- Canada

- /

- Metals and Mining

- /

- TSX:USA

Can Higher Silver Output Sustain Americas Gold and Silver's (TSX:USA) Operational Momentum?

Reviewed by Sasha Jovanovic

- Americas Gold and Silver Corporation reported consolidated silver production of 765,000 ounces and 2.3 million pounds of lead for the third quarter of 2025, reflecting significant year-over-year increases despite a planned 10-day shutdown for upgrades.

- Improved efficiencies at the Galena Complex and a transition to higher-grade zones at Cosalá highlight the company's continuing operational momentum and execution on key production initiatives.

- We'll explore how this accelerating silver and lead production progress could impact Americas Gold and Silver's broader investment narrative and longer-term outlook.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Americas Gold and Silver Investment Narrative Recap

To be a shareholder in Americas Gold and Silver, an investor must have confidence that ongoing production upgrades and higher-grade ore transitions will eventually translate into stable, profitable operations, despite the company’s historical losses and high reliance on debt. While the recent surge in Q3 silver and lead production confirms continued operational progress, it does not materially alter the most significant short-term catalyst: achieving commercial production at EC120, nor does it directly alleviate the persistent risk of ongoing losses and potential dilution from financing needs.

The recent completion of Phase 1 upgrades to the No. 3 Shaft at the Galena Complex stands out as especially relevant to this Q3 production news, as increased hoisting capacity has already helped drive higher output and greater operational efficiency. The upcoming Phase 2 upgrades, scheduled by year-end, remain closely tied to the company’s ability to capitalize on rising silver volumes and approach its profit targets.

Yet, with ramped-up production, investors should be aware of the continued risk that...

Read the full narrative on Americas Gold and Silver (it's free!)

Americas Gold and Silver's narrative projects $343.0 million revenue and $98.5 million earnings by 2028. This requires 52.6% yearly revenue growth and a $158.1 million earnings increase from -$59.6 million today.

Uncover how Americas Gold and Silver's forecasts yield a CA$6.17 fair value, a 10% upside to its current price.

Exploring Other Perspectives

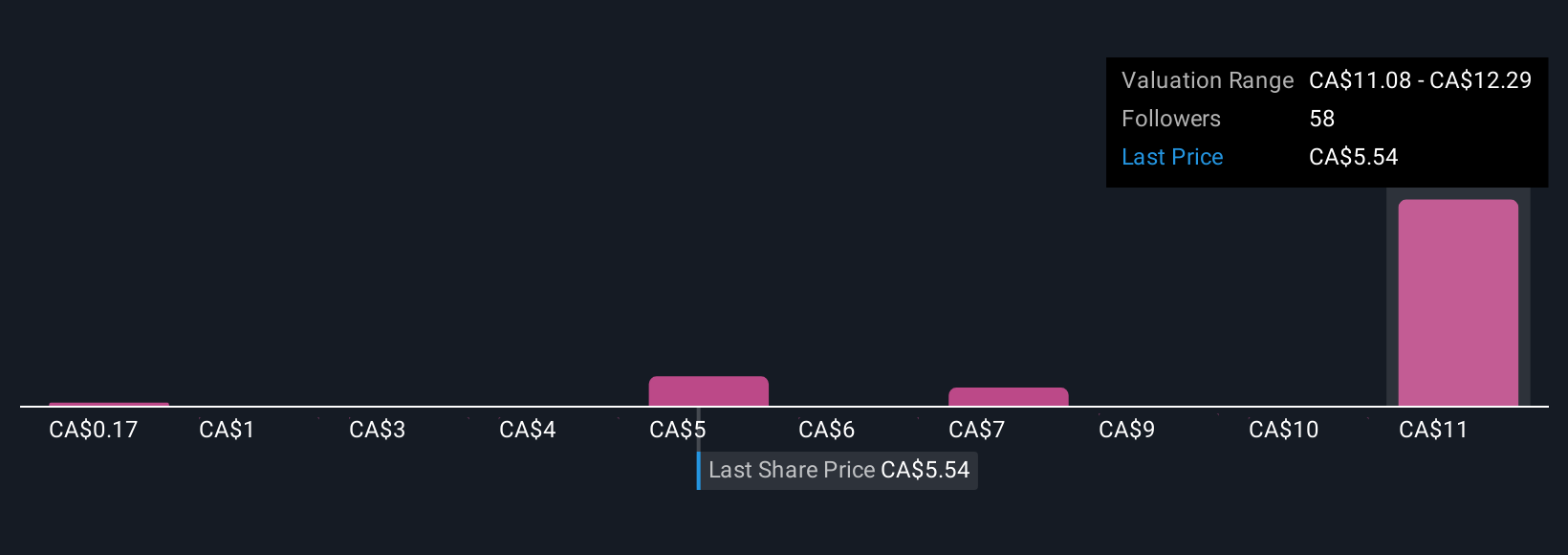

Fair values set by eight members of the Simply Wall St Community span from US$0.17 to US$12.29 per share. While production growth is encouraging, wide differences in outlook reflect ongoing uncertainty around future earnings and operational execution, explore a range of viewpoints to understand all the angles.

Explore 8 other fair value estimates on Americas Gold and Silver - why the stock might be worth less than half the current price!

Build Your Own Americas Gold and Silver Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Americas Gold and Silver research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Americas Gold and Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Americas Gold and Silver's overall financial health at a glance.

No Opportunity In Americas Gold and Silver?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:USA

Americas Gold and Silver

Engages in the exploration, development, and production of mineral properties in the Americas.

High growth potential and good value.

Market Insights

Community Narratives