- Canada

- /

- Metals and Mining

- /

- TSX:TI

Titan Mining (TSX:TI) Is Up 24.1% After US Export-Import Bank Considers $120M Kilbourne Funding

Reviewed by Sasha Jovanovic

- The U.S. Export-Import Bank recently expressed interest in providing up to US$120 million in financing for Titan Mining’s Kilbourne Graphite Project in New York, recognizing it as a key critical-minerals initiative.

- This potential support could enable Titan Mining to become the United States’ first fully integrated producer of natural flake graphite, a material essential for battery, defense, and industrial applications.

- We’ll explore how the prospect of government-backed funding for domestic graphite production shapes Titan Mining’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Titan Mining's Investment Narrative?

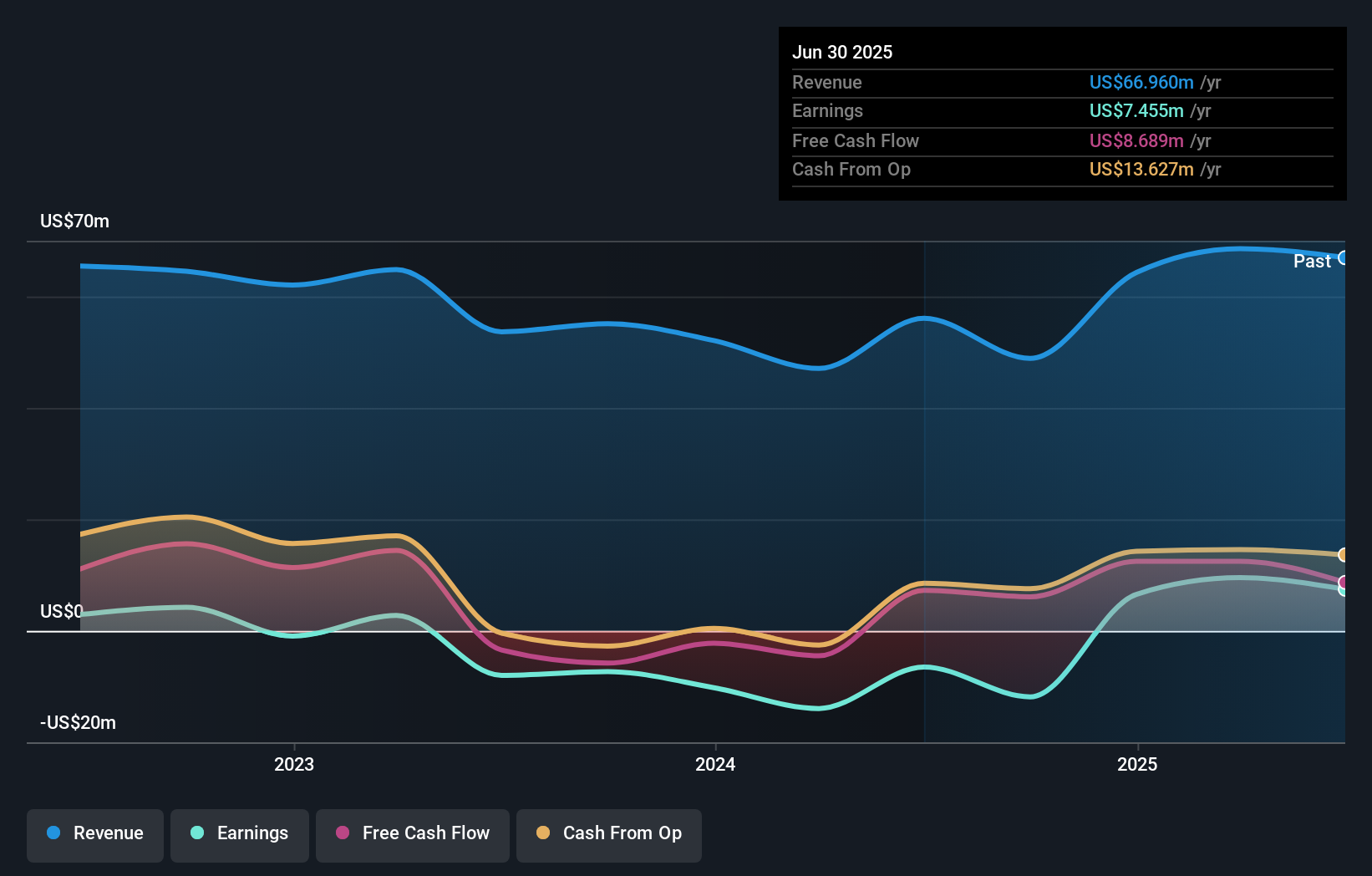

Titan Mining’s investment narrative has shifted meaningfully with the U.S. Export-Import Bank’s expression of up to US$120 million in project financing for its Kilbourne Graphite Project in New York. This news arrives on the heels of management changes and accelerating construction milestones on the company’s goal to launch America’s first integrated natural graphite supply chain in decades. Short-term, the possibility of government-backed funding adds a significant catalyst, as it may cover a large proportion of construction costs, reduce financing uncertainty, and potentially speed up commercial production timelines. Previously, the primary risks centered on high debt levels, volatile share price moves, and the ability to secure sufficient capital for project completion. While investor optimism has pushed the share price to historic highs, the new support meaningfully alters the risk profile and timeline for key project milestones, but execution, funding approval, and project ramp-up still carry real uncertainty.

Yet with the spotlight on growth, investors should still watch for debt and execution risks.

Exploring Other Perspectives

Explore 3 other fair value estimates on Titan Mining - why the stock might be worth less than half the current price!

Build Your Own Titan Mining Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Titan Mining research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Titan Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Titan Mining's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Titan Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TI

Titan Mining

A natural resource company, acquires, explores, develops, produces, and extracts mineral properties.

Good value with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.