- Canada

- /

- Healthcare Services

- /

- TSX:EXE

Discovering Canada's Undiscovered Gems for October 2024

Reviewed by Simply Wall St

As the Canadian market navigates a landscape influenced by shifting Fed expectations and potential productivity gains in the U.S., investors are closely watching how these dynamics impact small-cap stocks. In this environment, identifying promising opportunities requires a focus on companies that demonstrate resilience and adaptability, traits often found in Canada's undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.74% | 10.99% | 25.68% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 15.28% | 7.58% | ★★★★★★ |

| Santacruz Silver Mining | 14.30% | 49.04% | 63.44% | ★★★★★★ |

| Taiga Building Products | NA | 6.05% | 10.50% | ★★★★★★ |

| Westshore Terminals Investment | NA | -2.67% | -9.77% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 43.35% | 67.95% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Corby Spirit and Wine | 75.89% | 5.97% | -5.75% | ★★★★☆☆ |

| Genesis Land Development | 53.32% | 25.58% | 47.05% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Extendicare (TSX:EXE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Extendicare Inc., with a market cap of CA$768.73 million, operates through its subsidiaries to provide care and services for seniors in Canada.

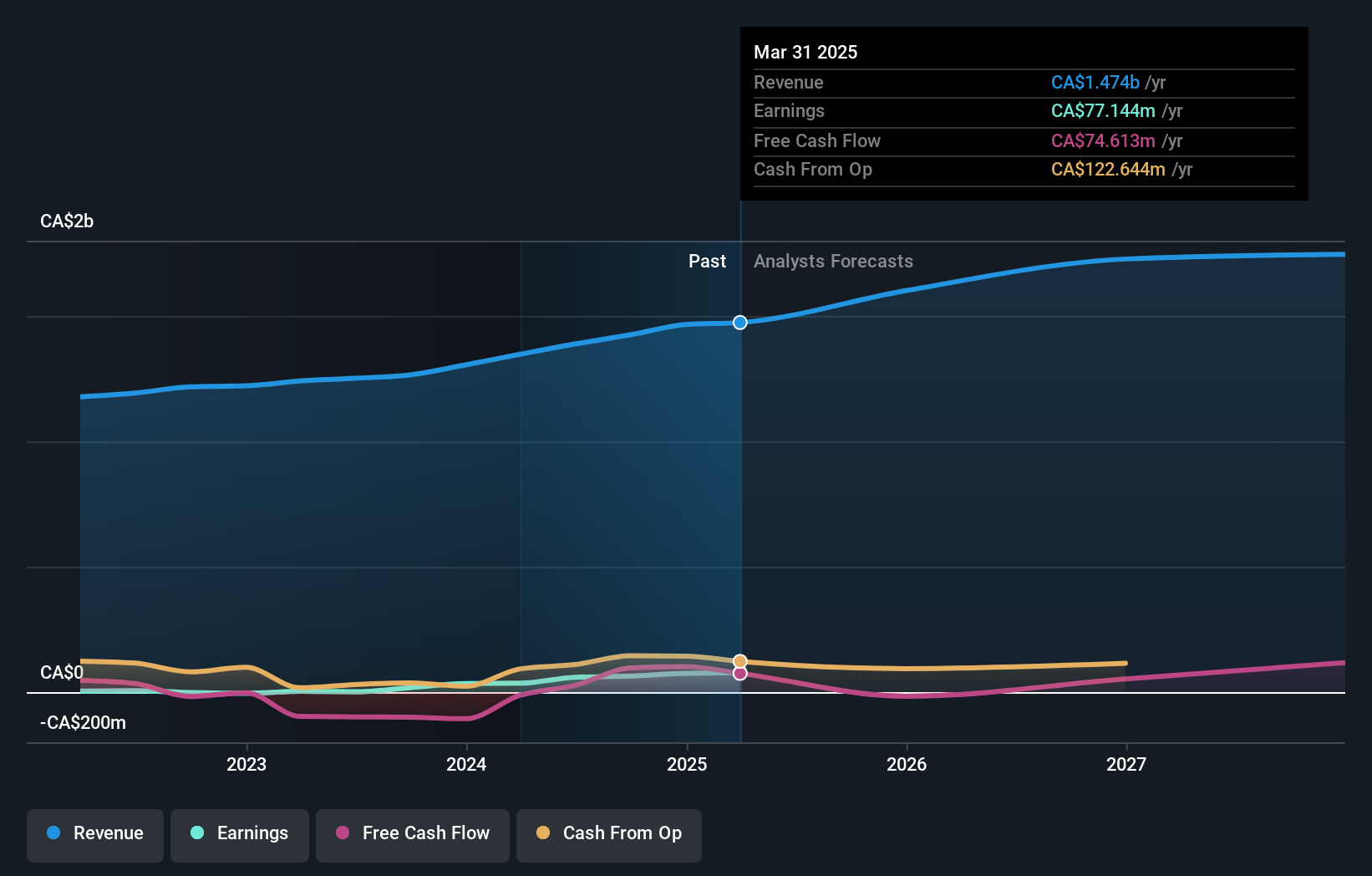

Operations: Extendicare generates revenue primarily from Long-Term Care (CA$798.80 million) and Home Health Care (CA$525.16 million), with additional income from Managed Services (CA$64.32 million).

Extendicare's recent performance highlights its potential as a standout in the Canadian market. With earnings skyrocketing by 3957% over the past year, it outpaced the healthcare industry's growth of 11.4%. Despite a high net debt to equity ratio of 133.7%, Extendicare has made strides by reducing its debt from 405.7% to 261.6% in five years, indicating financial improvement. The company's price-to-earnings ratio at 13x is attractive compared to the Canadian market average of 15.4x, suggesting good value for investors looking into this sector with robust earnings coverage at an EBIT interest coverage of 5.9x.

- Delve into the full analysis health report here for a deeper understanding of Extendicare.

Examine Extendicare's past performance report to understand how it has performed in the past.

Jaguar Mining (TSX:JAG)

Simply Wall St Value Rating: ★★★★★★

Overview: Jaguar Mining Inc. is a junior gold mining company focused on the acquisition, exploration, development, and operation of gold mineral properties in Brazil, with a market capitalization of CA$379.09 million.

Operations: Jaguar Mining generates revenue primarily from the acquisition, exploration, development, and operation of gold-producing properties, amounting to $144.85 million.

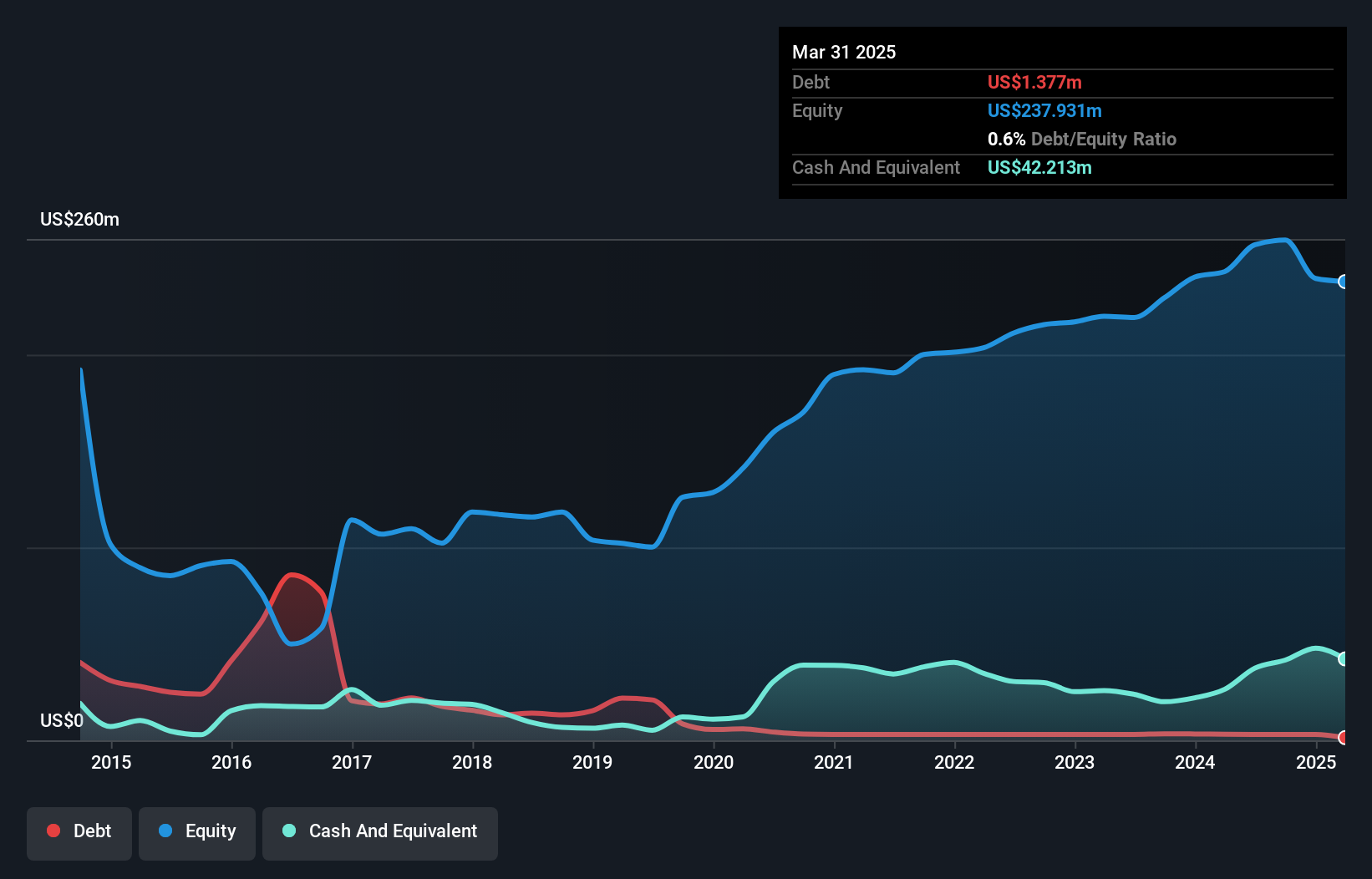

Jaguar Mining, a Canadian mining company, has shown impressive financial health with its debt-to-equity ratio dropping from 20.9% to 1.2% over five years and earnings growth of 58.9%, outpacing the industry average of 10.4%. The firm enjoys high-quality earnings and free cash flow positivity, indicating robust operational performance. Recent developments include progress at the BA zone in Brazil's Pilar mine, contributing to higher gold grades and production levels; third-quarter gold production was reported at 16,912 ounces compared to last year's figures. Additionally, Jaguar's price-to-earnings ratio stands attractively low at 8.7x against the market's 15.4x.

- Get an in-depth perspective on Jaguar Mining's performance by reading our health report here.

Review our historical performance report to gain insights into Jaguar Mining's's past performance.

Queen's Road Capital Investment (TSX:QRC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Queen's Road Capital Investment Ltd. is a resource-focused investment company that invests in privately held and publicly traded resource companies, with a market capitalization of CA$358.52 million.

Operations: Queen's Road Capital generates revenue primarily from the selection, acquisition, and management of investments, amounting to CA$115.10 million.

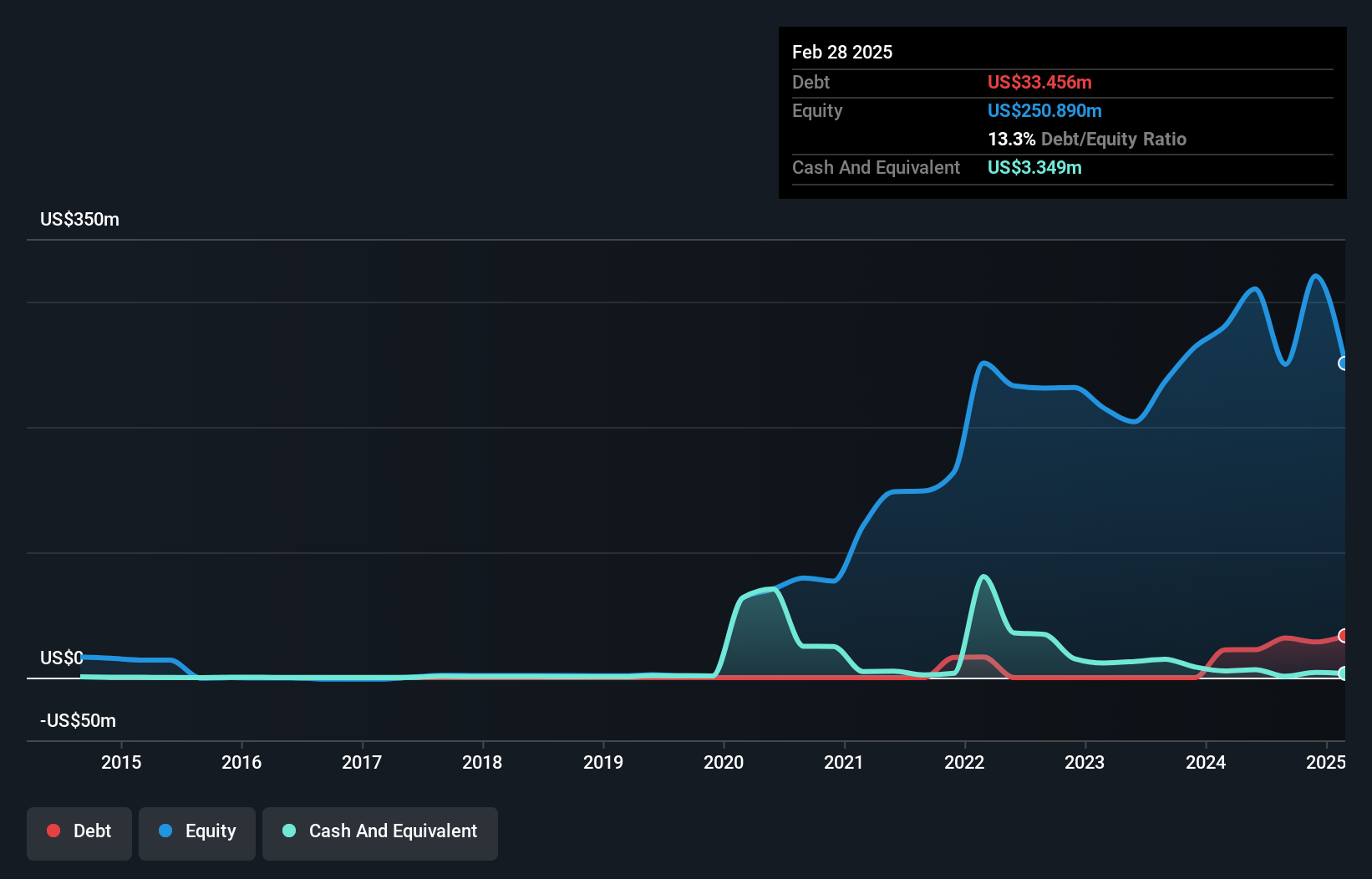

Queen's Road Capital (QRC) has emerged as a promising player, becoming profitable this year and demonstrating strong financial health with a net debt to equity ratio of 5.1%, which is considered satisfactory. The company trades at 11.7% below its estimated fair value, suggesting potential upside for investors. QRC's interest payments are well covered by EBIT, boasting a coverage of 94 times, indicating robust earnings quality despite past shareholder dilution. Recent events highlight growth initiatives like the CAD 15 million private placement and an increased annual dividend to CAD 0.021 per share, reflecting a significant rise since its first dividend in 2021.

Taking Advantage

- Unlock our comprehensive list of 51 TSX Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Extendicare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EXE

Extendicare

Through its subsidiaries, provides care and services for seniors in Canada.

Good value with proven track record and pays a dividend.

Market Insights

Community Narratives