- Canada

- /

- Metals and Mining

- /

- TSX:SVM

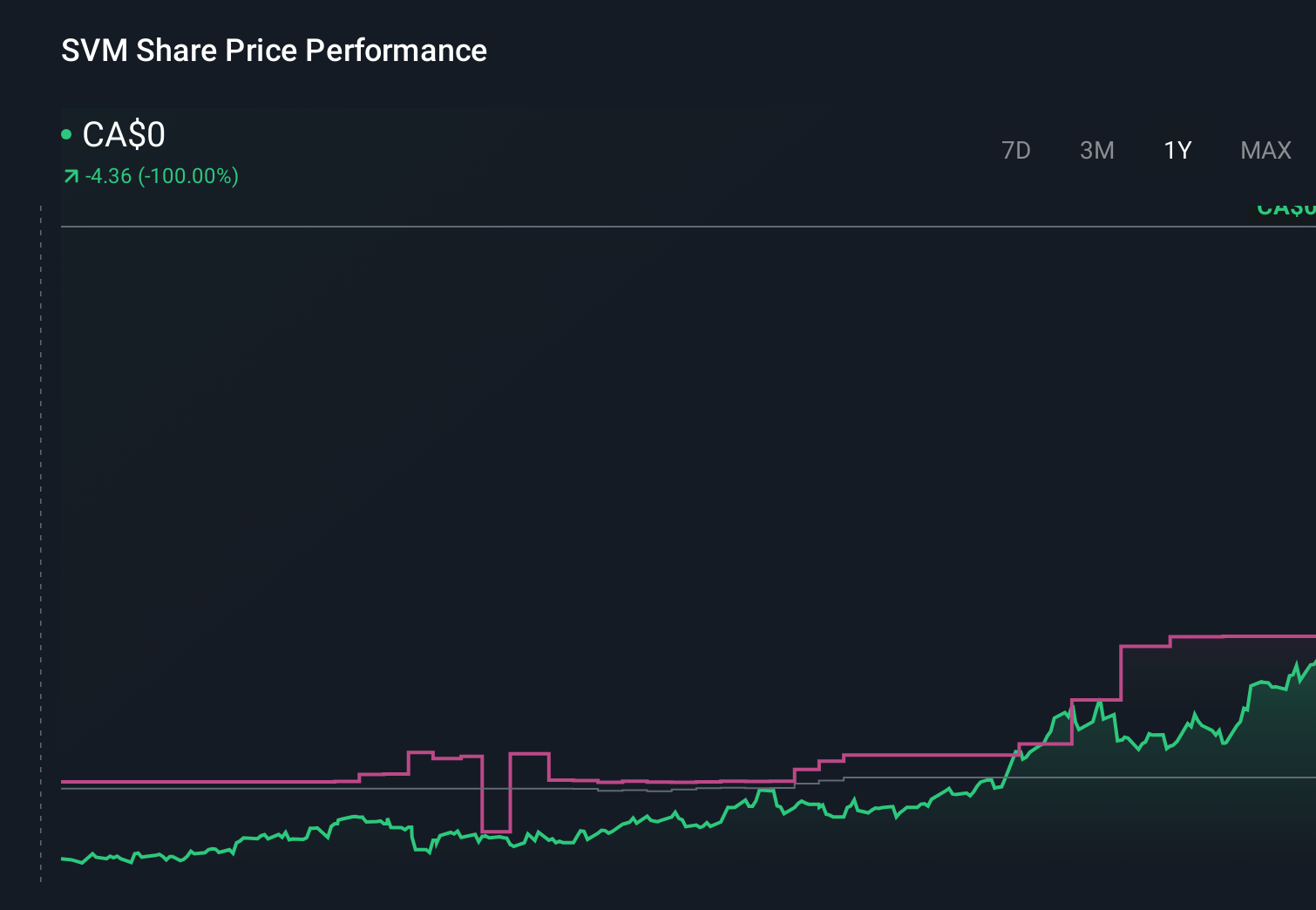

The Bull Case For Silvercorp Metals (TSX:SVM) Could Change Following Condor PEA And Index Addition

Reviewed by Sasha Jovanovic

- Earlier in December 2025, Silvercorp Metals Inc. (TSX:SVM) was added to the S&P/TSX Capped Composite Index and released a Preliminary Economic Assessment (PEA) for its Condor gold project in Ecuador, outlining a 13-year mine life with expected production of gold, silver, zinc, and lead.

- The PEA’s after-tax net present value of US$522 million and 29% internal rate of return highlight how Condor could reshape Silvercorp’s long-term production mix and geographic footprint, even though the study remains preliminary and relies on inferred resources.

- We’ll now examine how Condor’s preliminary economics might influence Silvercorp’s investment narrative, especially its push to diversify beyond China.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Silvercorp Metals Investment Narrative Recap

To own Silvercorp Metals, you need to believe that its Chinese silver operations can remain resilient while new assets gradually broaden its footprint. The Condor PEA and S&P/TSX Capped Composite Index inclusion both support a diversification story, but they do not change the near term focus on managing China specific regulatory and cost risks, which still look like the key catalyst and the biggest vulnerability for the business.

Among recent announcements, the Condor PEA in Ecuador is most relevant here. Its projected 13 year mine life and multi metal output profile give investors a first look at how future production might shift away from China over time, which directly ties into both the diversification catalyst and the permitting, legal, and social risks that could affect project timing.

Yet while Condor offers diversification potential, investors should be aware that permitting and social risks in Ecuador could still...

Read the full narrative on Silvercorp Metals (it's free!)

Silvercorp Metals' narrative projects $504.4 million revenue and $143.0 million earnings by 2028. This requires 17.9% yearly revenue growth and an $88.6 million earnings increase from $54.4 million today.

Uncover how Silvercorp Metals' forecasts yield a CA$12.88 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Eight members of the Simply Wall St Community currently see fair value for Silvercorp between US$0.86 and US$15.74, reflecting very different expectations. When you set that range against the company’s heavy exposure to regulatory and operational risks in China, it underlines why checking several viewpoints on future performance can be so important.

Explore 8 other fair value estimates on Silvercorp Metals - why the stock might be worth as much as 28% more than the current price!

Build Your Own Silvercorp Metals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Silvercorp Metals research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Silvercorp Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Silvercorp Metals' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SVM

Silvercorp Metals

Acquires, explores, develops, and mines mineral properties in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion