- Canada

- /

- Metals and Mining

- /

- TSXV:PEAK

TSX Penny Stock Opportunities For January 2025

Reviewed by Simply Wall St

As 2025 begins, the Canadian market reflects on a robust 2024, with the TSX gaining 18% and investors enjoying solid returns across various sectors. In this climate of continued economic growth and policy shifts, identifying stocks that combine value with growth potential becomes crucial. Penny stocks, often smaller or newer companies, offer such opportunities when backed by strong financials; we'll explore several that stand out for their financial strength and long-term promise.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$3.95 | CA$375.64M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.46 | CA$119.47M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.46 | CA$948.57M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.64 | CA$574.58M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$241.16M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.18 | CA$32.24M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$3.17M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.63 | CA$302.67M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$182.38M | ★★★★★☆ |

Click here to see the full list of 942 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Genesis Land Development (TSX:GDC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Genesis Land Development Corp. is an integrated land developer and residential home builder that owns and develops residential lands and serviced lots in the Calgary Metropolitan Area, with a market cap of CA$188.53 million.

Operations: The company's revenue is primarily derived from its Home Building segment, which generated CA$238.33 million, and its Land Development - Genesis segment, contributing CA$125.80 million.

Market Cap: CA$188.53M

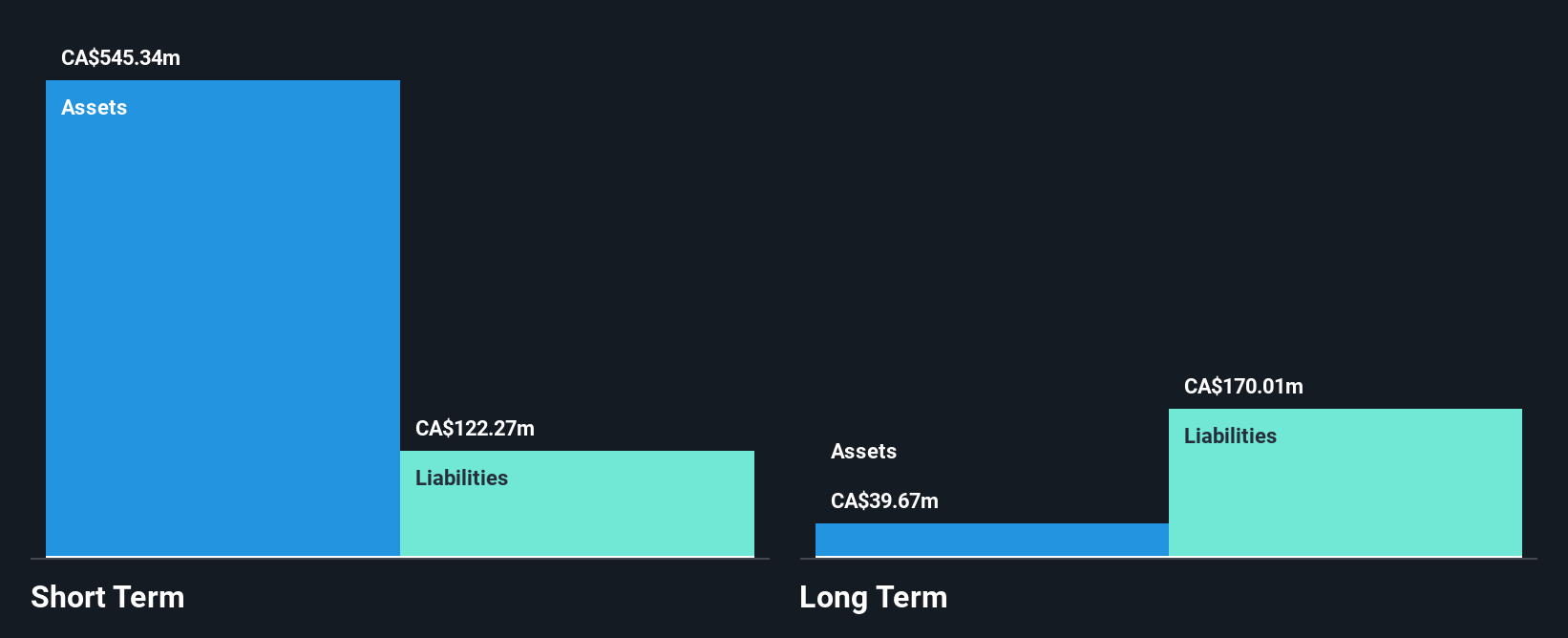

Genesis Land Development Corp. has shown robust financial growth, with earnings increasing 268.1% over the past year, surpassing its five-year average of 52.3%. Despite a low Return on Equity of 13.1%, the company maintains satisfactory debt levels and strong asset coverage for liabilities. Recent initiatives include a share repurchase program and a special dividend, reflecting confidence in its financial health. However, management's short tenure suggests potential leadership volatility. The company's Price-To-Earnings ratio of 5.4x indicates it may be undervalued compared to the broader Canadian market, offering potential appeal to investors interested in penny stocks with growth prospects.

- Click here to discover the nuances of Genesis Land Development with our detailed analytical financial health report.

- Gain insights into Genesis Land Development's historical outcomes by reviewing our past performance report.

Scandium International Mining (TSX:SCY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Scandium International Mining Corp. is an exploration stage company that focuses on the exploration, evaluation, and development of specialty metals assets in Australia, with a market cap of CA$7.10 million.

Operations: Scandium International Mining Corp. has not reported any revenue segments.

Market Cap: CA$7.1M

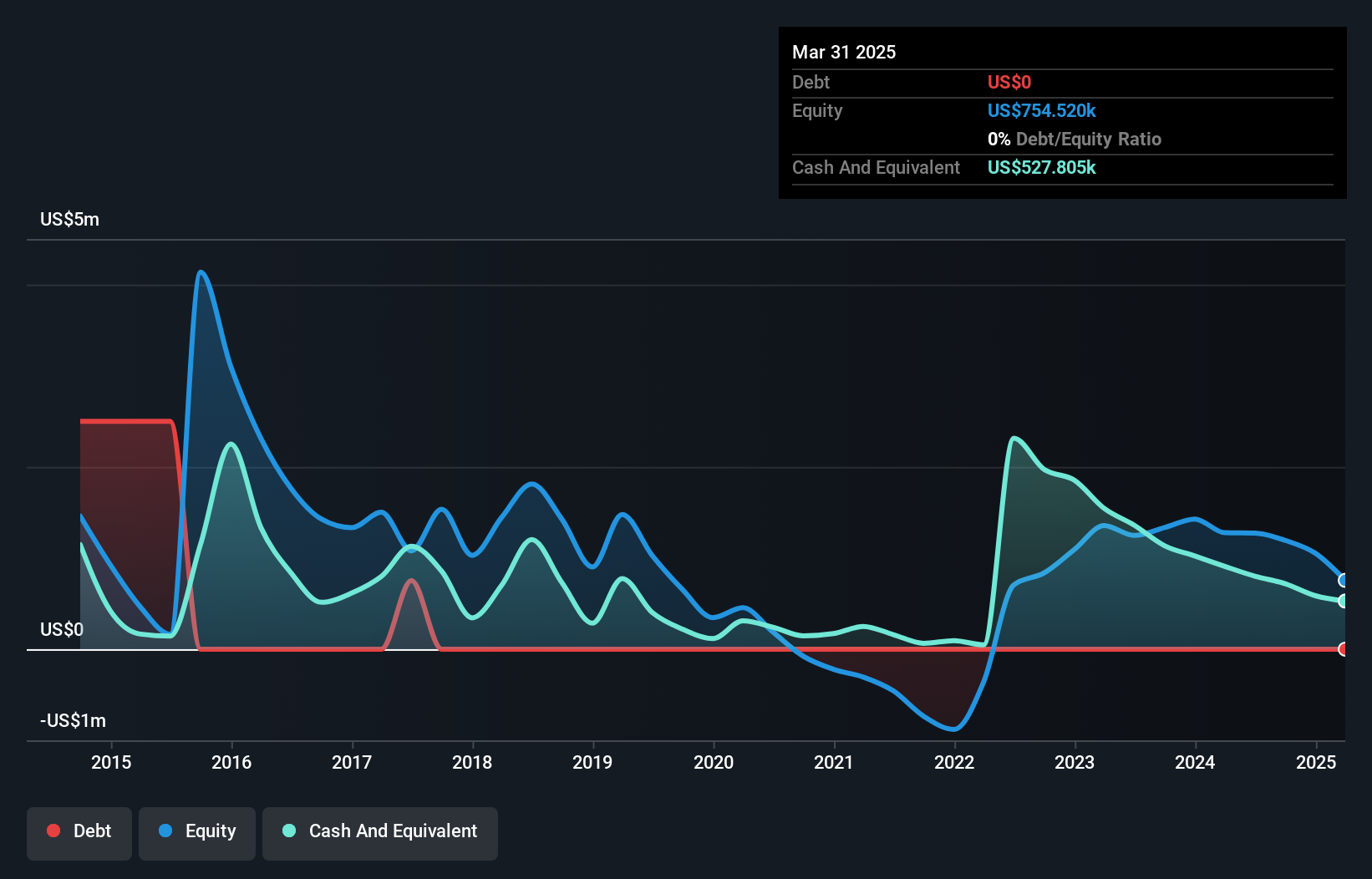

Scandium International Mining Corp., with a market cap of CA$7.10 million, is a pre-revenue company focused on specialty metals in Australia. Recent earnings reports indicate ongoing losses, with a net loss of US$0.07962 million for Q3 2024, compared to prior net income. Despite no significant revenue streams and high share price volatility, the company benefits from no long-term liabilities and short-term assets exceeding liabilities by US$477.7K. The management team has an average tenure of 2.8 years, while the board averages 8.9 years, suggesting experienced leadership amidst financial challenges and recent delisting actions from U.S exchanges.

- Click to explore a detailed breakdown of our findings in Scandium International Mining's financial health report.

- Explore historical data to track Scandium International Mining's performance over time in our past results report.

Sun Peak Metals (TSXV:PEAK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sun Peak Metals Corp. is a junior mining company focused on acquiring, exploring, and developing resource properties for precious and base metals in Ethiopia, with a market cap of CA$28.31 million.

Operations: Currently, there are no reported revenue segments for Sun Peak Metals Corp.

Market Cap: CA$28.31M

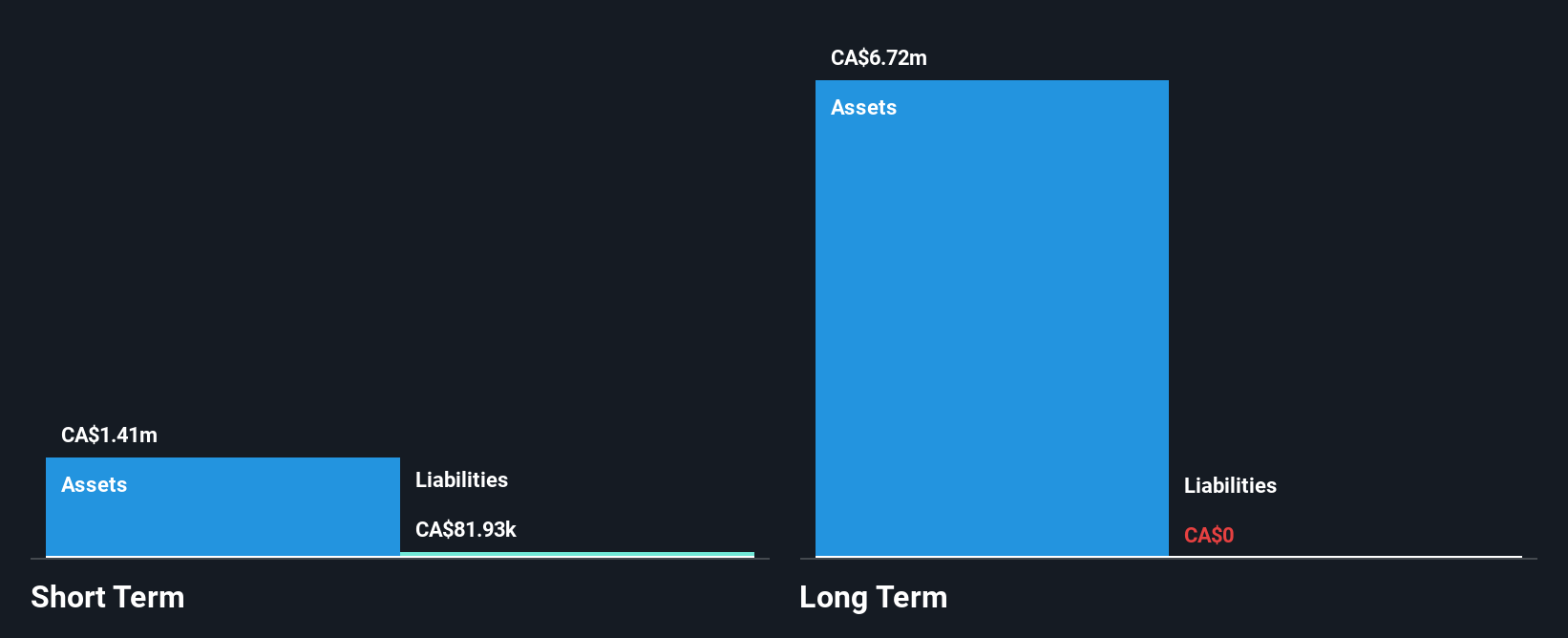

Sun Peak Metals Corp., with a market cap of CA$28.31 million, is a pre-revenue junior mining company focused on exploration in Ethiopia. Despite ongoing losses, the company has no long-term liabilities and its short-term assets exceed liabilities by CA$2.9 million. Recent updates on the Shire Project highlight promising exploration results and upcoming drilling programs targeting high-priority copper-gold VMS zones, indicating potential for future resource development. The stock's share price is highly volatile but has not been meaningfully diluted recently. The management team averages 8.4 years of tenure, providing seasoned leadership in navigating these exploratory phases.

- Unlock comprehensive insights into our analysis of Sun Peak Metals stock in this financial health report.

- Gain insights into Sun Peak Metals' past trends and performance with our report on the company's historical track record.

Next Steps

- Click this link to deep-dive into the 942 companies within our TSX Penny Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:PEAK

Sun Peak Metals

A junior mining company, engages in the acquisition, exploration, and development of resource properties for the mining of precious and base metals in Ethiopia.

Flawless balance sheet very low.

Market Insights

Community Narratives