- Canada

- /

- Metals and Mining

- /

- TSXV:MTA

Trilogy Metals And 2 Other TSX Penny Stocks To Watch Closely

Reviewed by Simply Wall St

As the Federal Reserve maintains a wait-and-see approach with interest rates, the Canadian market continues to navigate through economic uncertainties and geopolitical risks. Amid these conditions, investors often seek opportunities in areas that offer potential growth at lower price points. Penny stocks, though an older term, still hold relevance by representing smaller or newer companies that can provide a mix of affordability and growth potential when backed by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.64 | CA$64.74M | ✅ 3 ⚠️ 3 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.68 | CA$621.92M | ✅ 3 ⚠️ 4 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.45 | CA$12.89M | ✅ 2 ⚠️ 4 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.90 | CA$464.41M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.79 | CA$525.59M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.89 | CA$17.64M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.11 | CA$157.85M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.88 | CA$180.24M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.15 | CA$6.57M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 460 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Trilogy Metals (TSX:TMQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Trilogy Metals Inc. is involved in the exploration and development of mineral properties in the United States, with a market cap of CA$315.34 million.

Operations: Trilogy Metals Inc. currently does not report any revenue segments as it is focused on the exploration and development of mineral properties in the United States.

Market Cap: CA$315.34M

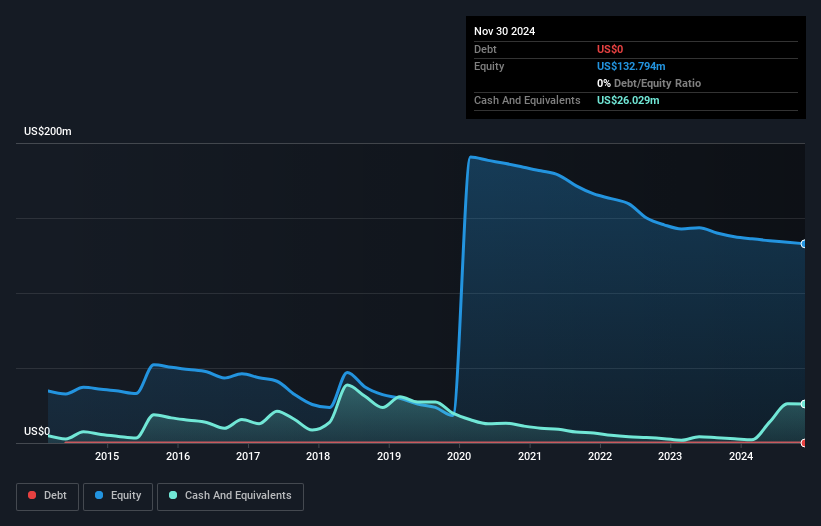

Trilogy Metals Inc., with a market cap of CA$315.34 million, is a pre-revenue company focused on mineral exploration in the U.S. The seasoned management and board bring stability, with average tenures of 5 and 10 years respectively. Despite being debt-free and having sufficient cash runway for over three years, Trilogy remains unprofitable with increasing losses over the past five years at an annual rate of 66.3%. Recent activities include a $25 million follow-on equity offering to bolster its financial position amidst ongoing exploration efforts. Shareholders have not faced significant dilution recently, maintaining confidence in its strategic direction.

- Navigate through the intricacies of Trilogy Metals with our comprehensive balance sheet health report here.

- Learn about Trilogy Metals' historical performance here.

Metalla Royalty & Streaming (TSXV:MTA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Metalla Royalty & Streaming Ltd. is a precious metals royalty and streaming company focused on acquiring and managing gold, silver, and copper royalties and streams in Canada, with a market cap of CA$462.62 million.

Operations: The company generates revenue of $6.35 million from its operations in acquiring and managing precious metal royalties, streams, and similar production-based interests.

Market Cap: CA$462.62M

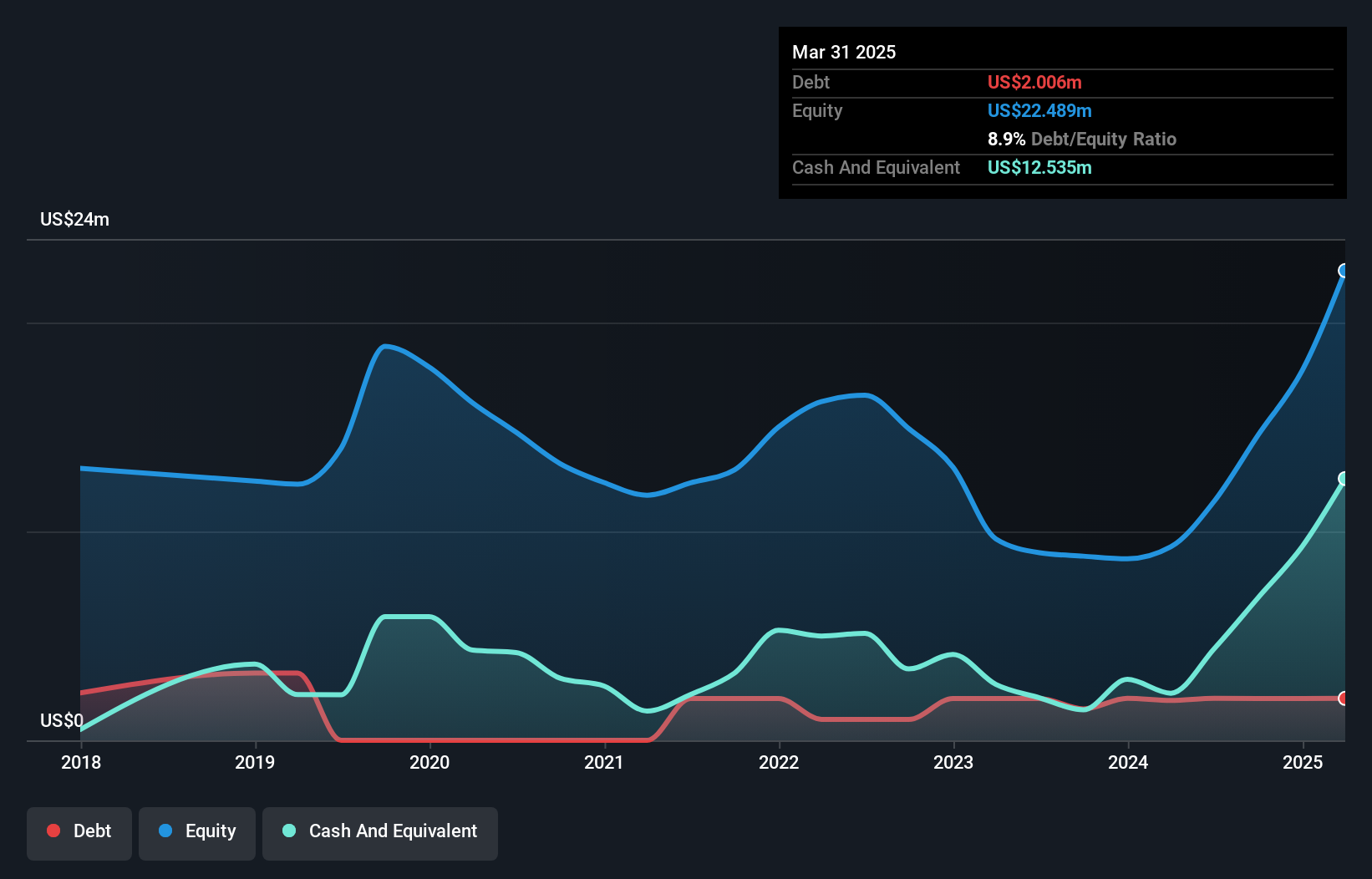

Metalla Royalty & Streaming Ltd., with a market cap of CA$462.62 million, operates in the precious metals royalty and streaming sector, generating US$6.35 million in revenue. Despite being unprofitable, it has reduced losses over five years by 4% annually and maintains a satisfactory net debt to equity ratio of 1.6%. The company’s short-term assets fall short of covering its liabilities but exceed long-term liabilities. Analysts anticipate a 42.5% stock price increase, while earnings are projected to grow significantly by 78.57% annually. Recent earnings show improved loss reduction compared to the previous year’s results.

- Click to explore a detailed breakdown of our findings in Metalla Royalty & Streaming's financial health report.

- Learn about Metalla Royalty & Streaming's future growth trajectory here.

Zoomd Technologies (TSXV:ZOMD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zoomd Technologies Ltd. is a global marketing technology company specializing in user acquisition and engagement, with a market cap of CA$123.96 million.

Operations: The company generates revenue from its Internet Software & Services segment, amounting to $63.92 million.

Market Cap: CA$123.96M

Zoomd Technologies Ltd., with a market cap of CA$123.96 million, has shown significant growth, reporting first-quarter 2025 sales of US$18.17 million, up from US$8.75 million the previous year. The company achieved profitability this year, with net income reaching US$4.76 million compared to US$0.539 million last year and basic earnings per share increasing to US$0.05 from US$0.01 year-over-year. Despite high volatility in its share price and a substantial increase in debt-to-equity ratio over five years, Zoomd's operating cash flow comfortably covers its debt obligations, while strategic M&A activities are being explored to further accelerate growth.

- Click here and access our complete financial health analysis report to understand the dynamics of Zoomd Technologies.

- Examine Zoomd Technologies' past performance report to understand how it has performed in prior years.

Seize The Opportunity

- Click here to access our complete index of 460 TSX Penny Stocks.

- Looking For Alternative Opportunities? The latest GPUs need a type of rare earth metal called Terbium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:MTA

Metalla Royalty & Streaming

A precious metals royalty and streaming company, engages in the acquisition and management of gold, silver, copper royalties, streams, and related production-based interests in Canada.

Undervalued with high growth potential.

Market Insights

Community Narratives