- Canada

- /

- Metals and Mining

- /

- TSX:SSRM

SSR Mining (TSX:SSRM) Acquires Cripple Creek & Victor Gold Mine, Undervalued at CA$9.01 vs CA$101.35

Reviewed by Simply Wall St

Navigate through the intricacies of SSR Mining with our comprehensive report here.

Competitive Advantages That Elevate SSR Mining

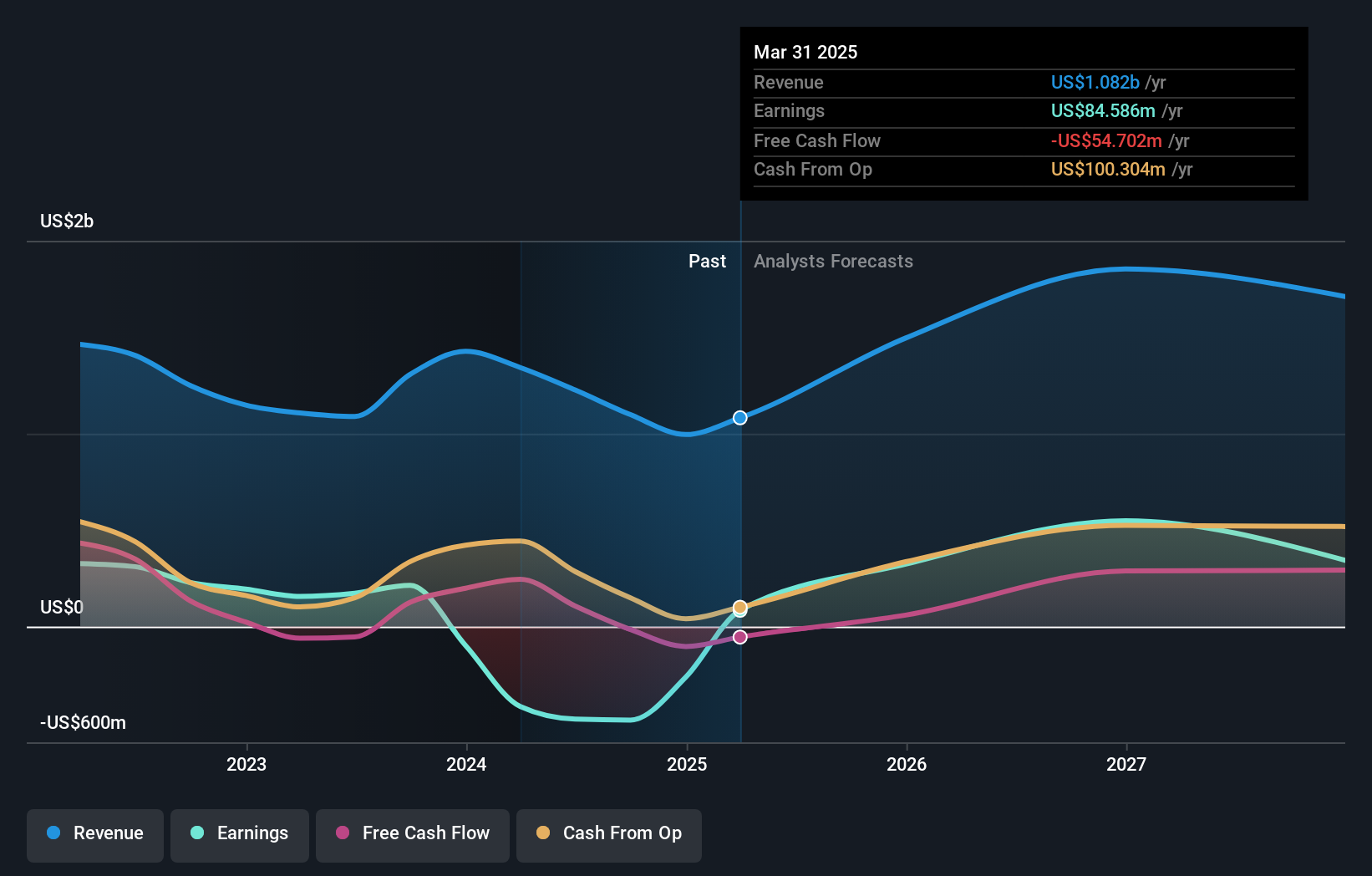

SSR Mining has demonstrated resilience and strategic foresight in addressing operational setbacks, particularly the Çöpler incident. Executive Chairman Rodney Antal emphasized the company's commitment to safety and environmental standards, highlighting effective containment and remediation efforts. Financially, SSR Mining is strong, with CFO Michael Sparks reporting a cash position of $334 million and a net cash position of $104 million, underlining its ability to manage costs and reinvest in operations. The Puna operation, noted for its operational excellence, significantly contributes to the company's production, with record throughput at the Pirquitas facility enhancing free cash flow margins. Moreover, SSRM's trading price of CA$9.01 is notably below its estimated fair value of CA$101.35, suggesting potential undervaluation.

Vulnerabilities Impacting SSR Mining

However, SSR Mining faces several challenges, including increased costs at Marigold due to higher royalty and maintenance expenses, as highlighted by EVP William MacNevin. This financial strain is compounded by negative cash flow, with operating activities generating a deficit of $1 million in the third quarter, as reported by CFO Sparks. Additionally, the temporary suspension at Seabee due to forest fires has disrupted production, impacting cost guidance and highlighting operational vulnerabilities. The company's negative return on equity and slow revenue growth compared to industry standards further underscore these weaknesses.

Areas for Expansion and Innovation for SSR Mining

Opportunities abound for SSR Mining, particularly in brownfield exploration and expansion. MacNevin noted advancements at Buffalo Valley, aiming to replace mine depletion and extend Marigold's life, presenting long-term growth potential. The anticipated restart of the Çöpler mine, pending regulatory approvals, could significantly boost production capacity. Furthermore, the Hod Maden project, progressing with expected capital updates in 2025, represents a high-quality asset poised to enhance the company's portfolio. These initiatives align with SSRM's strategic goals to capitalize on emerging opportunities and drive future performance.

Regulatory Challenges Facing SSR Mining

Despite these prospects, SSR Mining must navigate regulatory and external pressures. The Çöpler incident has attracted scrutiny, with Antal noting ongoing discussions with Turkish officials regarding remediation plans. Delays in obtaining necessary permits could hinder the restart timeline. Additionally, high gold prices continue to exert cost pressures, particularly on royalty expenses, as MacNevin highlighted. Environmental risks, exemplified by the Seabee suspension, remain a persistent threat to operational continuity. These challenges underscore the complex environment SSR Mining operates within, necessitating strategic management to sustain growth and market share.

Explore the current health of SSR Mining and how it reflects on its financial stability and growth potential.Conclusion

SSR Mining's strategic resilience and financial strength, evidenced by its substantial cash reserves and effective cost management, position it well to navigate current challenges and capitalize on future opportunities. Despite facing increased costs and operational disruptions, the company's ongoing initiatives in brownfield exploration and the potential restart of the Çöpler mine highlight its commitment to long-term growth and portfolio enhancement. Furthermore, with its current trading price of CA$9.01 significantly below the estimated fair value of CA$101.35, there is a strong indication that the market may not fully recognize SSR Mining's intrinsic value and growth potential. This undervaluation, coupled with strategic advancements, suggests that SSR Mining could see substantial appreciation as it continues to address regulatory hurdles and capitalize on its strategic initiatives.

Turning Ideas Into Actions

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SSRM

SSR Mining

Engages in the acquisition, exploration, and development of precious metal resource properties in the United States, Türkiye, Canada, and Argentina.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives