- Canada

- /

- Metals and Mining

- /

- TSX:TXG

Further Upside For Torex Gold Resources Inc. (TSE:TXG) Shares Could Introduce Price Risks After 25% Bounce

The Torex Gold Resources Inc. (TSE:TXG) share price has done very well over the last month, posting an excellent gain of 25%. The last 30 days bring the annual gain to a very sharp 67%.

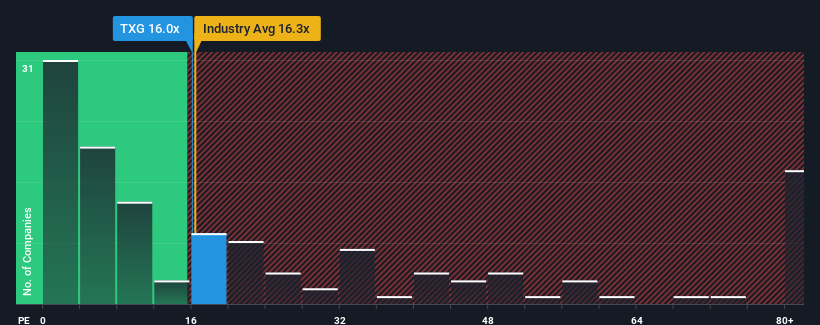

Although its price has surged higher, it's still not a stretch to say that Torex Gold Resources' price-to-earnings (or "P/E") ratio of 16x right now seems quite "middle-of-the-road" compared to the market in Canada, where the median P/E ratio is around 15x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Torex Gold Resources has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Torex Gold Resources

Does Growth Match The P/E?

In order to justify its P/E ratio, Torex Gold Resources would need to produce growth that's similar to the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 52%. The last three years don't look nice either as the company has shrunk EPS by 61% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 17% per annum over the next three years. Meanwhile, the rest of the market is forecast to only expand by 9.0% each year, which is noticeably less attractive.

In light of this, it's curious that Torex Gold Resources' P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Torex Gold Resources' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Torex Gold Resources currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Torex Gold Resources (of which 1 is a bit unpleasant!) you should know about.

If you're unsure about the strength of Torex Gold Resources' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Torex Gold Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:TXG

Very undervalued with exceptional growth potential.

Similar Companies

Market Insights

Community Narratives