- Canada

- /

- Metals and Mining

- /

- TSX:TECK.B

Teck Resources (TSX:TECK.B): Checking the Valuation After a Choppy 3-Month Climb

Reviewed by Simply Wall St

Teck Resources (TSX:TECK.B) has been grinding higher over the past 3 months, up about 9%, even as the past week saw a pullback. That mix of momentum and volatility raises some interesting valuation questions.

See our latest analysis for Teck Resources.

Zooming out, Teck’s roughly 9% 3 month share price return and modest year to date gain suggest steady, if choppy, momentum. This appears to build on the back of incremental progress in its copper focused growth story and shifting risk sentiment around commodities, even as the latest close sits at CA$59.36 and the one year total shareholder return is essentially flat compared with a much stronger multiyear record.

If Teck’s mixed momentum has you rethinking where the next leg of returns might come from, it could be worth scanning fast growing stocks with high insider ownership for other under the radar ideas with conviction behind them.

With earnings growing modestly and the share price sitting just below analyst targets but at a hefty discount to some intrinsic value estimates, is Teck quietly undervalued or is the market already baking in its copper driven upside?

Most Popular Narrative: 5.7% Undervalued

With Teck Resources last closing at CA$59.36 against a narrative fair value of about CA$62.94, the story leans toward modest upside grounded in copper centric growth assumptions.

The sanctioned Highland Valley Copper Mine Life Extension project and ongoing optimization/debottlenecking at QB are set to double Teck's copper production by decade's end, enabling the company to capitalize on the accelerating demand for copper from global electrification and energy transition, which should materially increase revenue and long-term earnings growth.

Curious how doubling copper output, steadier margins, and a richer future earnings multiple all fit together? The narrative spells out the full valuation blueprint.

Result: Fair Value of $62.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent project delays and escalating capital costs could strain free cash flow and undermine the copper growth story that underpins the undervaluation case.

Find out about the key risks to this Teck Resources narrative.

Another Angle on Valuation

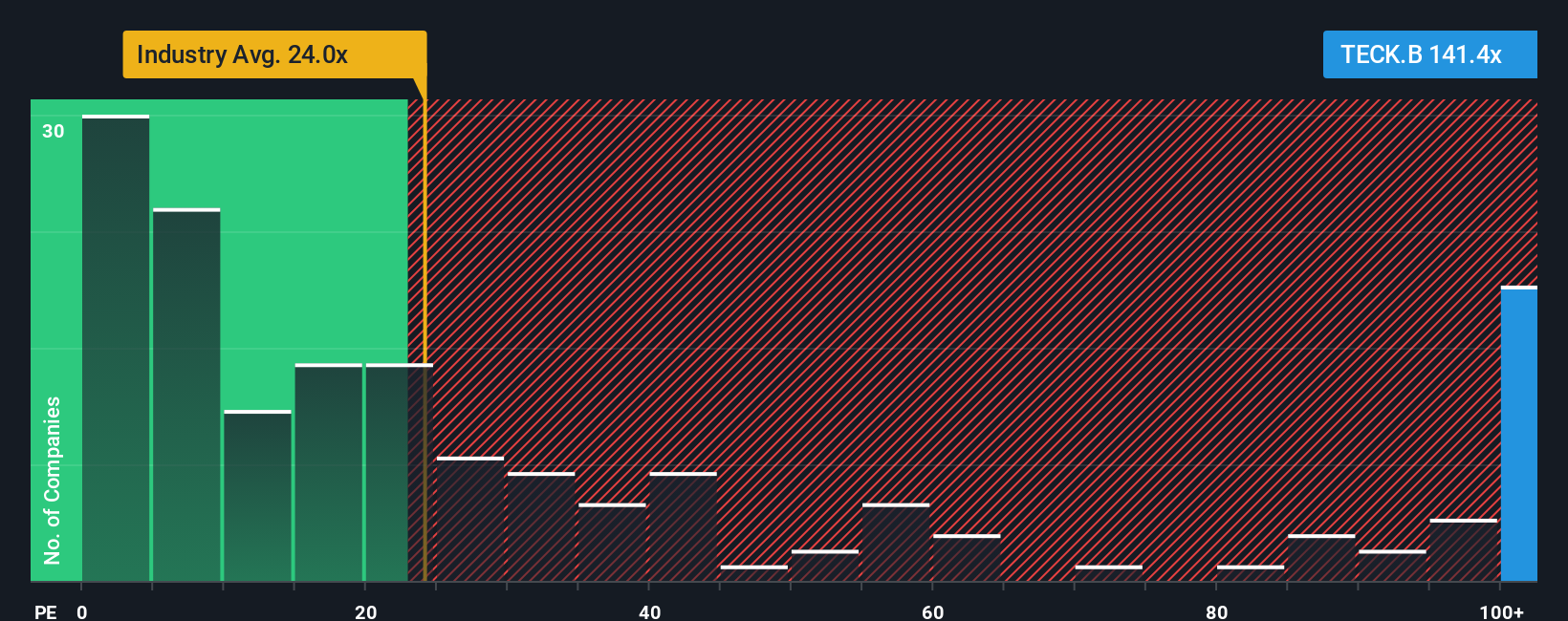

On earnings, Teck looks stretched, trading at about 23.3 times earnings versus a fair ratio near 17.3 times and a Canadian metals and mining average of 21.4 times. That richer ratio hints at valuation risk if copper or project delivery stumble from here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Teck Resources Narrative

If this storyline does not quite match your view, dive into the numbers yourself and craft a personalized thesis in minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Teck Resources.

Ready for more actionable investment ideas?

Before you move on, line up your next smart moves with carefully filtered opportunities from our screeners, so you are not leaving potential returns on the table.

- Capture potential deep value by reviewing these 915 undervalued stocks based on cash flows that look mispriced based on future cash flows and solid fundamentals.

- Ride powerful structural growth trends by assessing these 30 healthcare AI stocks transforming patient outcomes, diagnostics, and medical workflows.

- Position yourself early in emerging digital asset themes by scanning these 80 cryptocurrency and blockchain stocks tying real businesses to blockchain and cryptocurrency innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Teck Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TECK.B

Teck Resources

Engages in research, exploration, development, processing, smelting, refining, and reclamation of mineral properties in Asia, the Americas, and Europe.

Fair value with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion