- Canada

- /

- Metals and Mining

- /

- TSX:WDO

Will Strong Q3 Earnings and Revised Guidance Change Wesdome Gold Mines' (TSX:WDO) Narrative?

Reviewed by Sasha Jovanovic

- Wesdome Gold Mines Ltd. recently reported third quarter 2025 earnings with sales of CA$230.28 million and net income of CA$86.92 million, both materially higher than the prior year.

- Alongside strong earnings, Wesdome adjusted its 2025 production guidance due to operational challenges, updating expectations for consolidated output and costs at its Kiena mine.

- We'll examine how Wesdome's robust quarterly earnings and revised production guidance shape the company's investment narrative and future outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Wesdome Gold Mines Investment Narrative Recap

To be a Wesdome Gold Mines shareholder, you need to trust in the company’s ability to efficiently operate its core assets, especially as growth is closely tied to production success at the Kiena and Eagle River mines. The recent update, impressive Q3 earnings paired with lowered Kiena guidance, puts a spotlight on short-term production reliability as both a key catalyst and risk; the impact is material, as operational setbacks at Kiena could directly affect near-term revenue and profit certainty.

The latest revision to Kiena’s production guidance, prompted by execution challenges in the first three quarters, is particularly relevant to Wesdome’s investment case. While strong financial results support optimism, Kiena’s updated outlook, lower output and higher costs, re-emphasizes the concentration risk facing the business and how future growth depends on stabilizing this flagship mine.

In contrast, what investors may not fully appreciate is how reliance on one primary mining horizon at Kiena means that even minor disruptions can quickly escalate into...

Read the full narrative on Wesdome Gold Mines (it's free!)

Wesdome Gold Mines' outlook anticipates CA$986.3 million in revenue and CA$395.3 million in earnings by 2028. This is based on a projected annual revenue growth rate of 10.8% and an earnings increase of CA$154.5 million from the current CA$240.8 million.

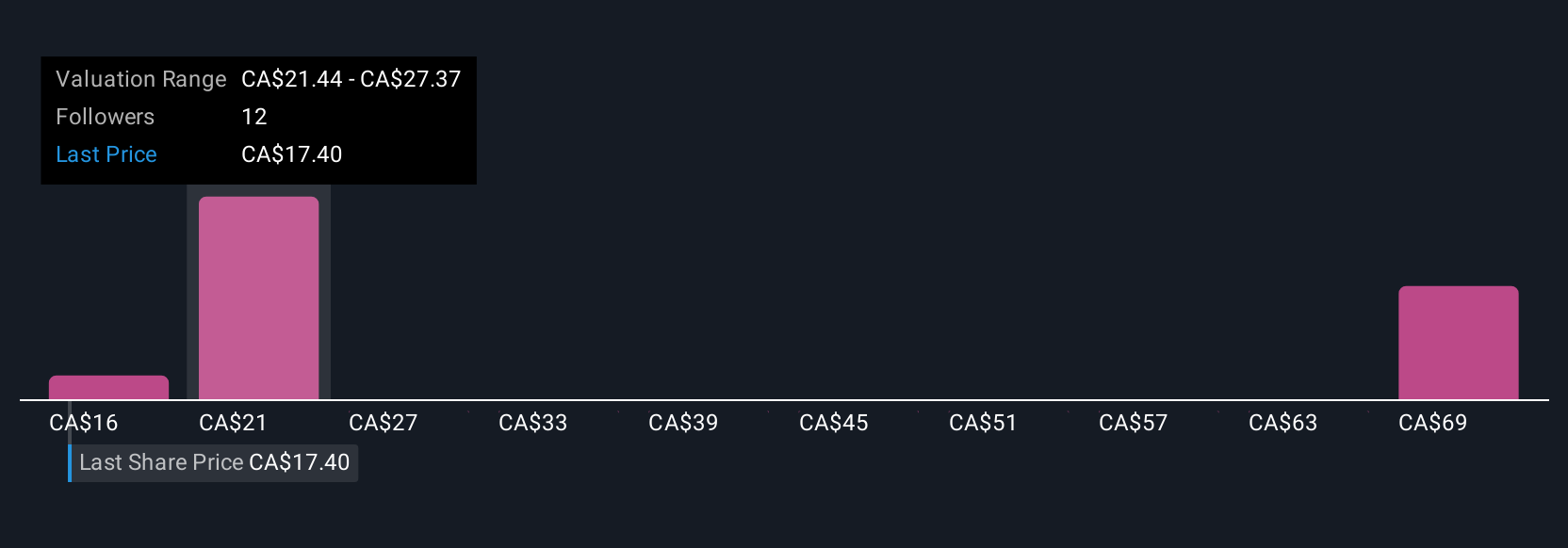

Uncover how Wesdome Gold Mines' forecasts yield a CA$26.61 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Private investors in the Simply Wall St Community estimate Wesdome’s fair value from CA$15.50 to CA$75.02, with ten distinct opinions. As you consider these varying viewpoints, keep in mind Kiena’s recent operational updates and what that could mean for production risks and longer term performance.

Explore 10 other fair value estimates on Wesdome Gold Mines - why the stock might be worth over 3x more than the current price!

Build Your Own Wesdome Gold Mines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wesdome Gold Mines research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Wesdome Gold Mines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wesdome Gold Mines' overall financial health at a glance.

No Opportunity In Wesdome Gold Mines?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wesdome Gold Mines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WDO

Wesdome Gold Mines

Wesdome Gold Mines Ltd. mines, develops, and explores for gold and silver deposits in Canada.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives