- Canada

- /

- Metals and Mining

- /

- TSX:WDO

How Higher Year-to-Date Gold Production at Wesdome (TSX:WDO) Has Changed Its Investment Story

Reviewed by Simply Wall St

- Wesdome Gold Mines recently reported its operating results for the second quarter and six months ended June 30, 2025, showing quarterly gold production of 42,781 ounces and a six-month total of 88,473 ounces.

- While second quarter production dipped slightly year-over-year, the notable increase in cumulative first-half output highlights ongoing operational progress at the company’s mines.

- We’ll now explore how the higher year-to-date gold production informs the company’s investment narrative and future outlook.

Wesdome Gold Mines Investment Narrative Recap

To be a shareholder in Wesdome Gold Mines, an investor needs to believe in the fill-the-mill strategy and the company's ability to ramp up high-grade ore production at its key Kiena and Eagle River mines. The increase in first-half gold production signals ongoing operational progress but is not a material shift to the biggest short-term catalyst, which remains consistent delivery against annual production guidance. The primary risk continues to be execution at Kiena and Eagle River; disruptions could affect revenue and undermine this narrative.

The recent underground exploration update at the Kiena Mine stands out, as it confirms high-grade mineralization in multiple zones. This supports the view that ongoing exploration can underpin production growth, directly tying into the company’s catalyst of converting resources to reserves and meeting or exceeding production forecasts.

However, investors should be aware that unless operational execution continues smoothly at both Kiena and Eagle River mines, revenues could come under pressure if...

Read the full narrative on Wesdome Gold Mines (it's free!)

Wesdome Gold Mines' outlook suggests CA$849.0 million in revenue and CA$218.0 million in earnings by 2028. This is based on an assumed 15.0% annual revenue growth rate and a CA$82.5 million increase in earnings from the current CA$135.5 million.

Exploring Other Perspectives

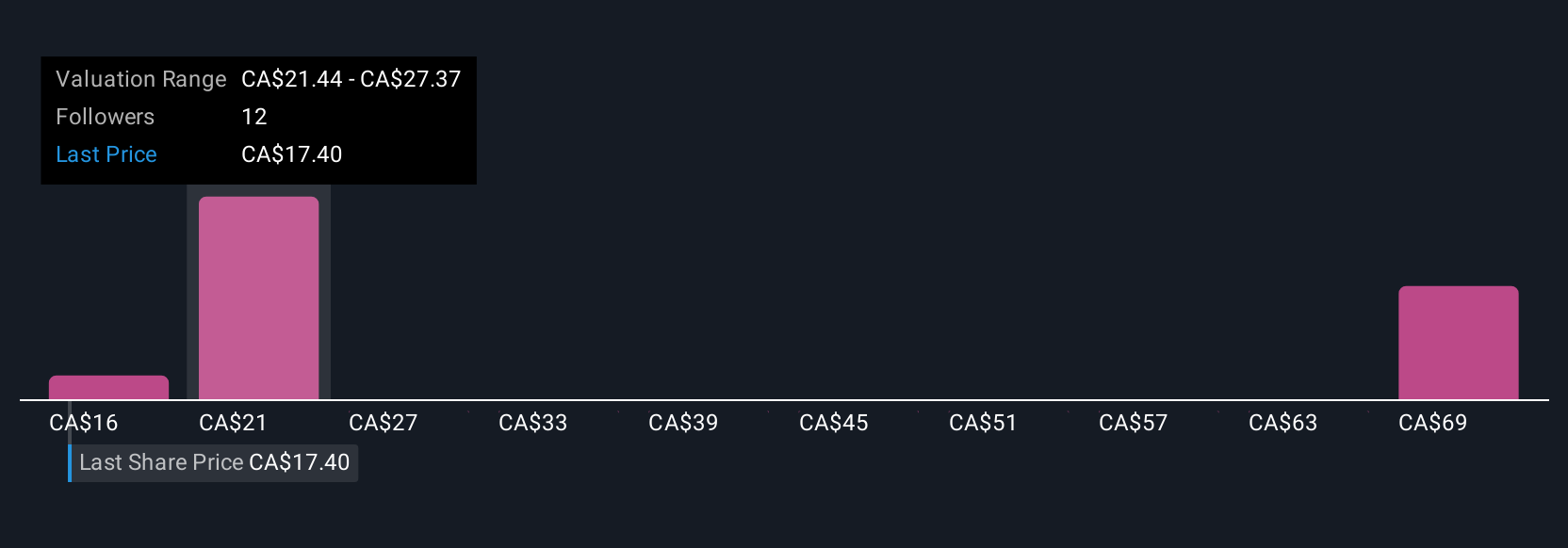

Simply Wall St Community members estimate Wesdome Gold Mines’ fair value anywhere from C$15.50 to C$70.05, with four distinct perspectives. As production growth continues to be a key catalyst, these differing views underscore why comparing multiple outlooks can help shape your investment approach.

Build Your Own Wesdome Gold Mines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wesdome Gold Mines research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Wesdome Gold Mines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wesdome Gold Mines' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wesdome Gold Mines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WDO

Wesdome Gold Mines

Wesdome Gold Mines Ltd. mines, develops, and explores for gold and silver deposits in Canada.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives