- Canada

- /

- Paper and Forestry Products

- /

- TSX:WFG

West Fraser Timber (TSX:WFG) Losses Worsen, Profitability Forecasts Challenge Dividend Sustainability Narrative

Reviewed by Simply Wall St

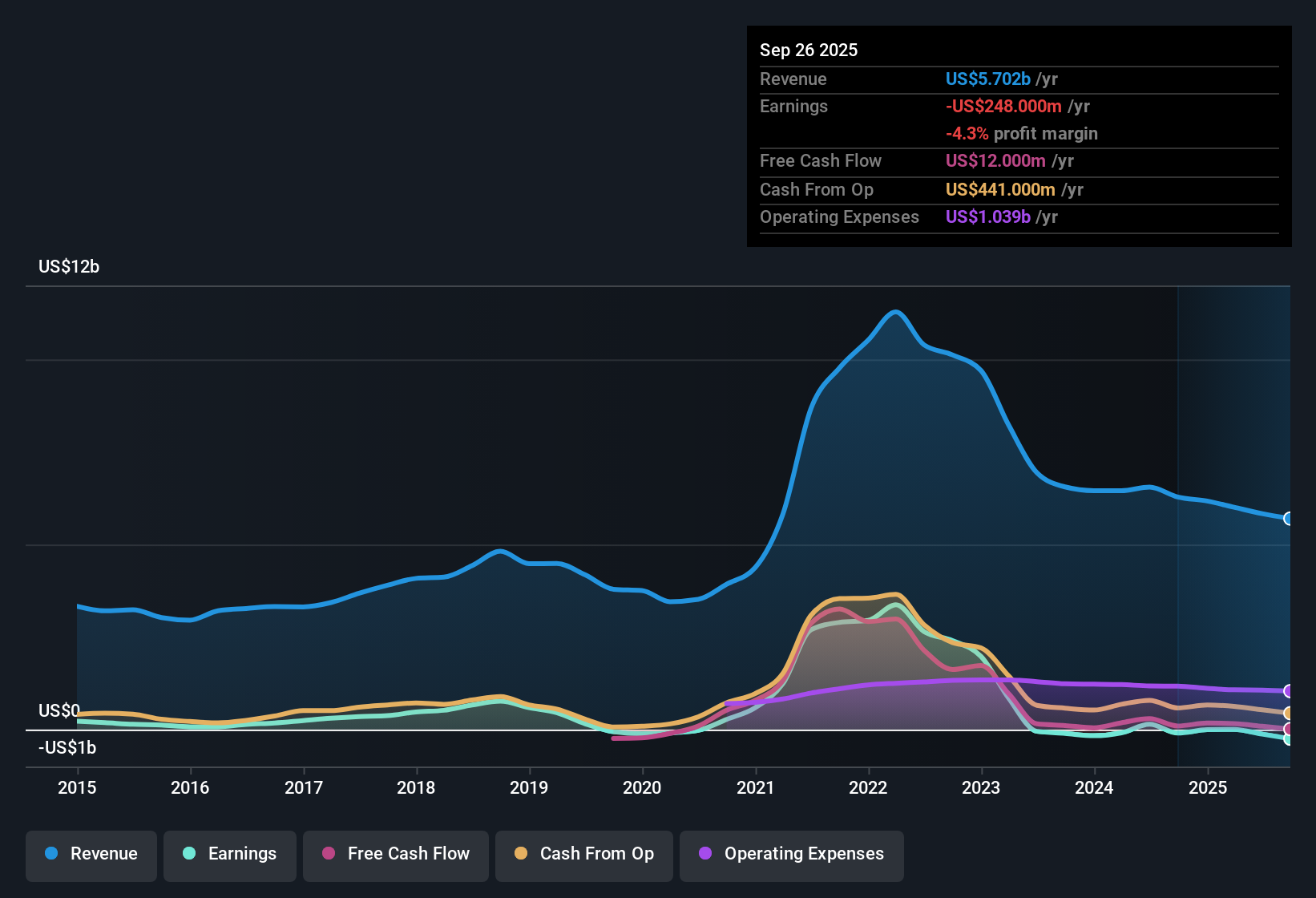

West Fraser Timber (TSX:WFG) remains in the red, with losses accelerating at a rate of 48.5% per year over the past five years and net profit margins still negative. Despite the ongoing unprofitability, revenue is forecast to grow 6.3% annually, outpacing the Canadian market’s 4.9% average. Earnings are projected to jump 58.75% per year. The company is expected to become profitable within three years. This aggressive growth outlook is a key focus for investors who must weigh strong forecasts against a challenging track record and flagged dividend risks.

See our full analysis for West Fraser Timber.Next, we’ll look at how these numbers compare to the ongoing market narratives. Some expectations will line up, while the facts may push back against others.

See what the community is saying about West Fraser Timber

Margins Forecasted to Swing from -2.2% to 9.7%

- Analysts expect net profit margins to recover from -2.2% today to 9.7% over the next three years, signaling a dramatic turnaround in profitability if forecasts hold.

- The consensus narrative spotlights West Fraser’s multi-year investments in mill modernization and diversification. These upgrades could bolster resilience and pricing power as demand returns.

- Accelerating adoption of sustainable building materials and ongoing demographic growth are expected to underpin more stable revenue in the long run.

- However, macroeconomic and cost headwinds remain. How quickly these margin gains materialize will test analysts’ confidence.

- The results match the analysts' consensus that West Fraser is positioning for margin expansion, but the timeline for true earnings strength depends on execution and cyclical recovery.

- Consider how this expected margin leap fits into the broader debate on resilience and future upside. Get the full narrative breakdown in the community story. 📊 Read the full West Fraser Timber Consensus Narrative.

Peer-Traded, But Sector Premium Persists

- West Fraser trades at a favorable price-to-sales ratio compared to peers, yet appears relatively expensive versus the North American forestry sector average.

- According to the analysts' consensus view, the valuation gap reflects both optimism about West Fraser's forecast growth and skepticism about lingering volatility from weak housing and regulatory pressures.

- The current share price of $92.08 sits about 21% below the DCF fair value of $110.82, reinforcing the argument that the stock is undervalued from a cash flow perspective.

- Still, analysts caution that sector-wide risks could hinder this valuation from being realized, including cost inflation and persistent external challenges.

Analyst Price Target: 25% Upside from Here

- With analysts assigning a target price of $115.50, shares would need to rise approximately 25% from their current level to hit the consensus forecast.

- The analysts' consensus narrative notes this upside relies on annual revenue growth of 4.9%, earnings reaching $653.7 million by 2028, and a future PE ratio of 12.2x, which is lower than the Canadian Forestry industry’s current 22.7x.

- Delivery on share buybacks, as analysts expect shares outstanding to decline 1.73% per year, could further support this target if sustained.

- However, reaching these projections depends on recovering demand and steady execution despite global trade and cost headwinds.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for West Fraser Timber on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a unique take on the data? Share your angle and craft your own story in just a few minutes. Do it your way

A great starting point for your West Fraser Timber research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

While West Fraser Timber is forecast to grow earnings rapidly, its historical losses, volatile profit margins, and sector headwinds raise questions about long-term consistency.

If steadier results and predictable expansion are what you’re after, use our stable growth stocks screener (2091 results) to focus on businesses with reliable track records through changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West Fraser Timber might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WFG

West Fraser Timber

A diversified wood products company, engages in manufacturing, selling, marketing, and distributing lumber, engineered wood products, pulp, newsprint, wood chips, and other residuals and renewable energy.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives