- Canada

- /

- Metals and Mining

- /

- TSX:SSRM

Do Its Financials Have Any Role To Play In Driving SSR Mining Inc.'s (TSE:SSRM) Stock Up Recently?

SSR Mining's (TSE:SSRM) stock is up by a considerable 11% over the past three months. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. Specifically, we decided to study SSR Mining's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

See our latest analysis for SSR Mining

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for SSR Mining is:

9.2% = US$375m ÷ US$4.1b (Based on the trailing twelve months to March 2022).

The 'return' is the amount earned after tax over the last twelve months. One way to conceptualize this is that for each CA$1 of shareholders' capital it has, the company made CA$0.09 in profit.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

SSR Mining's Earnings Growth And 9.2% ROE

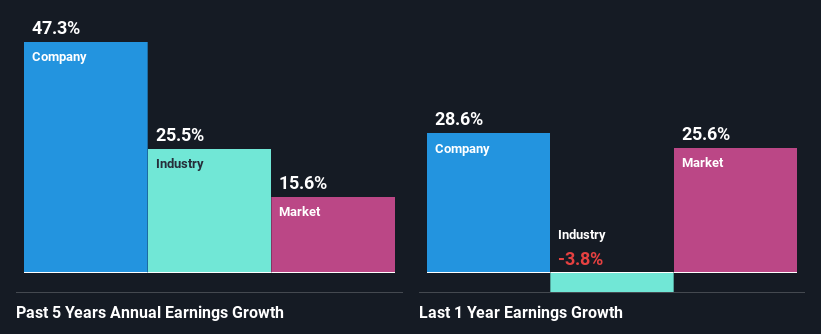

At first glance, SSR Mining's ROE doesn't look very promising. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 13% either. However, we we're pleasantly surprised to see that SSR Mining grew its net income at a significant rate of 47% in the last five years. So, there might be other aspects that are positively influencing the company's earnings growth. For instance, the company has a low payout ratio or is being managed efficiently.

Next, on comparing with the industry net income growth, we found that SSR Mining's growth is quite high when compared to the industry average growth of 25% in the same period, which is great to see.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. What is SSRM worth today? The intrinsic value infographic in our free research report helps visualize whether SSRM is currently mispriced by the market.

Is SSR Mining Using Its Retained Earnings Effectively?

SSR Mining's three-year median payout ratio to shareholders is 9.5%, which is quite low. This implies that the company is retaining 90% of its profits. This suggests that the management is reinvesting most of the profits to grow the business as evidenced by the growth seen by the company.

While SSR Mining has seen growth in its earnings, it only recently started to pay a dividend. It is most likely that the company decided to impress new and existing shareholders with a dividend.

Summary

On the whole, we do feel that SSR Mining has some positive attributes. With a high rate of reinvestment, albeit at a low ROE, the company has managed to see a considerable growth in its earnings. With that said, on studying the latest analyst forecasts, we found that while the company has seen growth in its past earnings, analysts expect its future earnings to shrink. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:SSRM

SSR Mining

Engages in the acquisition, exploration, and development of precious metal resource properties in the United States, Türkiye, Canada, and Argentina.

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026