- Canada

- /

- Infrastructure

- /

- TSX:WTE

Undiscovered Canadian Gems With Strong Fundamentals For October 2024

Reviewed by Simply Wall St

The Canadian market has shown robust performance, rising 1.4% in the past week with all sectors gaining ground, and achieving a 22% increase over the last year. In this thriving environment, identifying stocks with strong fundamentals is crucial for investors looking to capitalize on expected earnings growth of 15% per annum in the coming years.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.74% | 10.99% | 25.68% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 15.28% | 7.58% | ★★★★★★ |

| Taiga Building Products | NA | 6.05% | 10.50% | ★★★★★★ |

| Lithium Chile | NA | nan | 30.02% | ★★★★★★ |

| Westshore Terminals Investment | NA | -2.67% | -9.77% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 43.35% | 67.95% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Pizza Pizza Royalty | 15.66% | 3.64% | 3.95% | ★★★★☆☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 53.32% | 25.58% | 47.05% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Dundee Precious Metals (TSX:DPM)

Simply Wall St Value Rating: ★★★★★★

Overview: Dundee Precious Metals Inc. is a gold mining company involved in the acquisition, exploration, development, mining, and processing of precious metals with a market capitalization of CA$2.50 billion.

Operations: Dundee Precious Metals generates revenue primarily from its Ada Tepe and Chelopech segments, contributing $237.16 million and $304.68 million, respectively.

Dundee Precious Metals, a nimble player in the mining sector, has shown impressive growth with earnings rising 33.1% last year, outpacing industry norms of 2.8%. The company operates debt-free, enhancing its financial stability compared to five years ago when it had a debt-to-equity ratio of 6%. Recent buybacks saw the repurchase of over 3 million shares for $26.4 million. Notably, DPM trades at a discount of 26% below its estimated fair value.

- Dive into the specifics of Dundee Precious Metals here with our thorough health report.

Evaluate Dundee Precious Metals' historical performance by accessing our past performance report.

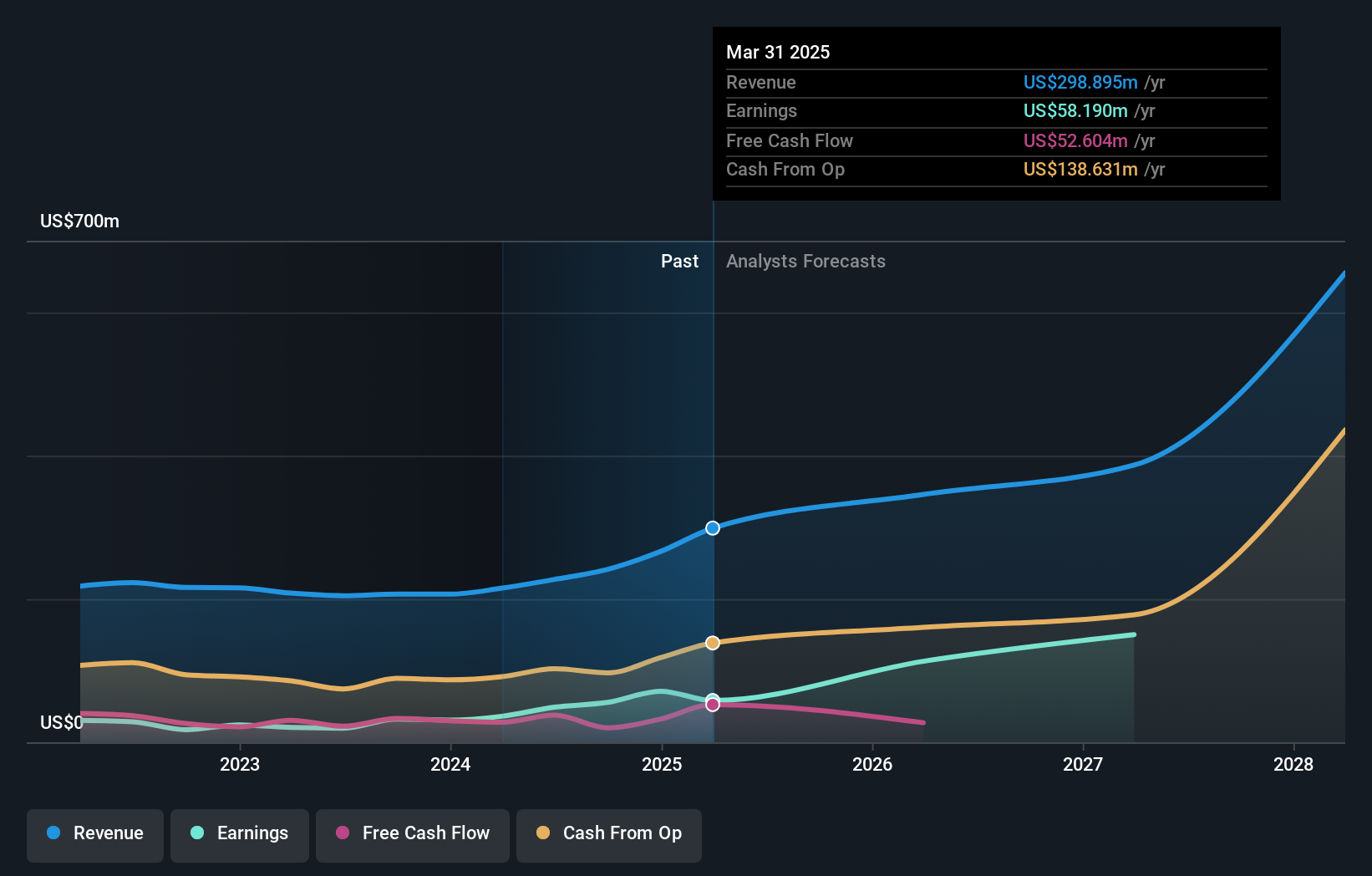

Silvercorp Metals (TSX:SVM)

Simply Wall St Value Rating: ★★★★★★

Overview: Silvercorp Metals Inc. is a company focused on the acquisition, exploration, development, and mining of mineral properties, with a market cap of CA$1.45 billion.

Operations: Silvercorp generates revenue primarily from its mining operations in Henan Luoning and Guangdong, with Henan Luoning contributing significantly more at $200 million compared to Guangdong's $27.35 million. The company's financial performance is highlighted by its gross profit margin trends over recent periods.

Silvercorp Metals, a notable player in the Canadian mining scene, showcases an intriguing profile. With earnings growth of 149% over the past year and trading at nearly 89% below its estimated fair value, it presents a compelling investment case. The company remains debt-free, eliminating concerns about interest coverage. Recent sales figures highlight increased silver and zinc production but reduced gold output compared to last year. Additionally, Silvercorp announced a share buyback program targeting up to 8.67 million shares to enhance shareholder value.

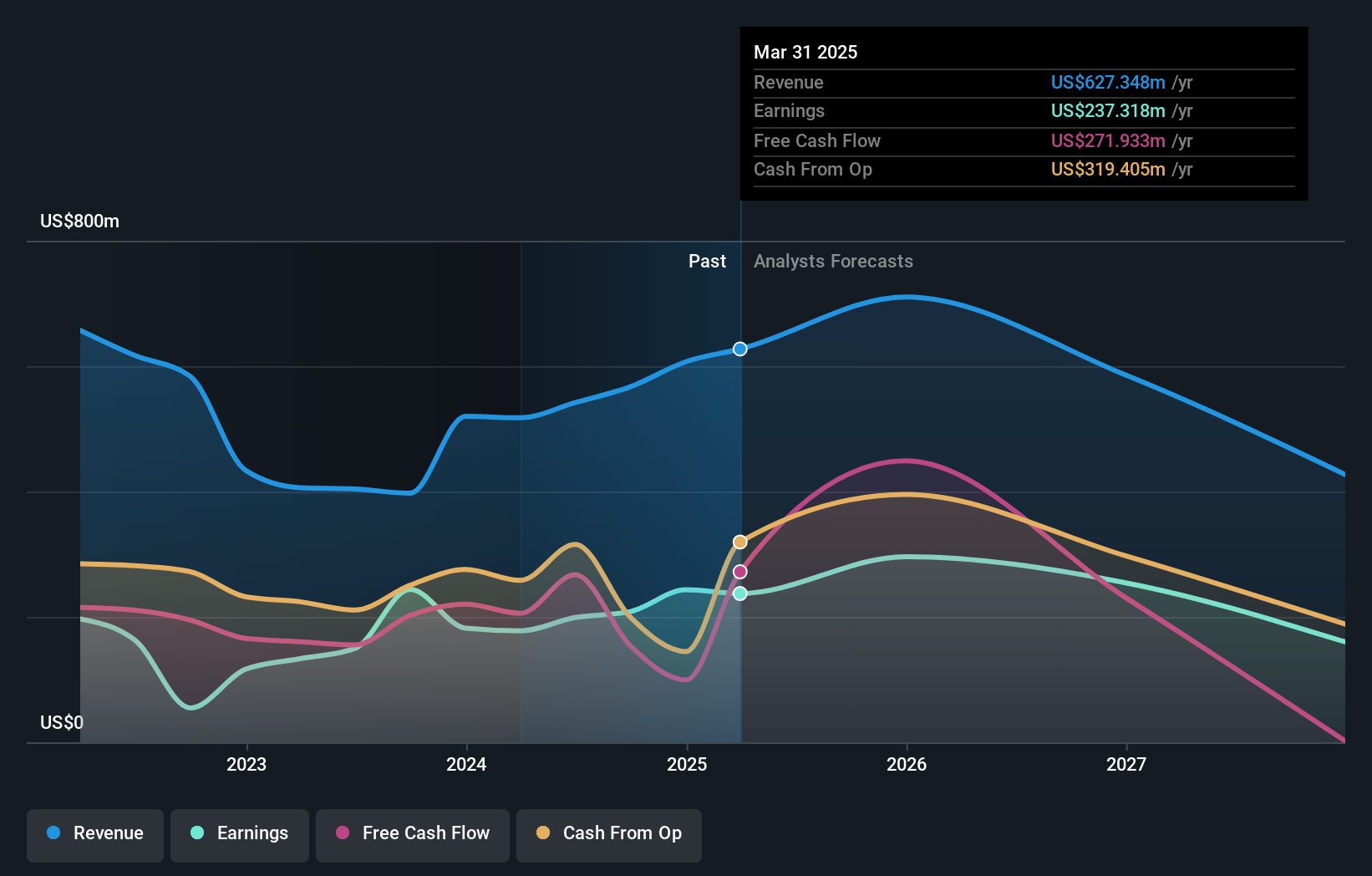

Westshore Terminals Investment (TSX:WTE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Westshore Terminals Investment Corporation operates a coal storage and unloading/loading terminal at Roberts Bank, British Columbia, with a market cap of CA$1.50 billion.

Operations: The primary revenue stream for Westshore Terminals comes from its transportation infrastructure segment, generating CA$379.34 million. The company's net profit margin is a key financial metric to consider, reflecting its profitability after all expenses.

Westshore Terminals, a smaller player in Canada's market, showcases impressive earnings growth of 36% over the past year, outpacing the infrastructure industry's 11%. The company is debt-free and trades at nearly 9% below its estimated fair value. Despite being dropped from several S&P/TSX indices recently, Westshore reported second-quarter revenue of C$105.62 million and net income of C$34.61 million. A recent share buyback saw 675,009 shares repurchased for C$15.56 million.

Where To Now?

- Unlock more gems! Our TSX Undiscovered Gems With Strong Fundamentals screener has unearthed 45 more companies for you to explore.Click here to unveil our expertly curated list of 48 TSX Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westshore Terminals Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WTE

Westshore Terminals Investment

Operates a coal storage and unloading/loading terminal at Roberts Bank, British Columbia.

6 star dividend payer and good value.

Market Insights

Community Narratives