- Canada

- /

- Communications

- /

- TSX:QTRH

3 TSX Penny Stocks With Market Caps Under CA$300M To Consider

Reviewed by Simply Wall St

The Canadian market has shown resilience, with the TSX recovering significantly from its lows and benefiting from strong performance in the materials sector. As investors navigate this evolving landscape, penny stocks—often representing smaller or emerging companies—continue to offer intriguing opportunities for growth. Although the term "penny stocks" might seem outdated, these investments can still provide potential upside when backed by solid fundamentals and financial health.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.63 | CA$60.69M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.67 | CA$67.7M | ✅ 4 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.64 | CA$405.83M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.17 | CA$611.96M | ✅ 4 ⚠️ 1 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.76 | CA$285.52M | ✅ 2 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.55 | CA$512.4M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.51 | CA$126.99M | ✅ 1 ⚠️ 2 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.48 | CA$93.89M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.49 | CA$14.61M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.24 | CA$45.42M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 929 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Quarterhill (TSX:QTRH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quarterhill Inc. operates in the intelligent transportation systems sector both in Canada and internationally, with a market cap of CA$155.74 million.

Operations: The company generates revenue of $153.31 million from its operations in the intelligent transportation systems sector.

Market Cap: CA$155.74M

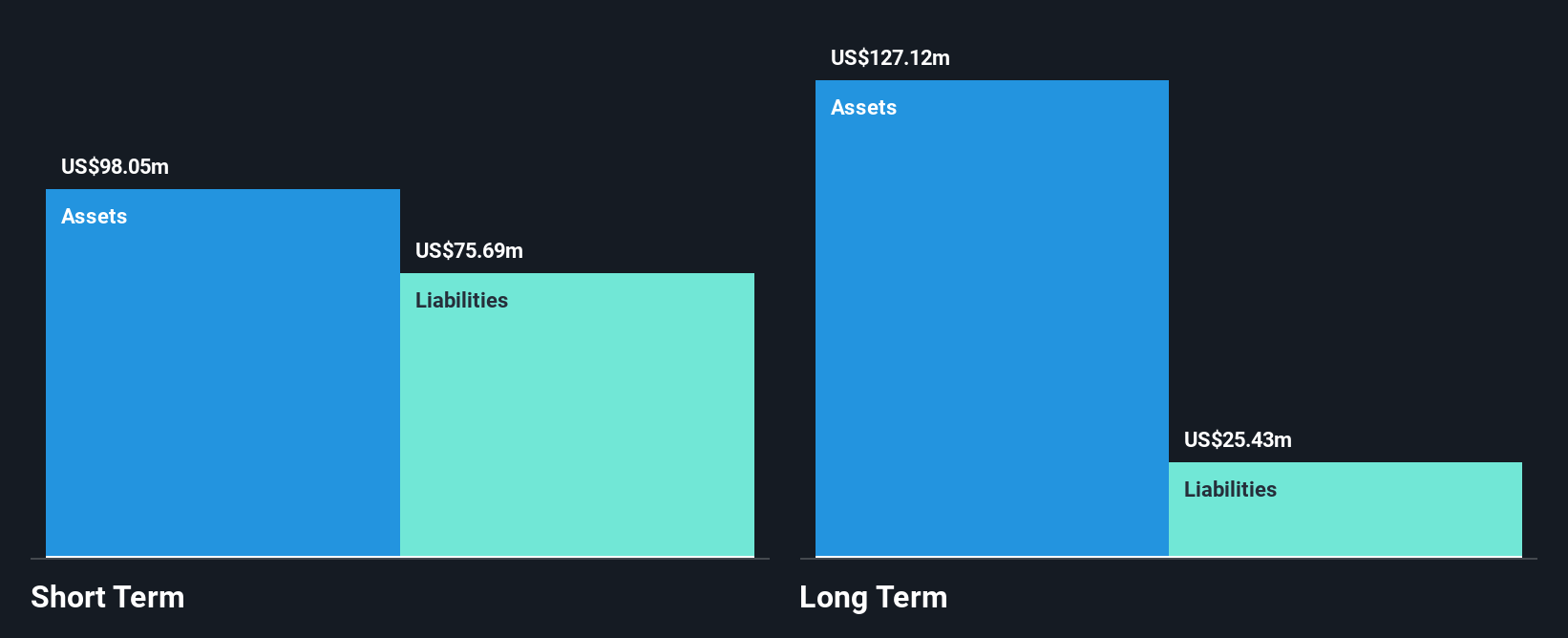

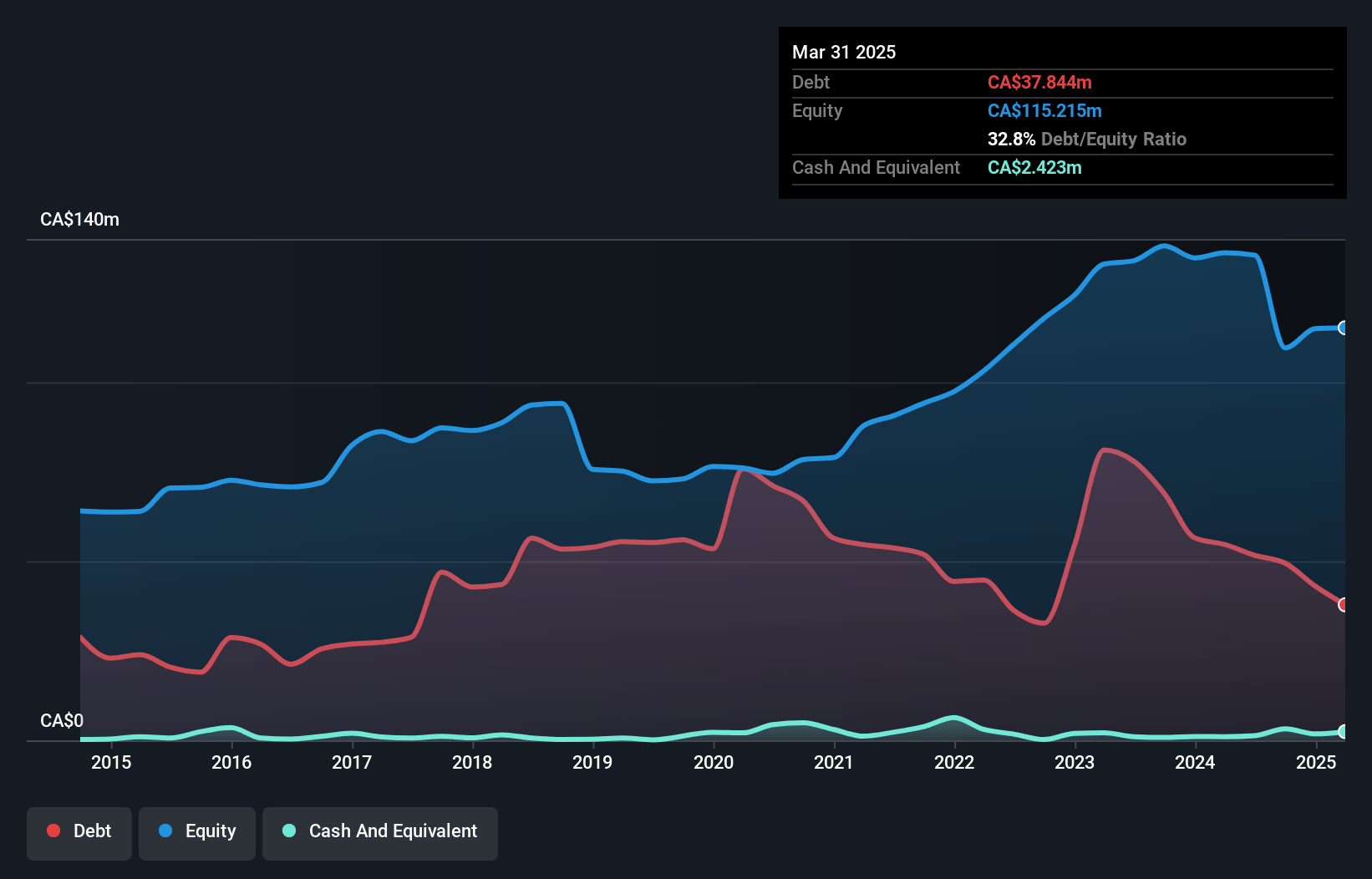

Quarterhill Inc., operating in the intelligent transportation systems sector, has a market cap of CA$155.74 million and generated revenue of US$153.31 million for 2024, despite remaining unprofitable with a net loss of US$11.02 million. The company has strong short-term asset coverage over liabilities and a satisfactory net debt to equity ratio of 17%. Analysts suggest potential stock price growth, trading at 70% below estimated fair value. Recent board changes include the appointment of Robin Saunders, enhancing financial expertise. However, management's lack of experience and increased debt-to-equity ratio over five years are concerns for investors.

- Get an in-depth perspective on Quarterhill's performance by reading our balance sheet health report here.

- Gain insights into Quarterhill's future direction by reviewing our growth report.

Supremex (TSX:SXP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Supremex Inc. is a company that manufactures and markets envelopes, paper-based packaging solutions, and specialty products for various clients in Canada and the United States, with a market cap of CA$101.19 million.

Operations: The company's revenue is derived from two main segments: Envelope, generating CA$199.16 million, and Packaging & Specialty Products, contributing CA$81.87 million.

Market Cap: CA$101.19M

Supremex Inc. has a market cap of CA$101.19 million, with revenue primarily from its Envelope (CA$199.16 million) and Packaging & Specialty Products (CA$81.87 million) segments. Despite a seasoned board and experienced management team, the company is unprofitable, reporting a net loss of CA$11.74 million in 2024 compared to a previous net income of CA$17.33 million. Supremex's debt is well-covered by operating cash flow, although short-term assets do not fully cover long-term liabilities. Recent executive changes include the departure of CFO François Bolduc, potentially impacting financial strategies moving forward.

- Click here to discover the nuances of Supremex with our detailed analytical financial health report.

- Assess Supremex's future earnings estimates with our detailed growth reports.

Colonial Coal International (TSXV:CAD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Colonial Coal International Corp. is involved in the acquisition, exploration, and development of coal properties in Canada with a market cap of CA$268.93 million.

Operations: Colonial Coal International Corp. has not reported any revenue segments.

Market Cap: CA$268.93M

Colonial Coal International Corp., with a market cap of CA$268.93 million, remains pre-revenue and unprofitable, having reported a net loss of CA$5.56 million for the six months ending January 31, 2025. Despite its financial challenges, the company benefits from being debt-free and having sufficient cash runway for over three years based on current free cash flow trends. The board and management team are seasoned with significant tenure, providing stability amid recent executive changes following the passing of founding director Anthony Hammond. Short-term assets comfortably cover liabilities, yet earnings have declined significantly over five years at an annual rate of 28.9%.

- Unlock comprehensive insights into our analysis of Colonial Coal International stock in this financial health report.

- Evaluate Colonial Coal International's historical performance by accessing our past performance report.

Summing It All Up

- Get an in-depth perspective on all 929 TSX Penny Stocks by using our screener here.

- Ready For A Different Approach? The latest GPUs need a type of rare earth metal called Neodymium and there are only 23 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quarterhill might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:QTRH

Quarterhill

Operates in the intelligent transportation systems business in Canada and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives