- Canada

- /

- Metals and Mining

- /

- TSX:USA

Why Americas Gold and Silver (TSX:USA) Is Up 14.2% After Addition to S&P Global BMI Index and What's Next

Reviewed by Sasha Jovanovic

- Americas Gold and Silver Corporation (TSX:USA) was added to the S&P Global BMI Index in September 2025, expanding the company's profile among institutional investors and index-linked funds following the announcement.

- This development is significant because index additions often draw new attention and capital flows from passive investment strategies, which can affect trading activity and liquidity.

- We’ll explore how the inclusion in the S&P Global BMI Index could shape expectations around institutional interest and future earnings growth for Americas Gold and Silver.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Americas Gold and Silver Investment Narrative Recap

To own shares of Americas Gold and Silver, you need to believe that its transformation into a high-grade silver and copper producer will ultimately translate to reliable revenue and stronger margins, despite the company’s recent reliance on debt and persistent net losses. The S&P Global BMI Index addition could modestly boost market attention and liquidity, but it does not directly address the pressing risks of negative earnings and concentrated operational exposure, which remain the key near-term challenges.

Most relevant to the S&P Global BMI Index news is the completion of Phase 1 shaft upgrades at the Galena Complex, which sharply increases hoisting capacity and is seen as a meaningful step toward operational efficiency. This infrastructure improvement aligns with critical catalysts for the stock, particularly the goal of scaling up production to lower costs and approach consistent profitability.

Yet investors should be aware that in contrast, operational setbacks at the Galena or Cosalá mines could...

Read the full narrative on Americas Gold and Silver (it's free!)

Americas Gold and Silver's narrative projects $343.0 million revenue and $98.5 million earnings by 2028. This requires 52.6% yearly revenue growth and a $158.1 million earnings increase from the current -$59.6 million.

Uncover how Americas Gold and Silver's forecasts yield a CA$5.50 fair value, in line with its current price.

Exploring Other Perspectives

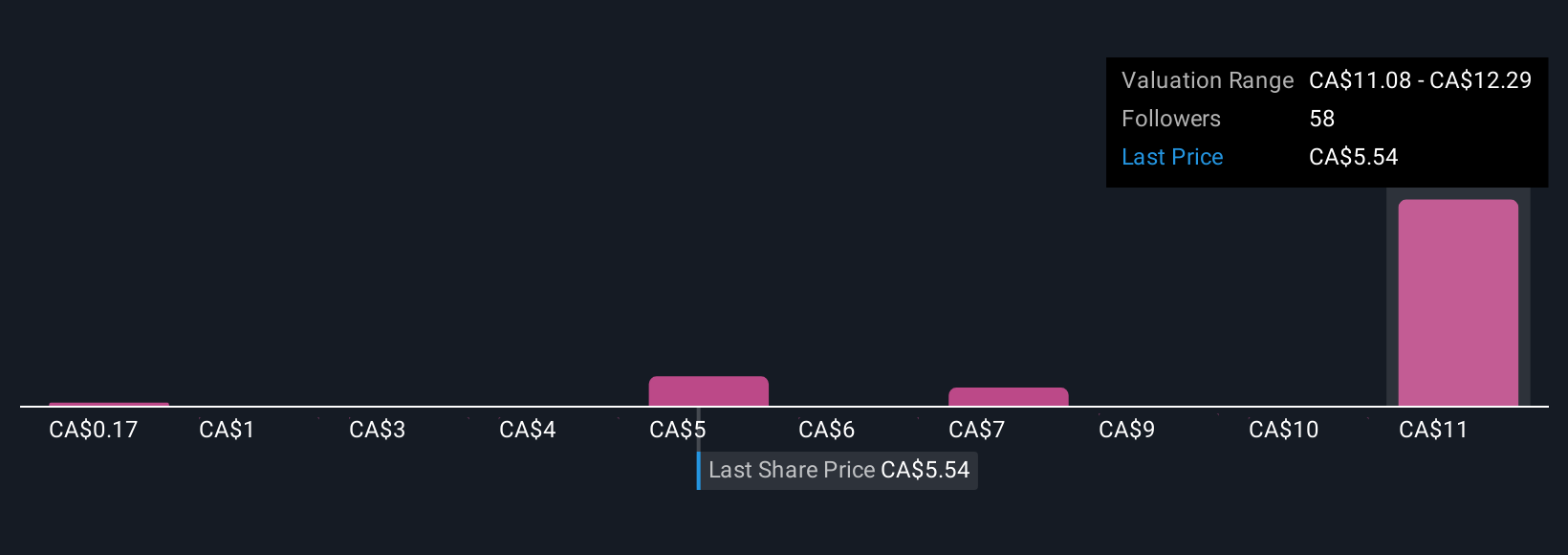

Eight individual fair value estimates from the Simply Wall St Community range widely, from as low as US$0.17 to US$12.29 per share. While this reflects the variety of investor outlooks, keep in mind that operational upgrades at Galena are seen as vital to supporting improved earnings and long-term value, making it important to examine several viewpoints before forming your own.

Explore 8 other fair value estimates on Americas Gold and Silver - why the stock might be worth less than half the current price!

Build Your Own Americas Gold and Silver Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Americas Gold and Silver research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Americas Gold and Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Americas Gold and Silver's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:USA

Americas Gold and Silver

Engages in the exploration, development, and production of mineral properties in the Americas.

High growth potential and fair value.

Market Insights

Community Narratives