- Canada

- /

- Metals and Mining

- /

- TSX:TECK.B

Teck Resources (TSX:TECK.B) Restructures Leadership and Business Units for Energy Transition Growth

Reviewed by Simply Wall St

Unlock comprehensive insights into our analysis of Teck Resources stock here.

Strengths: Core Advantages Driving Sustained Success For Teck Resources

Teck Resources has demonstrated strong operational and financial performance, with Q1 being particularly robust. CEO Jonathan Price highlighted the completion of major construction projects at Quebrada Blanca (QB), including the ship loader and molybdenum plant, which are expected to enhance production capabilities. The company has also shown a commitment to returning cash to shareholders, with $80 million in share buybacks executed under a $500 million return authorized by the Board. CFO Crystal Prystai emphasized Teck's strong liquidity position, with $7.1 billion in liquidity, including $1.6 billion in cash as of April 2024. Additionally, Teck's copper production saw a significant increase of 74% year-over-year, reaching 99,000 tonnes in the latest quarter.

Teck Resources is currently trading above its estimated fair value, indicating it may be overpriced relative to its intrinsic worth. However, the company's Price-To-Earnings Ratio (23.6x) compared to the peer average (66.4x) suggests it is a good value among its peers. This valuation strength underscores Teck's market positioning and financial health.

Weaknesses: Critical Issues Affecting Teck Resources' Performance and Areas For Growth

Despite its strengths, Teck Resources faces several challenges. The company reported a decline in adjusted EBITDA from $2 billion a year ago to $1.7 billion in the latest quarter, as noted by Jonathan Price. High unit costs at QB, particularly during the ramp-up phase, have also been a concern. Crystal Prystai highlighted that profit attributable to shareholders is now based on a reduced 77% ownership of Elk Valley Resources (EVR), with 23% of EVR profit attributable to noncontrolling interests. Additionally, Teck's Price-To-Earnings Ratio (23.6x) is higher than the Canadian Metals and Mining industry average (16.2x), indicating it may be expensive compared to industry standards. The company's current trading price of CA$66.43 is above the estimated fair value of CA$60.31, suggesting it may be overpriced.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Teck Resources has several opportunities to leverage for future growth. The energy transition is expected to significantly boost copper demand, potentially adding 6.5 to 7 million tonnes over the next five years. Regulatory approvals for the full sale of Glencore are progressing as anticipated, with closing expected no later than the third quarter of this year. This sale could provide substantial financial resources for further investments. Additionally, the company is advancing engineering and design projects, with substantial completion expected by Q1 2025. Teck's involvement in the North Pacific Green Corridor Consortium aims to decarbonize the value chain for commodities between North America and Asia, aligning with global green initiatives and enhancing its market position.

