- Canada

- /

- Health Care REITs

- /

- TSX:NWH.UN

Canadian Undervalued Small Caps With Insider Activity To Explore In October 2024

Reviewed by Simply Wall St

The Canadian market has shown robust performance, climbing 1.2% in the last week and rising 28% over the past year, with earnings projected to grow by 16% annually. In this dynamic environment, identifying small-cap stocks that appear undervalued and exhibit insider activity can present intriguing opportunities for investors looking to capitalize on potential growth.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Trican Well Service | 6.9x | 0.9x | 22.24% | ★★★★★★ |

| First National Financial | 10.6x | 3.4x | 49.20% | ★★★★★☆ |

| Spartan Delta | 4.1x | 2.0x | 41.33% | ★★★★★☆ |

| AutoCanada | NA | 0.1x | 36.21% | ★★★★★☆ |

| Nexus Industrial REIT | 3.6x | 3.6x | 18.83% | ★★★★☆☆ |

| Rogers Sugar | 15.4x | 0.6x | 48.18% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 13.1x | 3.5x | 43.92% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -45.04% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | 19.61% | ★★★★☆☆ |

| Vermilion Energy | NA | 1.2x | -209.29% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

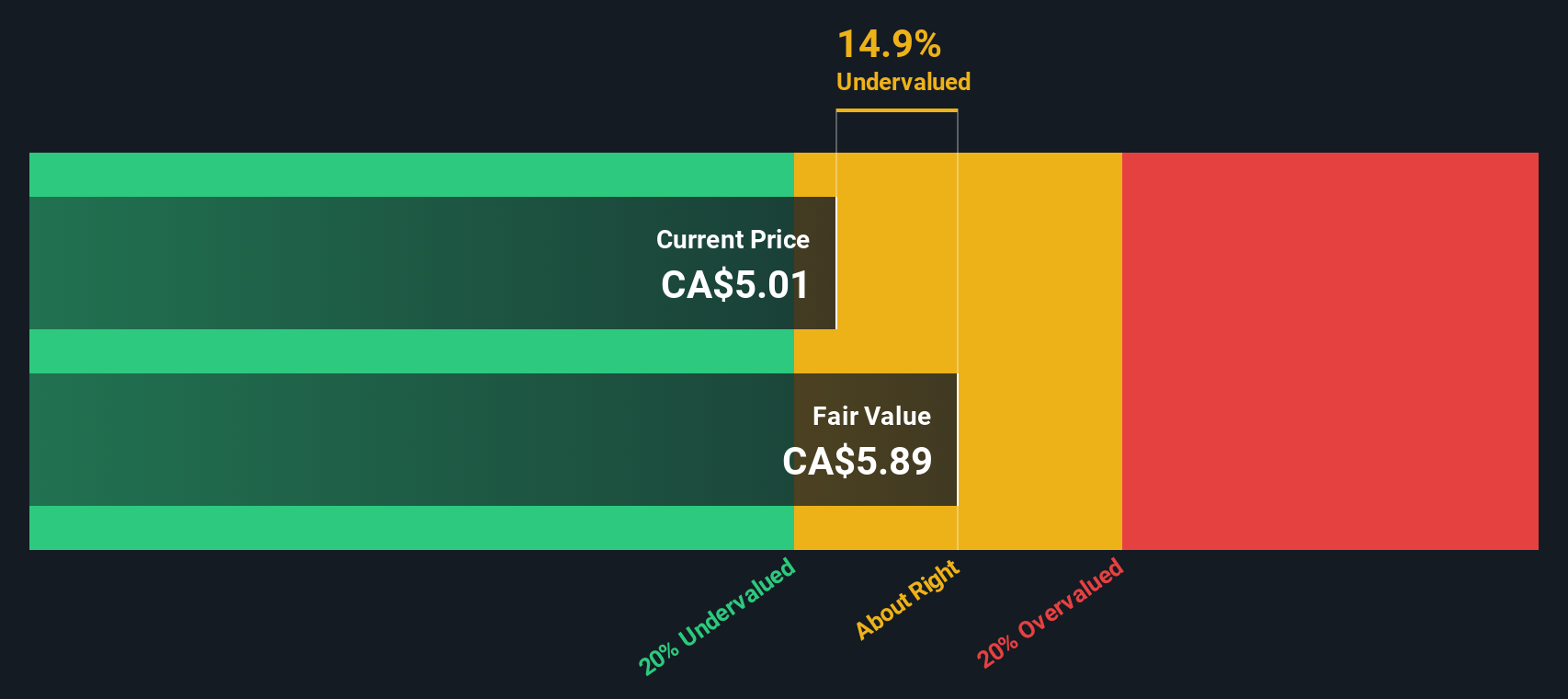

NorthWest Healthcare Properties Real Estate Investment Trust (TSX:NWH.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: NorthWest Healthcare Properties Real Estate Investment Trust operates in the healthcare real estate industry, focusing on managing and acquiring properties related to healthcare facilities, with a market capitalization of CA$2.05 billion.

Operations: NorthWest Healthcare Properties Real Estate Investment Trust generates revenue primarily from the healthcare real estate industry, with recent figures at CA$523.85 million. The company's gross profit margin has shown a fluctuating trend, most recently recorded at 77.81%. Operating expenses and non-operating expenses significantly impact net income, which has been negative in recent periods due to high non-operating costs reaching CA$746.41 million in the latest data available.

PE: -3.4x

NorthWest Healthcare Properties REIT, a smaller player in the Canadian market, is drawing attention for its potential value. Recent lease renewals at key Brazilian properties have extended their weighted-average lease expiry to 18.2 years, enhancing long-term stability with inflation-indexed leases. However, financial challenges persist with a net loss of C$122 million in Q2 2024 and reliance on riskier external borrowing for funding. Insider confidence is evident as insiders purchased shares recently, signaling belief in future growth prospects amidst ongoing executive transitions.

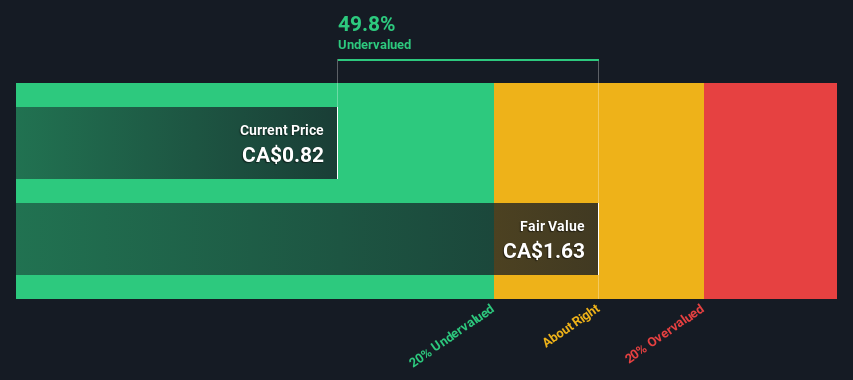

Queen's Road Capital Investment (TSX:QRC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Queen's Road Capital Investment focuses on the selection, acquisition, and management of investments with a market capitalization of approximately C$0.25 billion.

Operations: Queen's Road Capital Investment generates revenue primarily from the selection, acquisition, and management of investments. The company has consistently achieved a gross profit margin of 100% over recent periods. Operating expenses have varied but are generally low relative to revenue, with notable fluctuations in net income due to non-operating expenses.

PE: 2.5x

Queen's Road Capital Investment, a Canadian small-cap company, showcases insider confidence with consistent share purchases over the past year. Despite its reliance on higher-risk external borrowing, it maintains high-quality earnings. The recent dividend increase to CAD 0.021 per share underscores growth in its convertible debenture portfolio, marking a 40% rise since 2021. A fully subscribed private placement raised CAD 15 million at CAD 0.70 per share in September 2024, indicating strong investor interest and potential for future expansion.

- Click here and access our complete valuation analysis report to understand the dynamics of Queen's Road Capital Investment.

Learn about Queen's Road Capital Investment's historical performance.

Vermilion Energy (TSX:VET)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Vermilion Energy is engaged in the exploration and production of oil and gas, with a market cap of CA$3.5 billion.

Operations: The company generates revenue primarily from its oil and gas exploration and production activities, with recent figures showing CA$1.81 billion in revenue. Over the observed periods, the gross profit margin has shown variability, reaching as high as 82.55% but recently declining to 65.72%. Operating expenses have significantly impacted net income, contributing to negative net income margins in recent quarters.

PE: -2.5x

Vermilion Energy, a Canadian company with a small market capitalization, has shown promising developments in its operations. Recent insider confidence is evident as they have increased their share purchases over the past few months. The company reported a net loss of C$82.43 million in Q2 2024, yet continues to focus on strategic growth through successful gas exploration projects in Germany and Croatia. These initiatives aim to enhance production and cash flow, potentially improving future financial performance despite current challenges.

- Dive into the specifics of Vermilion Energy here with our thorough valuation report.

Examine Vermilion Energy's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Explore the 23 names from our Undervalued TSX Small Caps With Insider Buying screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NorthWest Healthcare Properties Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NWH.UN

NorthWest Healthcare Properties Real Estate Investment Trust

Northwest Healthcare Properties Real Estate Investment Trust (TSX: NWH.UN) (Northwest) is an unincorporated, open-ended real estate investment trust established under the laws of the Province of Ontario.

Good value with moderate growth potential.