- Canada

- /

- Metals and Mining

- /

- TSX:SIL

Optimistic Investors Push SilverCrest Metals Inc. (TSE:SIL) Shares Up 26% But Growth Is Lacking

SilverCrest Metals Inc. (TSE:SIL) shares have continued their recent momentum with a 26% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 2.1% isn't as impressive.

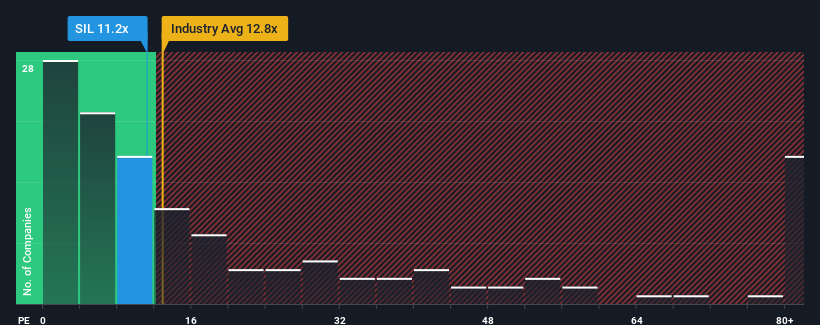

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about SilverCrest Metals' P/E ratio of 11.2x, since the median price-to-earnings (or "P/E") ratio in Canada is also close to 12x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been pleasing for SilverCrest Metals as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for SilverCrest Metals

Is There Some Growth For SilverCrest Metals?

In order to justify its P/E ratio, SilverCrest Metals would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 371%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 10% as estimated by the five analysts watching the company. With the market predicted to deliver 11% growth , that's a disappointing outcome.

In light of this, it's somewhat alarming that SilverCrest Metals' P/E sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

What We Can Learn From SilverCrest Metals' P/E?

SilverCrest Metals' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of SilverCrest Metals' analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider and we've discovered 3 warning signs for SilverCrest Metals (1 is a bit unpleasant!) that you should be aware of before investing here.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:SIL

SilverCrest Metals

Engages in the acquiring, exploration, and development of precious metal properties in Mexico.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)