- Canada

- /

- Metals and Mining

- /

- TSX:USA

A Closer Look at Americas Gold and Silver (TSX:USA) Valuation After Q3 Production Surge

Reviewed by Simply Wall St

Americas Gold and Silver (TSX:USA) saw its silver production nearly double in the third quarter of 2025 due to operational improvements at the Galena Complex and higher-grade mining at Cosalá. Lead output also climbed 23% despite scheduled upgrades.

See our latest analysis for Americas Gold and Silver.

Following its surge in silver output, Americas Gold and Silver has enjoyed a sharp upswing, with a 29.4% one-month share price return and a remarkable 302.9% gain year-to-date. This momentum has more than offset prior underperformance. It has helped drive a 1-year total shareholder return of 217.8% as investors revisit the stock’s growth prospects and risk profile.

If significant turnarounds catch your attention, this could be a great moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock surging after a dramatic operational turnaround, investors now face a key question: is Americas Gold and Silver still trading at a bargain, or has the market already priced in much of its future growth?

Most Popular Narrative: 54.1% Undervalued

Americas Gold and Silver’s narrative fair value sits well above its last close of CA$5.64, signaling a huge upside opportunity if the narrative’s projections play out. According to Agricola, this ambitious outlook incorporates assumptions of substantial commodity price increases, sustained production growth, and a high-inflation environment over the next five years.

“Americas Gold and Silver Corporation is a precious metals producer with operations in Mexico (Cosalá Operations) and the United States (Galena Complex). The company focuses on silver, gold, zinc, lead, and other by-products. Key assets include: Cosalá Operations (Mexico): Includes the San Rafael mine and the EC120 project, expected to reach commercial production by the end of 2025. Galena Complex (Idaho, USA): A high-grade silver mine, with 100% ownership acquired in December 2024, undergoing a recapitalization plan to boost production.”

Want to know the high-stakes logic behind this lofty price target? The narrative centers on outsized growth in production and metals prices, but there is a key financial variable few are watching. Find out what makes these projections bold and who could benefit most if they are right.

Result: Fair Value of $12.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weaker-than-expected silver prices or delays in ramping up production at key projects could quickly challenge even the most bullish outlooks.

Find out about the key risks to this Americas Gold and Silver narrative.

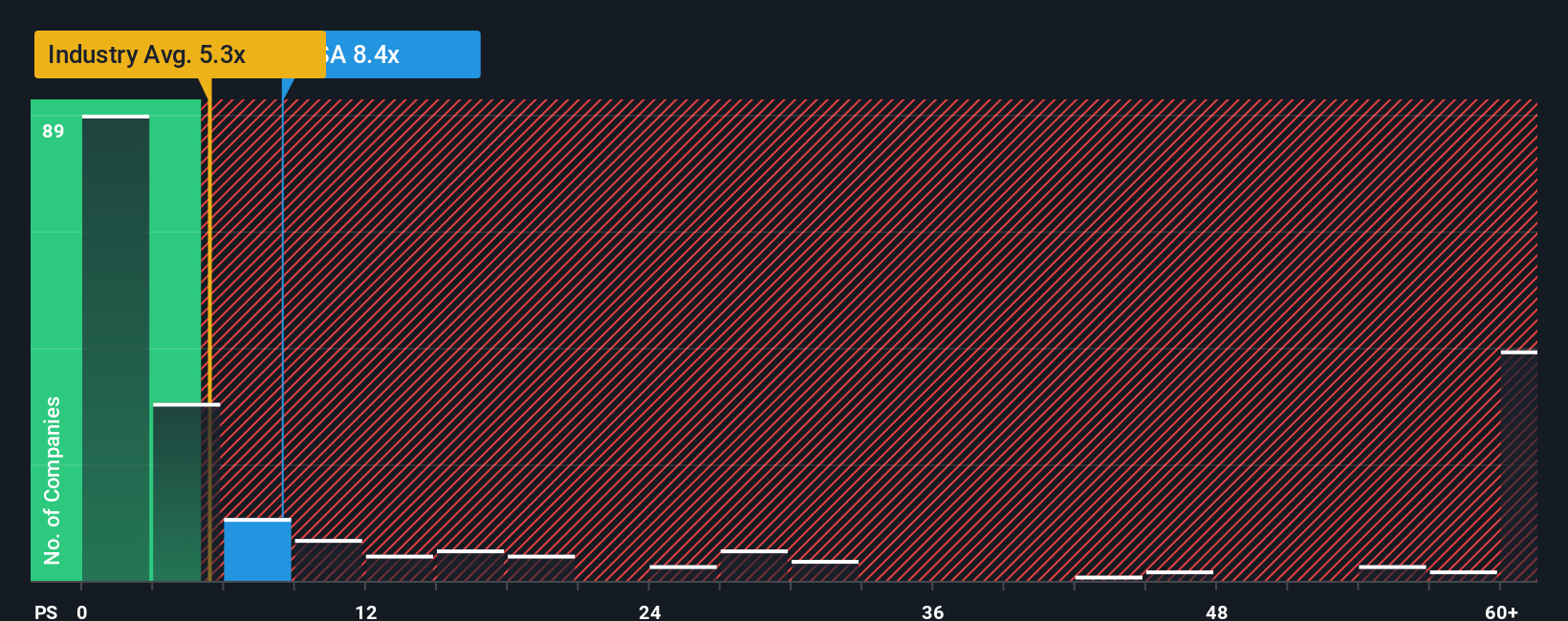

Another View: Gauging Value by Sales Ratios

Looking through the lens of sales ratios, Americas Gold and Silver trades at 11.3 times revenue. While this is far lower than peer companies at 14 times, it stands well above the Canadian Metals and Mining industry average of 5.9 and more than four times the fair ratio of 2.3. This wide gap means growth expectations are sky-high. Could the stock be vulnerable if those assumptions fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Americas Gold and Silver Narrative

If you have a different perspective or want to dive into the numbers on your own terms, you can craft your own take in just a few minutes. Do it your way

A great starting point for your Americas Gold and Silver research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stop waiting on the sidelines when there are overlooked investment gems ready to be found. Uncover real opportunities and avoid missing out by checking these hand-picked ideas:

- Capture stable income potential with access to attractive dividend yields through these 17 dividend stocks with yields > 3%, offering opportunities for consistent returns in any market environment.

- Take advantage of technology’s next wave by exploring these 26 AI penny stocks, where artificial intelligence pioneers could help shape the next decade of growth.

- Enhance your search for value using these 872 undervalued stocks based on cash flows, which highlights companies trading below their intrinsic worth and may be positioned for a potential rebound.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:USA

Americas Gold and Silver

Engages in the exploration, development, and production of mineral properties in the Americas.

Exceptional growth potential and fair value.

Market Insights

Community Narratives