- Canada

- /

- Metals and Mining

- /

- TSX:WDO

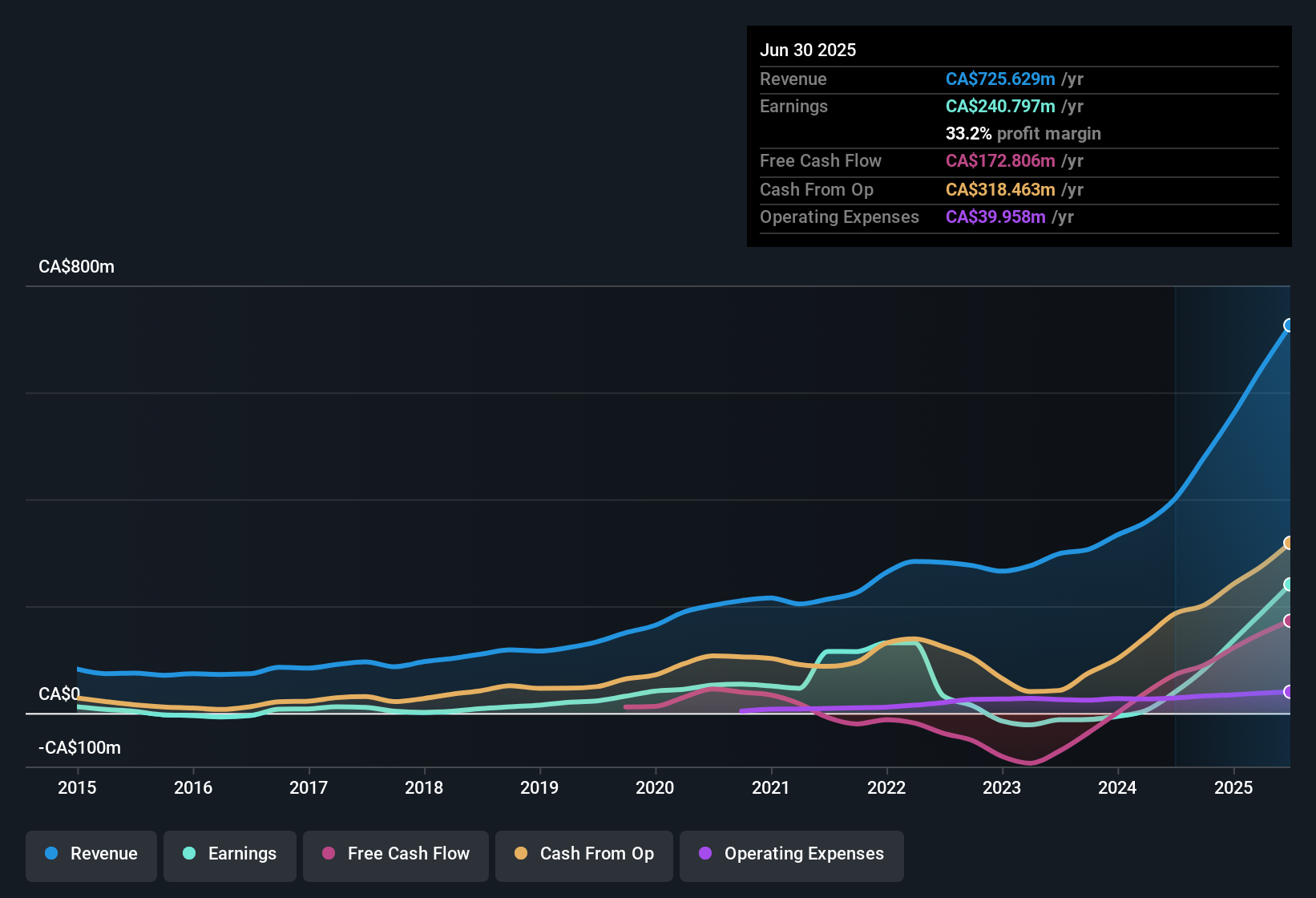

Wesdome Gold Mines (TSX:WDO) Net Profit Margin Surges to 33.2%, Reinforcing Bullish Narratives

Reviewed by Simply Wall St

Wesdome Gold Mines (TSX:WDO) posted a dramatic earnings surge this year, with net profit margins now at 33.2%, a significant jump from 9.7% a year ago. Annual earnings growth hit 517.2%, more than 35 times the company’s five-year average growth rate of 14.6% per year. Trading at a price-to-earnings ratio of 12.5x, well below both industry and peer averages, the company stands out for robust profitability, high-quality earnings, and a positive revenue growth outlook.

See our full analysis for Wesdome Gold Mines.Next up, we’ll compare these numbers to the most widely followed narratives and expectations, to see which market stories get reinforced or upended by the new results.

See what the community is saying about Wesdome Gold Mines

Margins Poised for More Expansion

- Analysts expect profit margins to rise from the current 33.2% to 40.1% within three years, indicating further room for improvement beyond already robust levels.

- According to the analysts' consensus view, operational upgrades at Eagle River and strategic investments at Kiena are set to support sustained margin gains,

- automation and owner-operated initiatives at Eagle River are cited as directly reducing costs per ounce and enhancing mine reliability, reinforcing long-term margin expansion,

- however, this thesis depends heavily on executing operational improvements and achieving reserve conversions at a few core assets, meaning any disruption could threaten these forecasted gains.

Gold Price Moves Strengthen Top Line

- Revenue growth is forecast at 7.9% per year, outpacing the Canadian market’s 5.1%, with consensus assuming this is underpinned by expectations for structurally higher gold prices amid inflation and macroeconomic shifts.

- The consensus narrative notes that elevated gold prices and robust exploration programs, anchored by the Angus Gold acquisition and increased drilling spend, are expected to improve both realized revenue and mine life,

- but highlights that overall top-line momentum remains dependent on maintaining strong gold prices and continued exploration success to offset reserve depletion,

- making long-term revenue growth especially sensitive to macroeconomic variables and resource conversion outcomes.

Market Discount Still in Play

- Wesdome trades at a 12.5x price-to-earnings ratio, well below the Canadian metals and mining industry average of 19.8x and peer average of 19x, while the current share price of CA$19.93 remains below the single permitted analyst price target of CA$26.61.

- From the analysts' consensus perspective, the stock’s discount relative to both sector multiples and price targets offers upside if forecasted margin and revenue growth are realized,

- still, much of the potential re-rating hinges on the company delivering multi-year production growth and keeping project costs in line,

- with the lack of material flagged risks in filings suggesting a reward-focused outlook, but with all eyes on execution and gold market trends.

See how the bullish, bearish, and consensus narratives stack up against these numbers and what it could mean for the stock’s next chapter. 📊 Read the full Wesdome Gold Mines Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Wesdome Gold Mines on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your take on these results? Put your perspective to work and shape your own narrative in just minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Wesdome Gold Mines.

See What Else Is Out There

While Wesdome’s growth forecasts are promising, its long-term performance still depends on maintaining high gold prices and delivering consistent production gains, which remain uncertain.

If you want more confidence in steady results, seek out stable growth stocks screener (2074 results) to discover companies that have a proven record of consistent earnings and revenue expansion regardless of market swings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Wesdome Gold Mines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WDO

Wesdome Gold Mines

Wesdome Gold Mines Ltd. mines, develops, and explores for gold and silver deposits in Canada.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion