- Canada

- /

- Paper and Forestry Products

- /

- TSX:SXP

TSX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

As the Canadian market navigates shifting expectations from the Federal Reserve and global economic trends, investors are keenly watching how these factors influence local equities. In this context, penny stocks—often representing smaller or newer companies—continue to offer intriguing opportunities for growth, especially when backed by robust financial health. Despite being a somewhat outdated term, these stocks remain relevant as they can provide a unique blend of affordability and potential returns for those looking to explore under-the-radar investments.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.65 | CA$602.45M | ★★★★★★ |

| Alvopetro Energy (TSXV:ALV) | CA$4.85 | CA$182.69M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.39 | CA$119.63M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.40 | CA$11.46M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.18 | CA$5.66M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.40 | CA$327.12M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$291.81M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.07 | CA$28.74M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$4.07M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.10 | CA$129.82M | ★★★★☆☆ |

Click here to see the full list of 954 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Minco Silver (TSX:MSV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Minco Silver Corporation is involved in the exploration, evaluation, and development of precious metal and other mineral properties, with a market cap of CA$11.59 million.

Operations: No revenue segments are reported for this company.

Market Cap: CA$11.59M

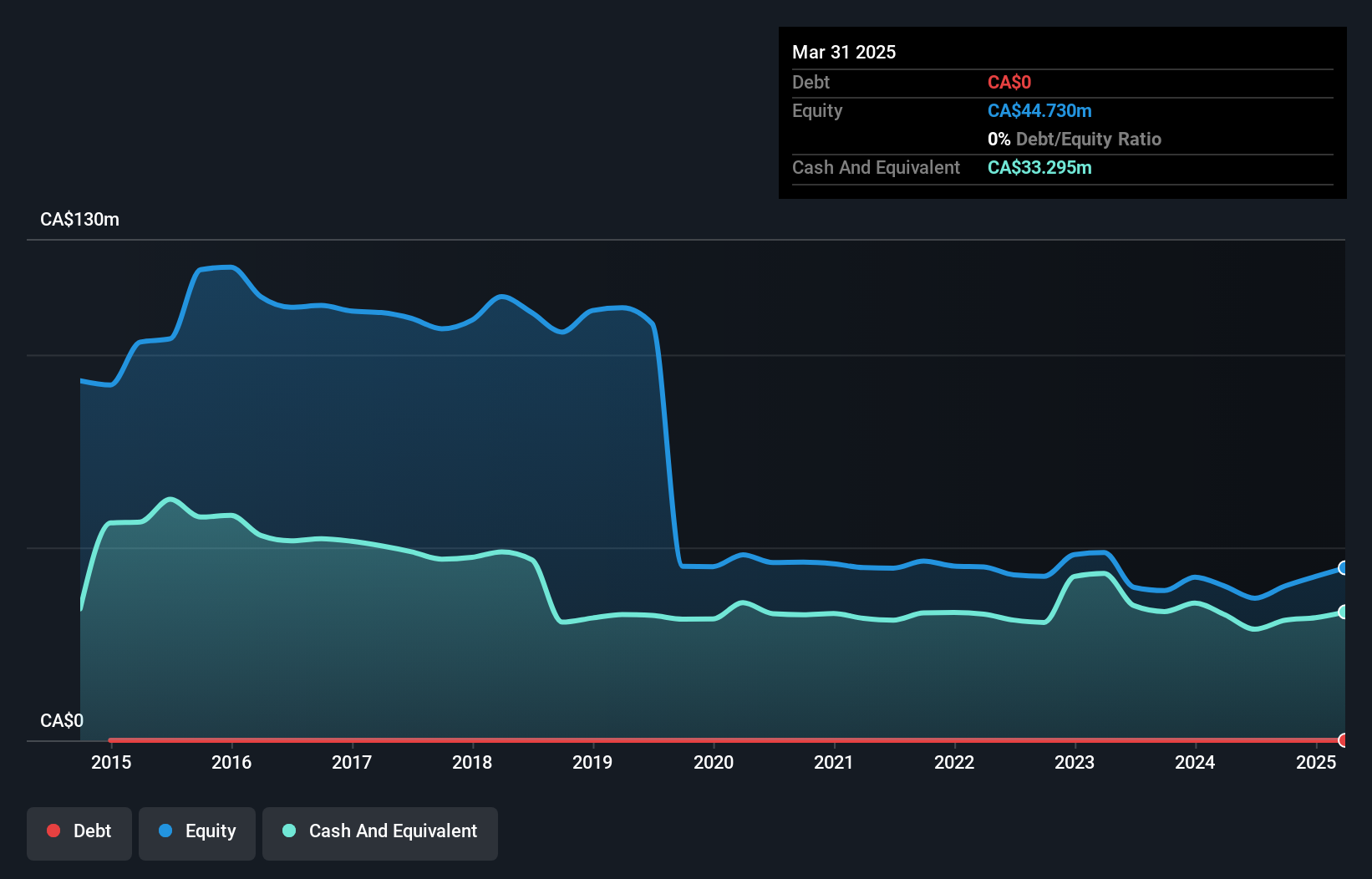

Minco Silver Corporation, with a market cap of CA$11.59 million, operates as a pre-revenue entity in the mining sector. Despite being unprofitable, it has successfully reduced losses by 60.2% annually over the past five years and remains debt-free for the last five years. The company boasts sufficient cash runway exceeding three years if its free cash flow continues to grow at historical rates. Its short-term assets of CA$37.9 million comfortably cover both short and long-term liabilities, while shareholders have not faced dilution recently. The board is seasoned with an average tenure of 14 years.

- Get an in-depth perspective on Minco Silver's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Minco Silver's track record.

Supremex (TSX:SXP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Supremex Inc. manufactures and markets envelopes, paper-based packaging solutions, and specialty products primarily in Canada and the United States, with a market cap of CA$99.47 million.

Operations: The company's revenue is derived from two primary segments: Envelope, generating CA$202.76 million, and Packaging & Specialty Products, contributing CA$81.95 million.

Market Cap: CA$99.47M

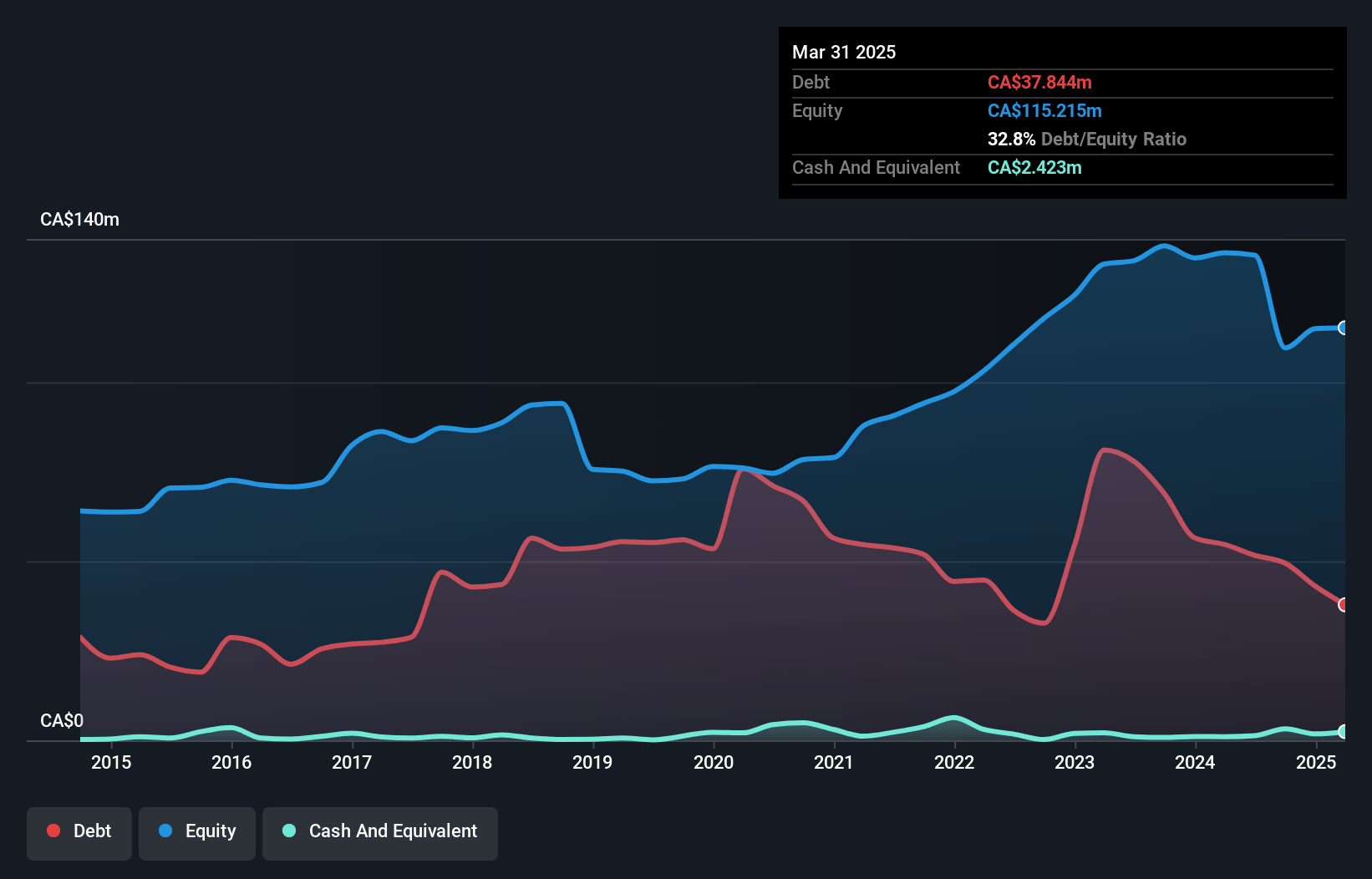

Supremex Inc., with a market cap of CA$99.47 million, has shown mixed performance as a penny stock. The company's revenue is primarily driven by its Envelope and Packaging & Specialty Products segments. Despite well-covered interest payments and satisfactory debt levels, Supremex's earnings growth has been negative recently, with net income declining year-over-year for the past quarter and six months ending June 30, 2024. However, it maintains high-quality earnings and stable weekly volatility. The firm also completed a share buyback program while sustaining dividend payments despite an unstable track record in this area.

- Jump into the full analysis health report here for a deeper understanding of Supremex.

- Explore Supremex's analyst forecasts in our growth report.

Canaf Investments (TSXV:CAF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Canaf Investments Inc., with a market cap of CA$14.70 million, processes anthracite coal into de-volatized anthracite through its operations in Canada and South Africa.

Operations: Canaf Investments Inc. does not report specific revenue segments for its operations in Canada and South Africa, where it processes anthracite coal into de-volatized anthracite.

Market Cap: CA$14.7M

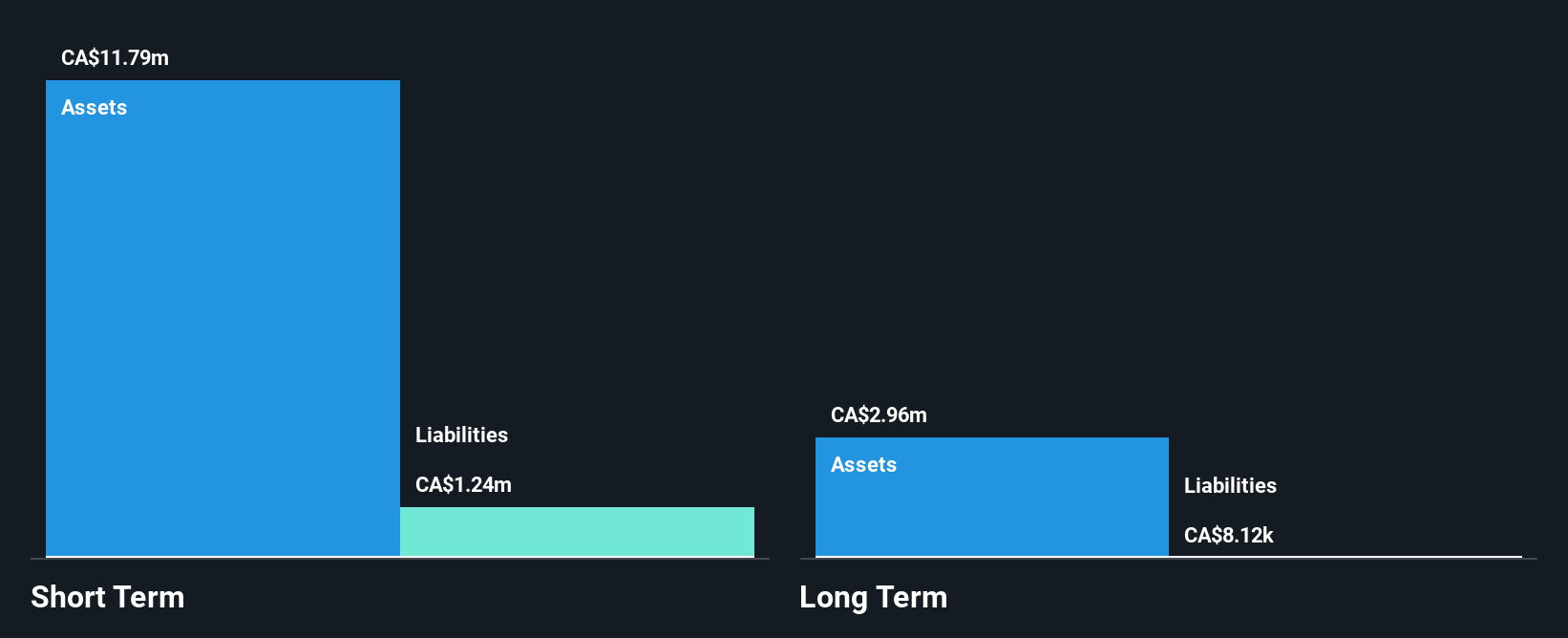

Canaf Investments Inc., with a market cap of CA$14.70 million, has demonstrated robust financial performance, reporting earnings growth of 36.9% over the past year, surpassing the industry average. The company is debt-free and boasts a high return on equity at 24.3%, indicating efficient use of capital. Its short-term assets significantly exceed liabilities, ensuring strong liquidity. Recent developments include establishing Canaf Capital in South Africa to provide asset-backed financing, potentially diversifying revenue streams further. Despite stable weekly volatility and no shareholder dilution last year, management's tenure data remains insufficient for assessment of experience levels.

- Click here to discover the nuances of Canaf Investments with our detailed analytical financial health report.

- Evaluate Canaf Investments' historical performance by accessing our past performance report.

Taking Advantage

- Jump into our full catalog of 954 TSX Penny Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SXP

Supremex

Manufactures and markets envelopes, and paper-based packaging solutions and specialty products for corporations, direct mailers, resellers, government entities, small and medium sized enterprises, and solution providers in Canada and the United States.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives