- Canada

- /

- Metals and Mining

- /

- TSX:WPM

Wheaton Precious Metals (TSX:WPM): Exploring Valuation After Record Q2 Results and Upgraded Analyst Forecasts

Reviewed by Simply Wall St

If you have been watching Wheaton Precious Metals (TSX:WPM), recent headlines may have caught your attention. Just this week, the company announced record-setting second-quarter results, surpassing previous highs in revenue, adjusted net income, and cash flow. What’s getting the market talking is not just the numbers on the income statement but also the wave of analyst optimism that followed. Several analysts have raised their earnings forecasts for fiscal 2025 as a result.

This buzz comes as Wheaton’s stock continues to climb, up around 58% over the past year and building serious momentum in recent months. Investors seem to be reacting to both the company’s execution and its ambitious plans to boost gold equivalent production by 40% within five years. While some rivals have stumbled, Wheaton’s liquidity, supported by over $1 billion in cash, gives it room to fund growth or acquisitions. This reinforces a sense of stability and opportunity in a volatile sector.

So after such a strong run and renewed optimism, is Wheaton Precious Metals attractively valued now, or is the market already factoring in years of future growth?

Most Popular Narrative: 10% Undervalued

According to community narrative, Wheaton Precious Metals is seen as undervalued by 10% based on aggressive assumptions about revenue and earnings growth, supportive industry trends, and ambitious company expansion plans.

“A robust pipeline of new and expanding streaming agreements, including the ramp-up at Salobo III, commercial production at Blackwater, accelerated Phase 2/3 expansions at Blackwater, and new streams such as Goose and Platreef, positions Wheaton for approximately 40% organic production growth by 2029. This is expected to directly support higher future revenue and earnings growth. A surge in global demand for gold and silver, driven by central bank reserve diversification, geopolitical uncertainty, and persistent inflation fears, is underpinning higher commodity prices. Wheaton's asset-light, full-exposure streaming model aims to maximize the benefit from commodity price appreciation, amplifying revenues and margins.”

How does Wheaton aim to justify that premium price target? Some bold growth assumptions and ambitious profitability figures factor heavily into this calculation. Want to know just how high the analysts are setting their sights, and what kind of industry shifts they see coming? The narrative’s valuation rests on a few key numbers that might reshape your view of where this stock could go.

Result: Fair Value of $146.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying competition for streaming deals and potential regulatory disruptions in key regions could quickly change the outlook for Wheaton’s growth prospects.

Find out about the key risks to this Wheaton Precious Metals narrative.Another View: Value Looks Stretched on Profitability

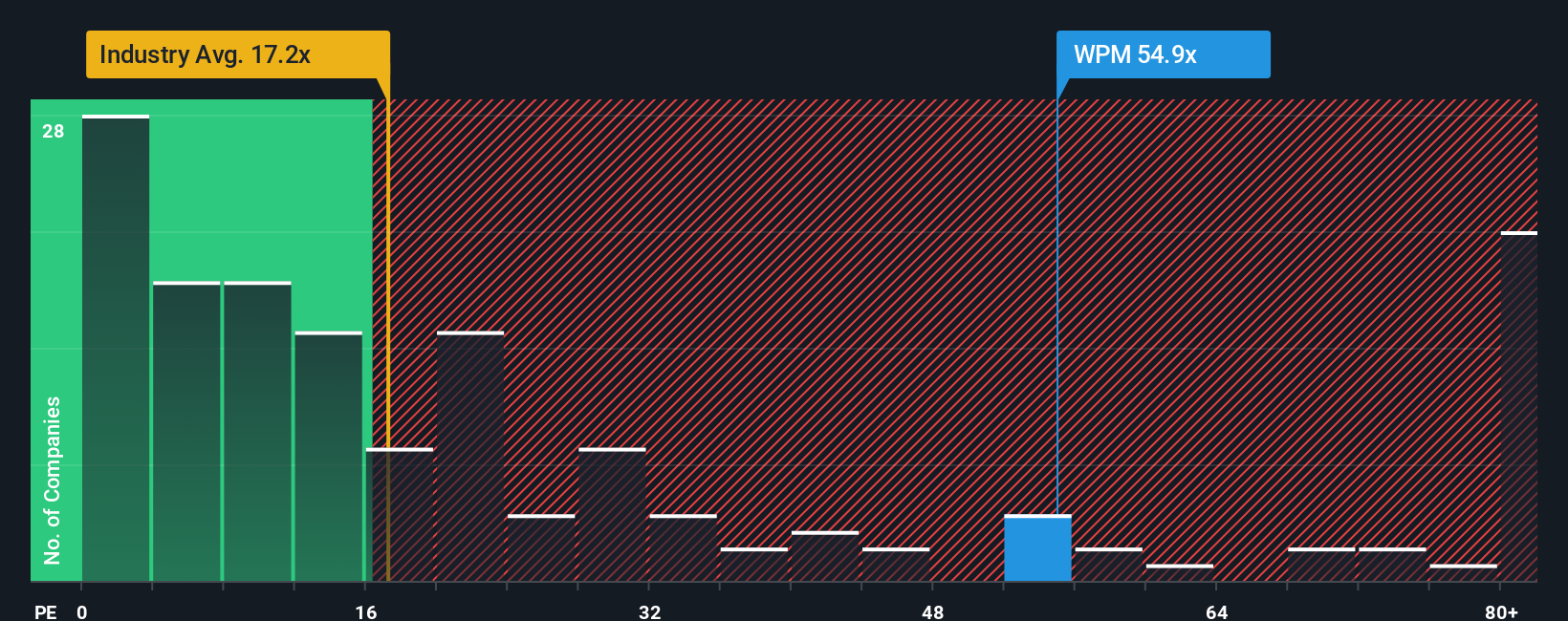

While the previous approach suggests upside, a look through the lens of typical profitability multiples shows Wheaton’s valuation is well above its industry’s average. Could the market be expecting too much from future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Wheaton Precious Metals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Wheaton Precious Metals Narrative

If you want a different angle or prefer hands-on analysis, you can dig into the numbers and build your own narrative in just minutes. Go ahead and do it your way.

A great starting point for your Wheaton Precious Metals research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why settle for just one angle when you could be tapping into some of today’s most exciting stocks? Take your research further and gain an edge by exploring fresh ideas tailored to what really moves the market. The right opportunity could be waiting just a click away.

- Unlock reliable income streams by checking out dividend stocks with yields > 3% with above-average yields. These options might boost your returns and help build a resilient portfolio.

- Spot emerging trends before the crowd by researching AI penny stocks. These are companies spearheading cutting-edge developments in artificial intelligence and shaping the future of the tech sector.

- Capture potential growth from a healthcare revolution by reviewing healthcare AI stocks. These opportunities combine medical expertise with innovative AI-driven solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wheaton Precious Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WPM

Wheaton Precious Metals

Sells precious metals in North America, Europe, Africa, and South America.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives