- Canada

- /

- Metals and Mining

- /

- TSX:MAG

Discovering Canada's Undiscovered Gems for January 2025

Reviewed by Simply Wall St

As we step into 2025, the Canadian market is buoyed by a supportive economic backdrop, with the TSX having gained 18% in 2024 and broader markets experiencing robust growth across various sectors and market caps. In this environment of healthy economic growth and rising corporate profits, identifying undiscovered gems becomes crucial for investors seeking to capitalize on potential opportunities within Canada's diverse landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.24% | 12.63% | 23.89% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 9.16% | 15.11% | ★★★★★★ |

| Lithium Chile | NA | nan | 42.01% | ★★★★★★ |

| Amerigo Resources | 14.04% | 7.04% | 11.73% | ★★★★★☆ |

| Maxim Power | 25.01% | 12.79% | 17.14% | ★★★★★☆ |

| Mako Mining | 10.21% | 38.44% | 58.78% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 19.37% | 188.55% | ★★★★★☆ |

| Corby Spirit and Wine | 65.79% | 7.46% | -5.76% | ★★★★☆☆ |

| Petrus Resources | 19.44% | 17.20% | 46.03% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Hammond Power Solutions (TSX:HPS.A)

Simply Wall St Value Rating: ★★★★★★

Overview: Hammond Power Solutions Inc. designs, manufactures, and sells transformers across Canada, the United States, Mexico, and India with a market cap of CA$1.49 billion.

Operations: Hammond Power Solutions generates revenue primarily from the manufacture and sale of transformers, amounting to CA$766.82 million. The company's financial performance is highlighted by its gross profit margin, which reflects its profitability in managing production costs relative to sales.

HPS.A, a notable player in the electrical industry, has shown impressive financial health with its debt to equity ratio dropping from 27.3% to 6% over five years. Its earnings growth of 9.9% surpasses the industry's 5.1%, indicating robust performance and potential for future growth at an estimated rate of 11.48% annually. The company trades at a significant discount of about 35.7% below its fair value estimate, suggesting room for appreciation in value terms while maintaining strong interest coverage with EBIT covering interest payments by an impressive factor of 80x.

- Navigate through the intricacies of Hammond Power Solutions with our comprehensive health report here.

Explore historical data to track Hammond Power Solutions' performance over time in our Past section.

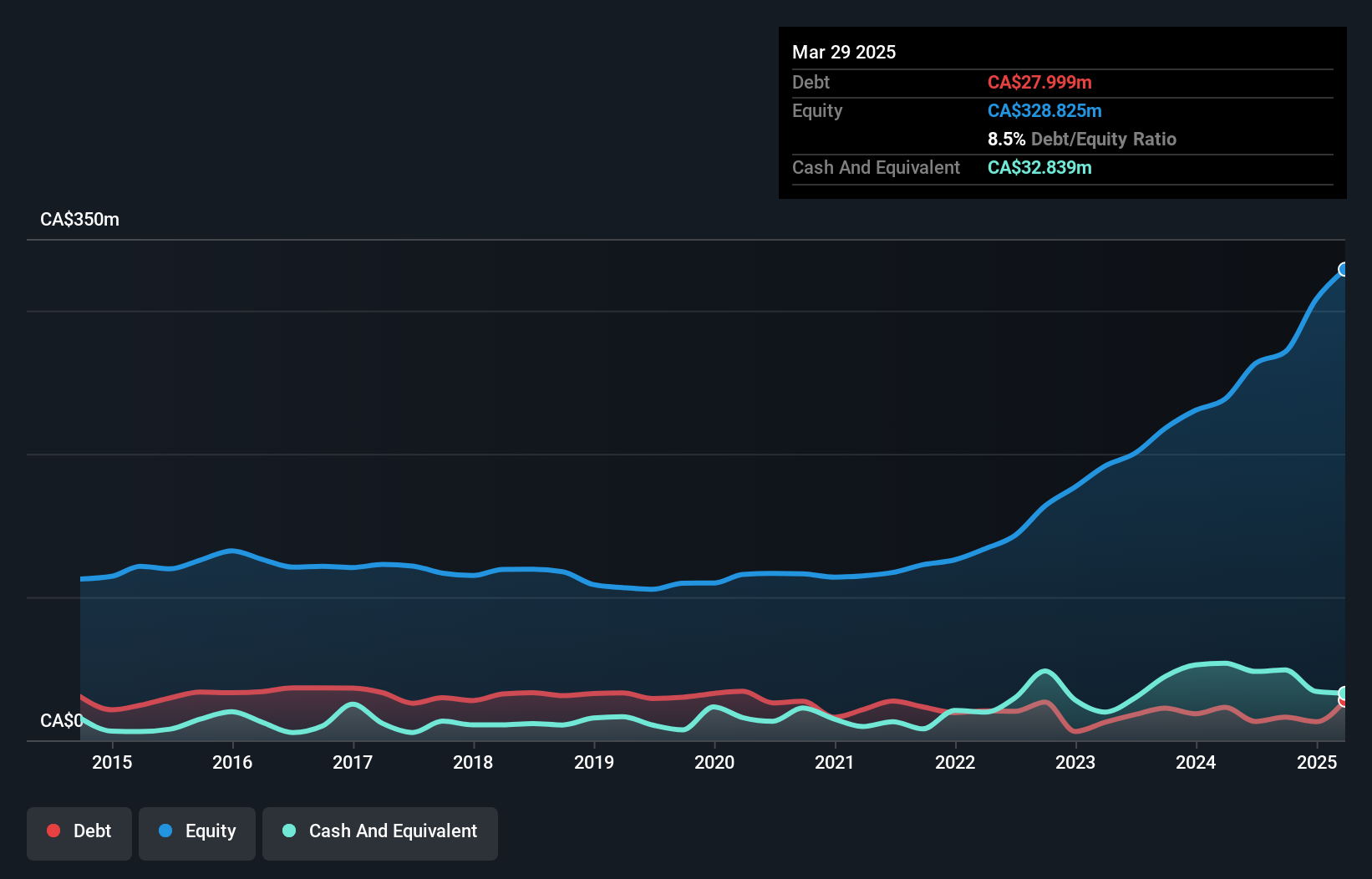

MAG Silver (TSX:MAG)

Simply Wall St Value Rating: ★★★★★★

Overview: MAG Silver Corp. is engaged in the development and exploration of precious metal properties in Canada, with a market capitalization of CA$2.10 billion.

Operations: MAG Silver Corp. does not currently report revenue segments, indicating its primary focus is on exploration and development activities within the precious metals sector in Canada.

MAG Silver, a nimble player in the mining sector, has seen impressive earnings growth of 131.8% over the past year, outpacing the industry's 36.4%. Despite generating less than US$1 million in revenue, its high level of non-cash earnings suggests robust underlying operations. The company remains debt-free for five years, ensuring no interest payment concerns and highlighting prudent financial management. Recent results show net income for Q3 2024 at US$22.29 million compared to US$8.86 million last year, with basic earnings per share rising to US$0.22 from US$0.09 a year ago—indicating strong profitability momentum moving forward.

- Take a closer look at MAG Silver's potential here in our health report.

Gain insights into MAG Silver's past trends and performance with our Past report.

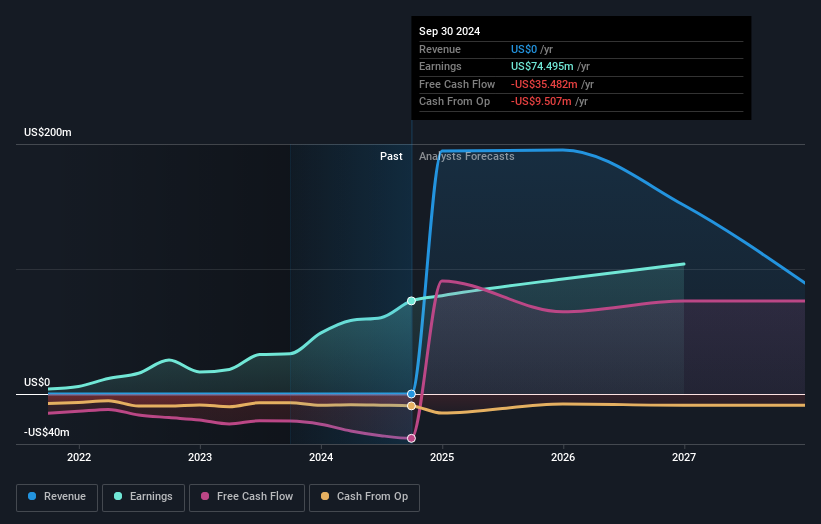

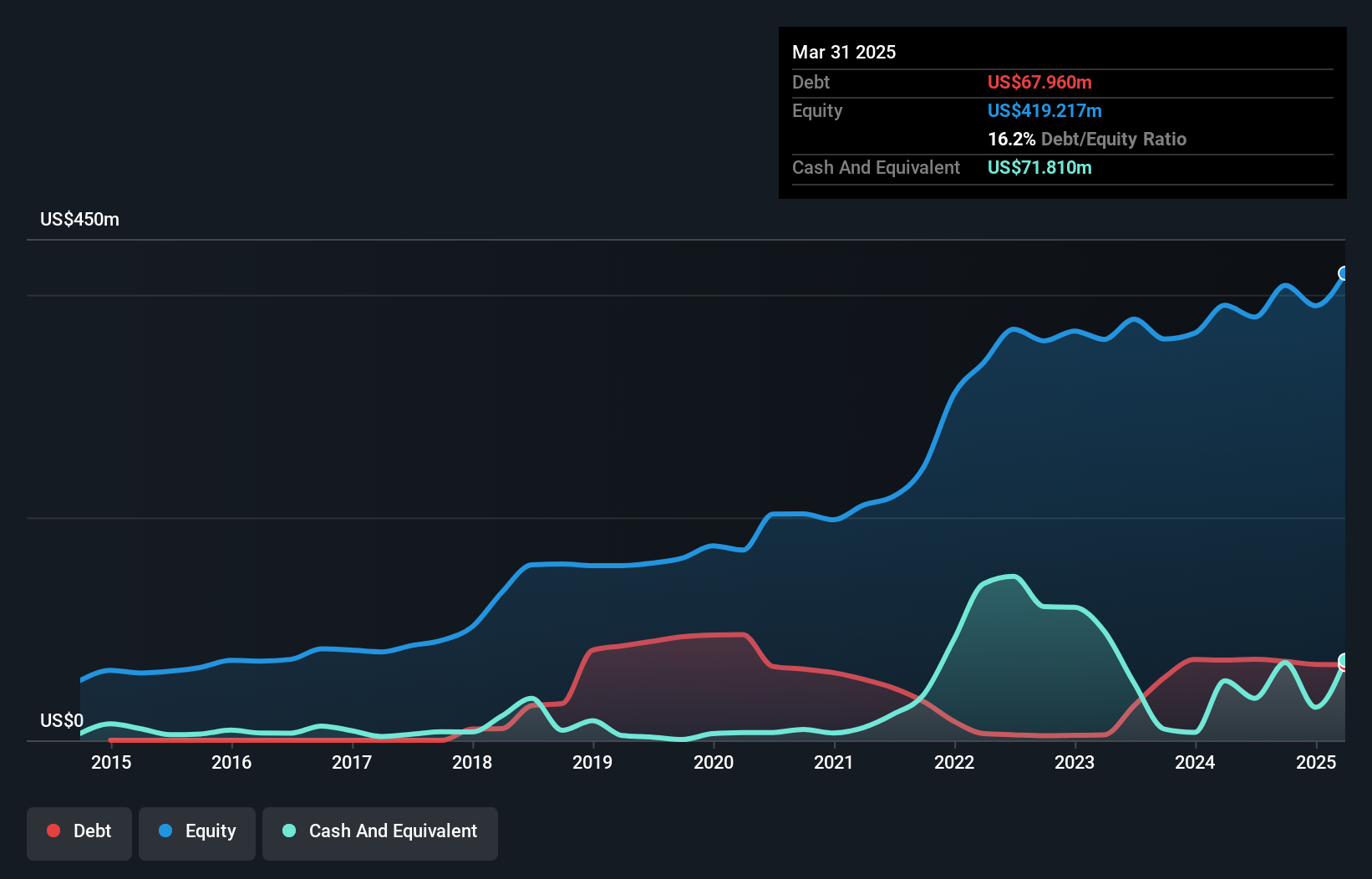

Alphamin Resources (TSXV:AFM)

Simply Wall St Value Rating: ★★★★★★

Overview: Alphamin Resources Corp., along with its subsidiaries, focuses on the production and sale of tin concentrates, with a market capitalization of CA$1.47 billion.

Operations: Alphamin generates revenue primarily through the production and sale of tin from its Bisie Tin Mine, amounting to $436.73 million. The company's financial performance can be assessed by examining its net profit margin, which provides insight into profitability after accounting for all expenses.

Alphamin Resources, a nimble player in the mining sector, has demonstrated robust financial health over recent years. Its debt to equity ratio impressively dropped from 56.8% to 17.3%, reflecting prudent financial management. Earnings have surged at an annual rate of 39.2%, showcasing strong growth potential, although slightly trailing the industry pace of 36.4%. The company's interest payments are comfortably covered by EBIT at a ratio of 17.9x, indicating solid operational efficiency and high-quality earnings. Recent results highlight significant sales growth to US$174 million for Q3 and net income doubling year-over-year to US$32 million, underscoring its upward trajectory in profitability and market presence.

- Click here and access our complete health analysis report to understand the dynamics of Alphamin Resources.

Understand Alphamin Resources' track record by examining our Past report.

Taking Advantage

- Click here to access our complete index of 47 TSX Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MAG

MAG Silver

Develops and explores for precious metal properties in Canada.

Flawless balance sheet and fair value.