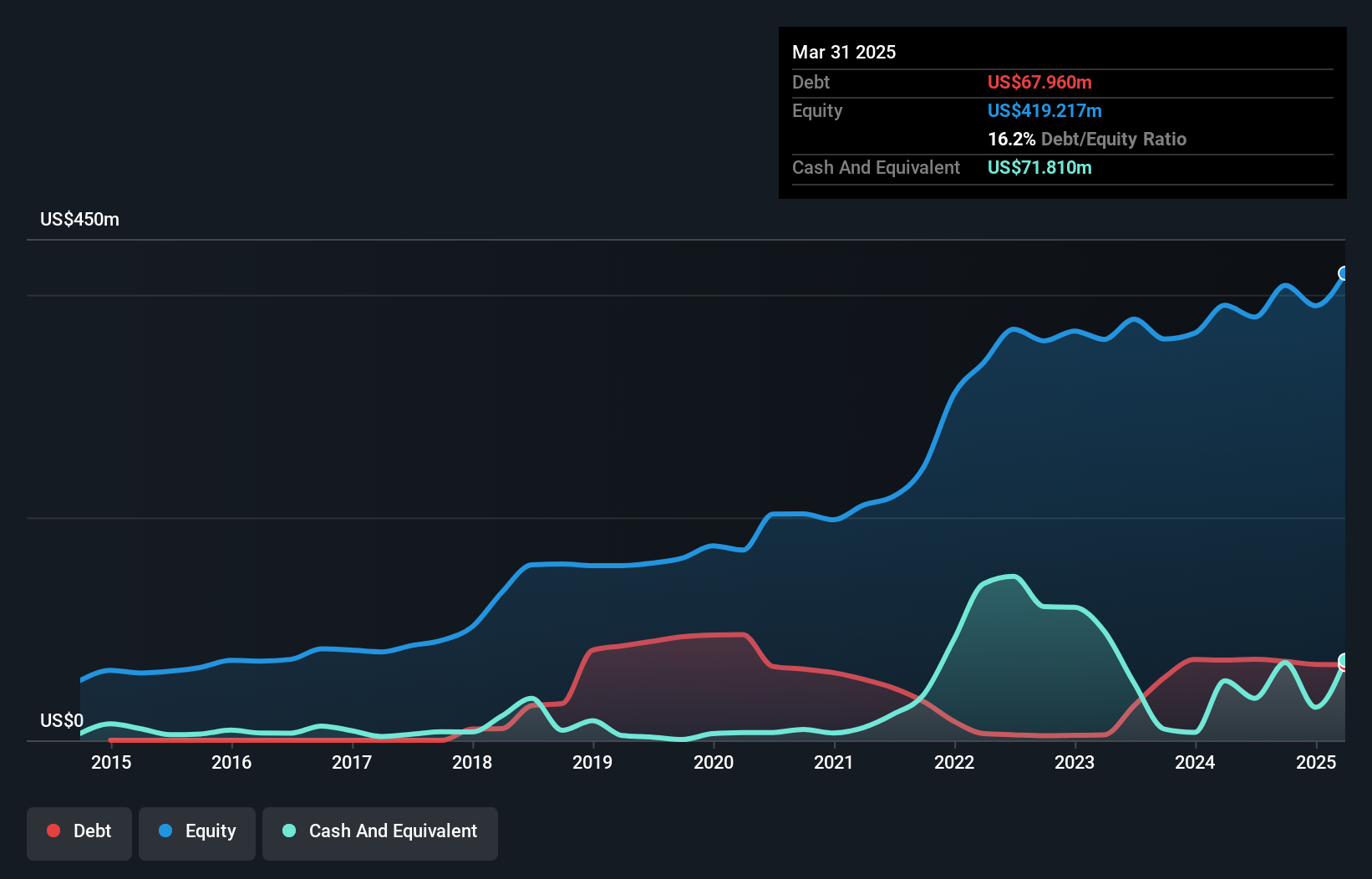

Alphamin Resources, a nimble player in the metals and mining sector, has shown impressive earnings growth of 101.3% over the past year, outpacing the industry average of 33.5%. The company trades at a discount of 29.1% below its estimated fair value, suggesting potential upside for investors. Despite recent operational hiccups due to security concerns in the DRC, Alphamin's Bisie tin mine resumed production and achieved targeted processing recoveries with 1,290 tonnes produced between mid-April and early May 2025. Financially robust with high-quality earnings and reduced debt-to-equity from 55.5% to 16.2%, Alphamin remains an intriguing prospect amidst volatility.

- Click to explore a detailed breakdown of our findings in Alphamin Resources' health report.

Examine Alphamin Resources' past performance report to understand how it has performed in the past.

Thor Explorations (TSXV:THX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Thor Explorations Ltd., along with its subsidiaries, is engaged in gold production and exploration, with a market capitalization of CA$445.75 million.

Operations: Thor Explorations generates revenue primarily from its Segilola Mine Project, which contributed $193.13 million.

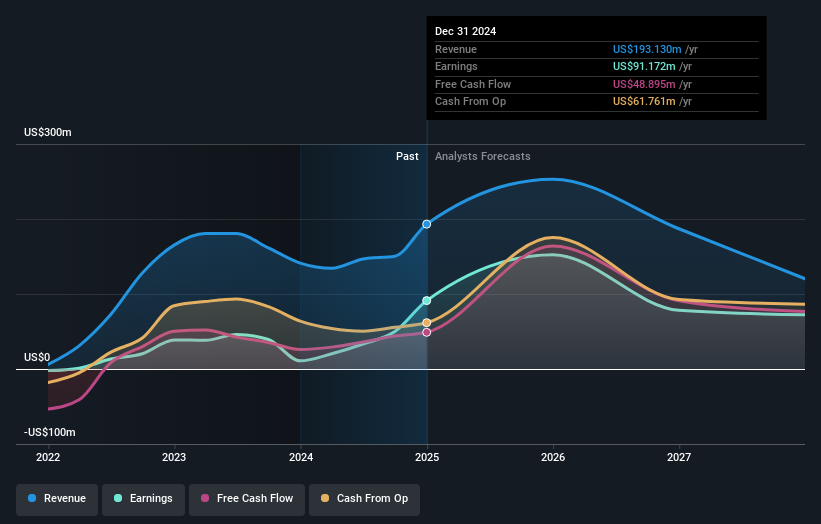

Thor Explorations, a nimble player in the mining sector, is making strides with its flagship Segilola Gold project in Nigeria. The company reported impressive earnings growth of 738.8% over the past year, significantly outpacing industry averages. With net income jumping to US$91 million from US$10.87 million and basic earnings per share increasing to US$0.14 from US$0.017, Thor demonstrates robust financial health despite geopolitical risks in West Africa. Trading at a PE ratio of 6.4x suggests potential undervaluation compared to peers, while recent drilling successes at Douta-West highlight promising exploration prospects for future growth and value creation.

Turning Ideas Into Actions

- Access the full spectrum of 45 TSX Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CMG

Computer Modelling Group

A software and consulting technology company, engages in the development and licensing of reservoir simulation and seismic interpretation software and related services.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives