- Canada

- /

- Auto Components

- /

- TSX:MG

3 TSX Dividend Stocks Yielding Up To 8.3%

Reviewed by Simply Wall St

As the Canadian economy faces a contraction in GDP and potential easing from the Bank of Canada, investors are increasingly looking towards dividend stocks as a reliable income source amidst shifting market dynamics. In this environment, selecting dividend stocks with strong fundamentals and stable cash flows can offer resilience and consistent returns, making them an attractive option for those navigating the current economic landscape.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Total Energy Services (TSX:TOT) | 3.00% | ★★★★☆☆ |

| Sun Life Financial (TSX:SLF) | 4.39% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.13% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.09% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.21% | ★★★★★☆ |

| North West (TSX:NWC) | 3.17% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.27% | ★★★★★☆ |

| Magna International (TSX:MG) | 4.23% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.66% | ★★★★★☆ |

| Bank of Montreal (TSX:BMO) | 3.92% | ★★★★★☆ |

Click here to see the full list of 22 stocks from our Top TSX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Magna International (TSX:MG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Magna International Inc. manufactures and supplies vehicle engineering, contract, and automotive components with a market cap of CA$17.76 billion.

Operations: Magna International Inc.'s revenue is derived from several segments, including Power & Vision ($15.13 billion), Body Exteriors & Structures ($16.32 billion), Seating Systems ($5.63 billion), and Complete Vehicles ($5.06 billion).

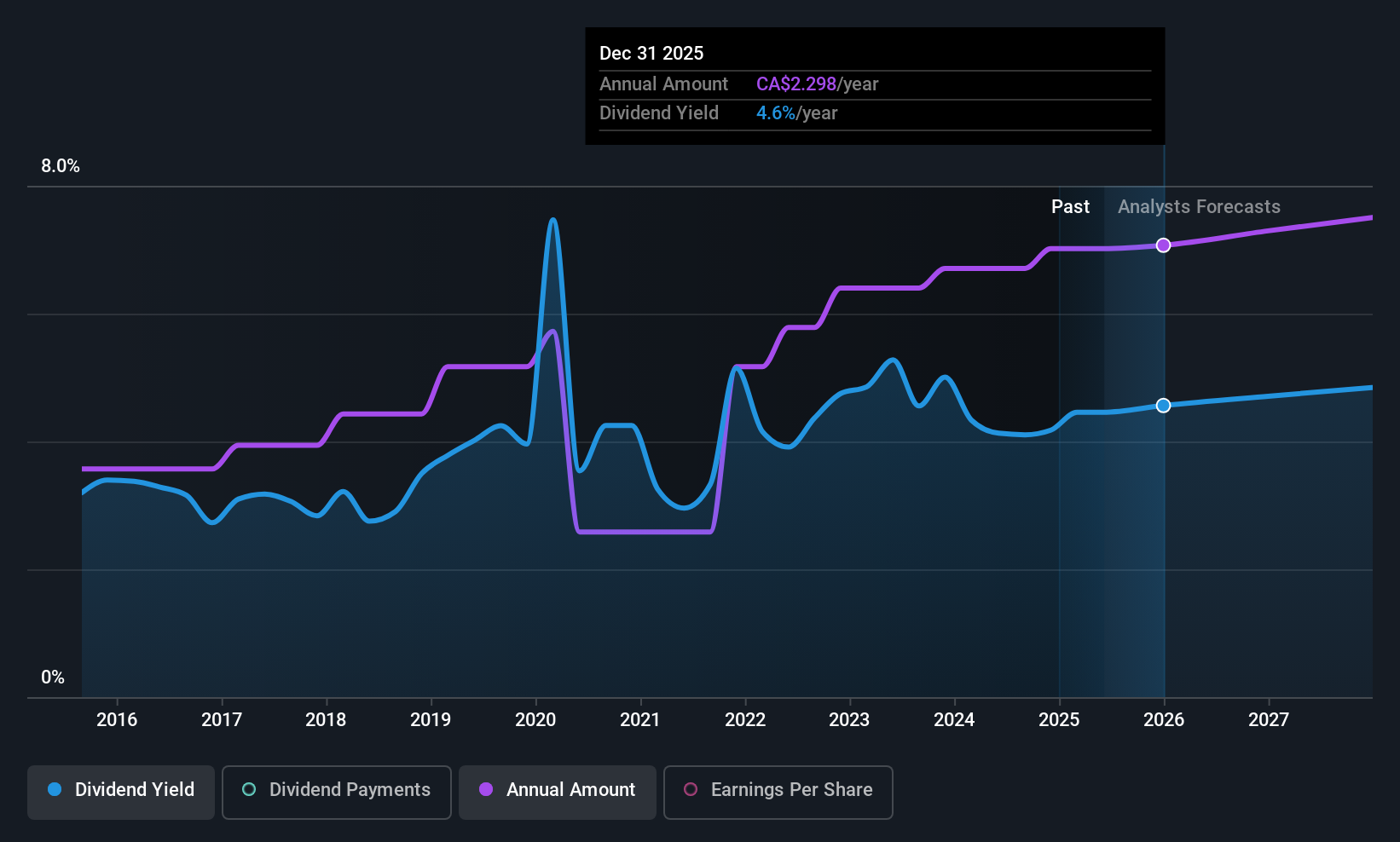

Dividend Yield: 4.2%

Magna International's dividend strategy is well-supported by a cash payout ratio of 33.3% and an earnings payout ratio of 45.3%, indicating sustainability. Although its dividend yield of 4.23% is below the top tier in Canada, it remains reliable with stable growth over the past decade. Recent financials show improved net income and earnings per share, while product innovations highlight Magna's commitment to future mobility, potentially influencing long-term value for investors.

- Click to explore a detailed breakdown of our findings in Magna International's dividend report.

- Our expertly prepared valuation report Magna International implies its share price may be lower than expected.

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company operating in Canada, the United States, and internationally with a market cap of CA$68.88 billion.

Operations: Suncor Energy Inc.'s revenue primarily comes from its Oil Sands segment at CA$25.21 billion, followed by Refining and Marketing at CA$30.61 billion, and Exploration and Production contributing CA$2.12 billion.

Dividend Yield: 4%

Suncor Energy's dividend yield of 4.02% is below Canada's top quartile, yet its dividends are well-covered with a cash payout ratio of 32.8% and an earnings payout ratio of 49.5%. Despite a volatile dividend history, payments have grown over the past decade. Recent financials show decreased net income and revenue compared to last year, but the company completed a CAD 1.25 billion share buyback, potentially enhancing shareholder value through reduced share count.

- Get an in-depth perspective on Suncor Energy's performance by reading our dividend report here.

- The analysis detailed in our Suncor Energy valuation report hints at an deflated share price compared to its estimated value.

Alphamin Resources (TSXV:AFM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Alphamin Resources Corp. is involved in the production and sale of tin concentrate, with a market capitalization of CA$1.36 billion.

Operations: Alphamin Resources Corp. generates revenue of $579.49 million from its Bisie Tin Mine through the production and sale of tin concentrate.

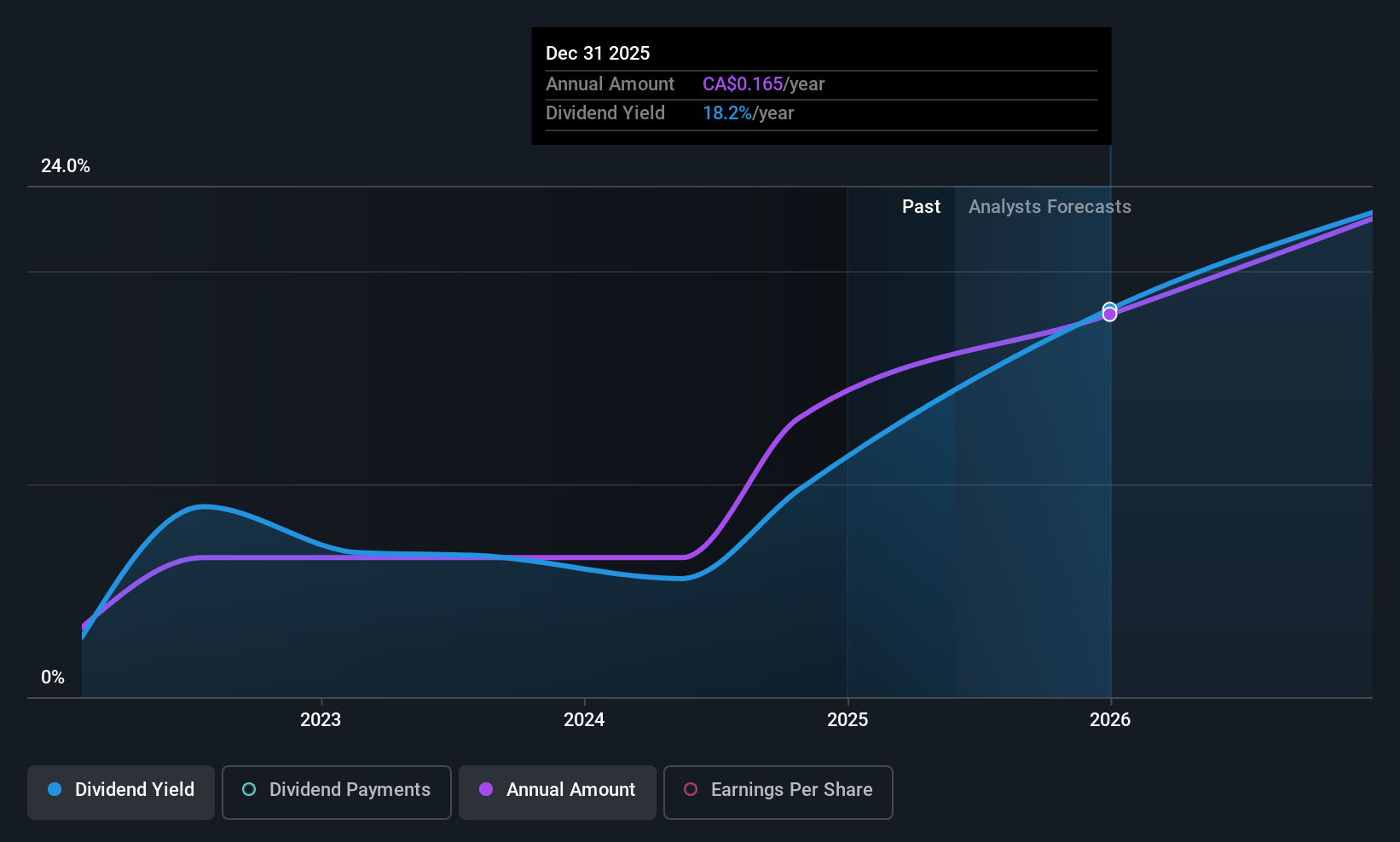

Dividend Yield: 8.3%

Alphamin Resources' dividend yield of 8.35% ranks in the top quartile for Canadian stocks, supported by a payout ratio of 76.2%. Despite only four years of dividend history and some volatility, recent dividends are backed by cash flows with a cash payout ratio of 51.1%. The company reported strong financials with net income rising to US$31.75 million in Q2 2025 from US$18.08 million a year earlier, enhancing its ability to sustain dividends.

- Click here to discover the nuances of Alphamin Resources with our detailed analytical dividend report.

- Our valuation report here indicates Alphamin Resources may be undervalued.

Summing It All Up

- Discover the full array of 22 Top TSX Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MG

Magna International

Manufactures and supplies vehicle engineering, contract, and automotive space.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives