Today we are going to look at Abcourt Mines Inc. (CVE:ABI) to see whether it might be an attractive investment prospect. In particular, we'll consider its Return On Capital Employed (ROCE), as that can give us insight into how profitably the company is able to employ capital in its business.

Firstly, we'll go over how we calculate ROCE. Next, we'll compare it to others in its industry. Last but not least, we'll look at what impact its current liabilities have on its ROCE.

Return On Capital Employed (ROCE): What is it?

ROCE measures the amount of pre-tax profits a company can generate from the capital employed in its business. All else being equal, a better business will have a higher ROCE. Overall, it is a valuable metric that has its flaws. Renowned investment researcher Michael Mauboussin has suggested that a high ROCE can indicate that 'one dollar invested in the company generates value of more than one dollar'.

So, How Do We Calculate ROCE?

Analysts use this formula to calculate return on capital employed:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

Or for Abcourt Mines:

0.12 = CA$4.4m ÷ (CA$43m - CA$7.0m) (Based on the trailing twelve months to December 2018.)

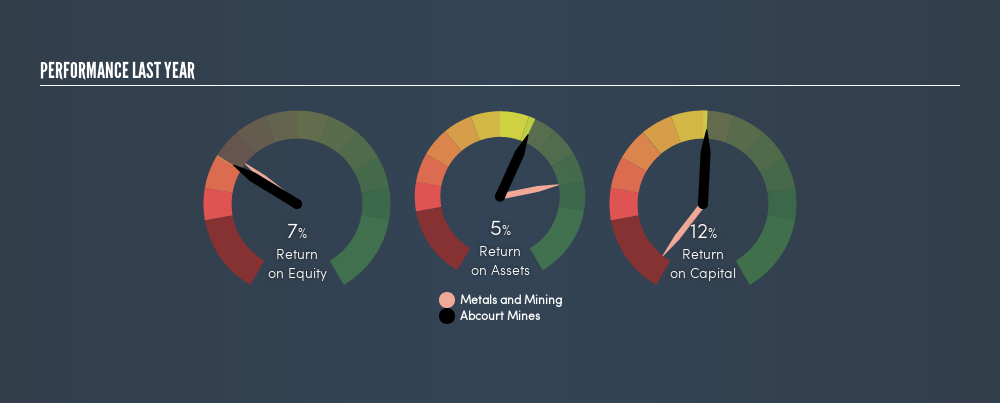

So, Abcourt Mines has an ROCE of 12%.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

See our latest analysis for Abcourt Mines

Does Abcourt Mines Have A Good ROCE?

One way to assess ROCE is to compare similar companies. Using our data, we find that Abcourt Mines's ROCE is meaningfully better than the 2.8% average in the Metals and Mining industry. We consider this a positive sign, because it suggests it uses capital more efficiently than similar companies. Independently of how Abcourt Mines compares to its industry, its ROCE in absolute terms appears decent, and the company may be worthy of closer investigation.

Abcourt Mines has an ROCE of 12%, but it didn't have an ROCE 3 years ago, since it was unprofitable. That implies the business has been improving.

Remember that this metric is backwards looking - it shows what has happened in the past, and does not accurately predict the future. Companies in cyclical industries can be difficult to understand using ROCE, as returns typically look high during boom times, and low during busts. This is because ROCE only looks at one year, instead of considering returns across a whole cycle. Given the industry it operates in, Abcourt Mines could be considered cyclical. How cyclical is Abcourt Mines? You can see for yourself by looking at this free graph of past earnings, revenue and cash flow.

How Abcourt Mines's Current Liabilities Impact Its ROCE

Current liabilities are short term bills and invoices that need to be paid in 12 months or less. The ROCE equation subtracts current liabilities from capital employed, so a company with a lot of current liabilities appears to have less capital employed, and a higher ROCE than otherwise. To check the impact of this, we calculate if a company has high current liabilities relative to its total assets.

Abcourt Mines has total liabilities of CA$7.0m and total assets of CA$43m. Therefore its current liabilities are equivalent to approximately 16% of its total assets. A fairly low level of current liabilities is not influencing the ROCE too much.

Our Take On Abcourt Mines's ROCE

This is good to see, and with a sound ROCE, Abcourt Mines could be worth a closer look. There might be better investments than Abcourt Mines out there, but you will have to work hard to find them . These promising businesses with rapidly growing earnings might be right up your alley.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSXV:ABI

Abcourt Mines

Engages in the acquisition, exploration, evaluation, and exploitation of gold mining properties in Canada.

Medium-low risk with imperfect balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026