Threats: Key Risks and Challenges That Could Impact Teck Resources' Success

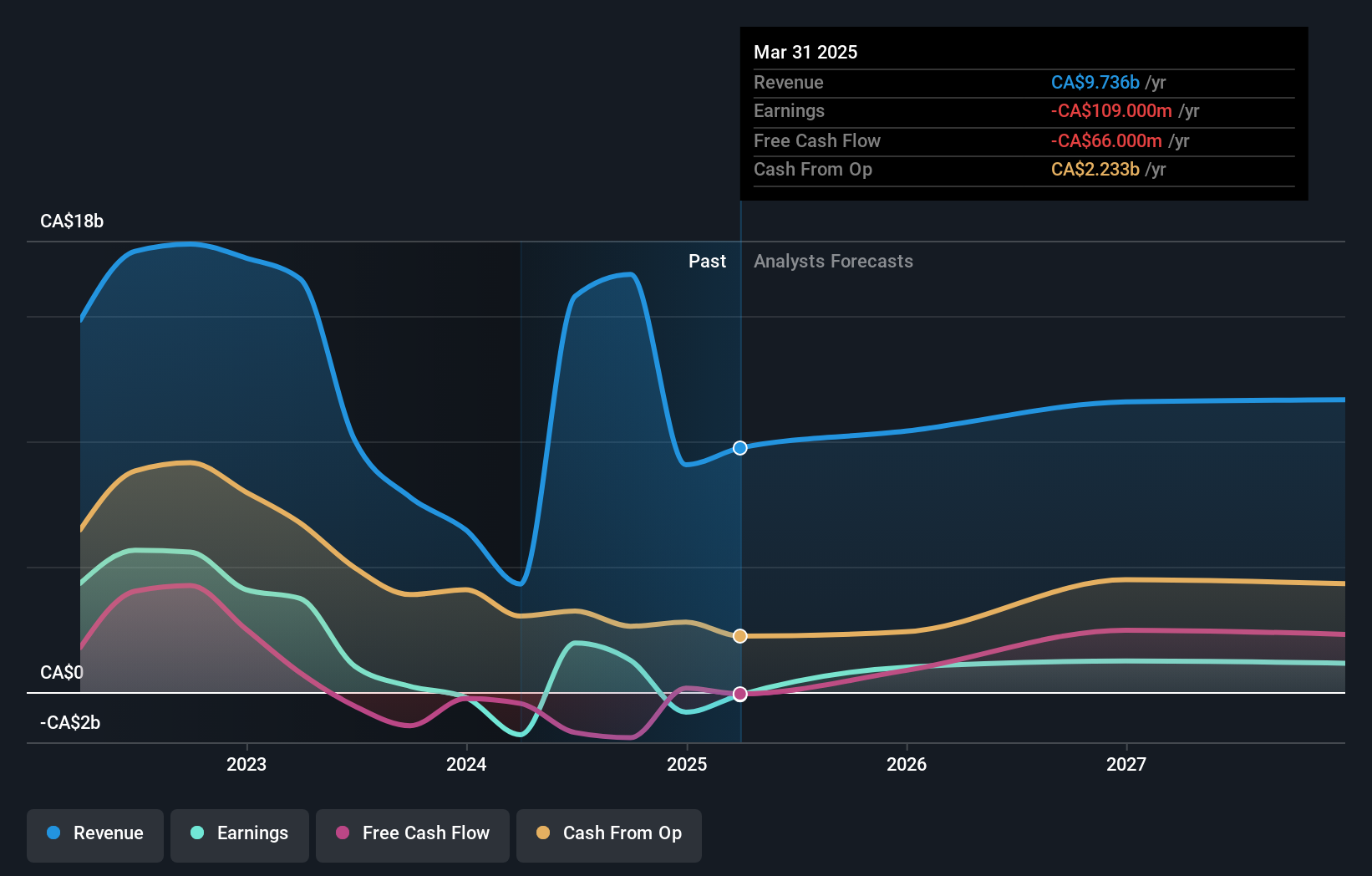

Teck Resources faces several external threats that could impact its success. Market pricing pressures, particularly in the zinc market, have been a concern, with prices falling by 2% over Q4 2023. Operational risks, such as equipment failures, though temporary, can disrupt production and increase costs. Competitive pressures from potential takeovers, like the proposed Anglo volume BHP, highlight the attractiveness of the copper market and could intensify competition. Regulatory challenges also pose a threat, as the company continues to respond to information requests from regulators on the permit application for mine-life extensions. These factors, combined with the forecasted decline in earnings by an average of 1.8% per year over the next three years, underscore the challenges Teck Resources must navigate.

Conclusion

Teck Resources' strong operational performance and significant liquidity position highlight its capacity for sustained growth, particularly with the completion of key projects at Quebrada Blanca and a notable increase in copper production. However, challenges such as declining EBITDA, high unit costs, and a reduced profit share from Elk Valley Resources indicate areas that need strategic focus. The company's proactive steps toward future opportunities, like the energy transition and regulatory approvals for asset sales, position it well for long-term growth. Despite these strengths, the current trading price above its estimated fair value suggests that investors should be cautious about potential overpricing relative to its intrinsic worth, which could impact its attractiveness in the near term.

Seize The Opportunity

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Teck Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:TECK.B

Teck Resources

Engages in research, exploration, development, processing, smelting, refining, and reclamation of mineral properties in Asia, the Americas, and Europe.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives