- Canada

- /

- Medical Equipment

- /

- TSXV:ZEN

TSX Penny Stocks To Watch In March 2025

Reviewed by Simply Wall St

As the Canadian market navigates a period of sideways consolidation, investors are increasingly focused on strategies to fortify their portfolios against potential volatility. In this context, penny stocks—often overlooked but still relevant—offer intriguing opportunities for growth. These smaller or newer companies, when supported by solid financials and balance sheet strength, can present hidden value and the potential for significant returns.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.61 | CA$169.27M | ★★★★★★ |

| NTG Clarity Networks (TSXV:NCI) | CA$2.10 | CA$81.78M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.52 | CA$14.04M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.95 | CA$462.03M | ★★★★★★ |

| BluMetric Environmental (TSXV:BLM) | CA$1.00 | CA$39.5M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.67 | CA$623.15M | ★★★★★★ |

| New Gold (TSX:NGD) | CA$4.06 | CA$3.08B | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$30.89M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.82 | CA$379.19M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$1.87 | CA$186.53M | ★★★★★☆ |

Click here to see the full list of 932 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Probe Gold (TSX:PRB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Probe Gold Inc. is a precious metal exploration company focused on acquiring, exploring, and developing gold properties in Canada with a market cap of CA$331.59 million.

Operations: Probe Gold Inc. does not report any revenue segments.

Market Cap: CA$331.59M

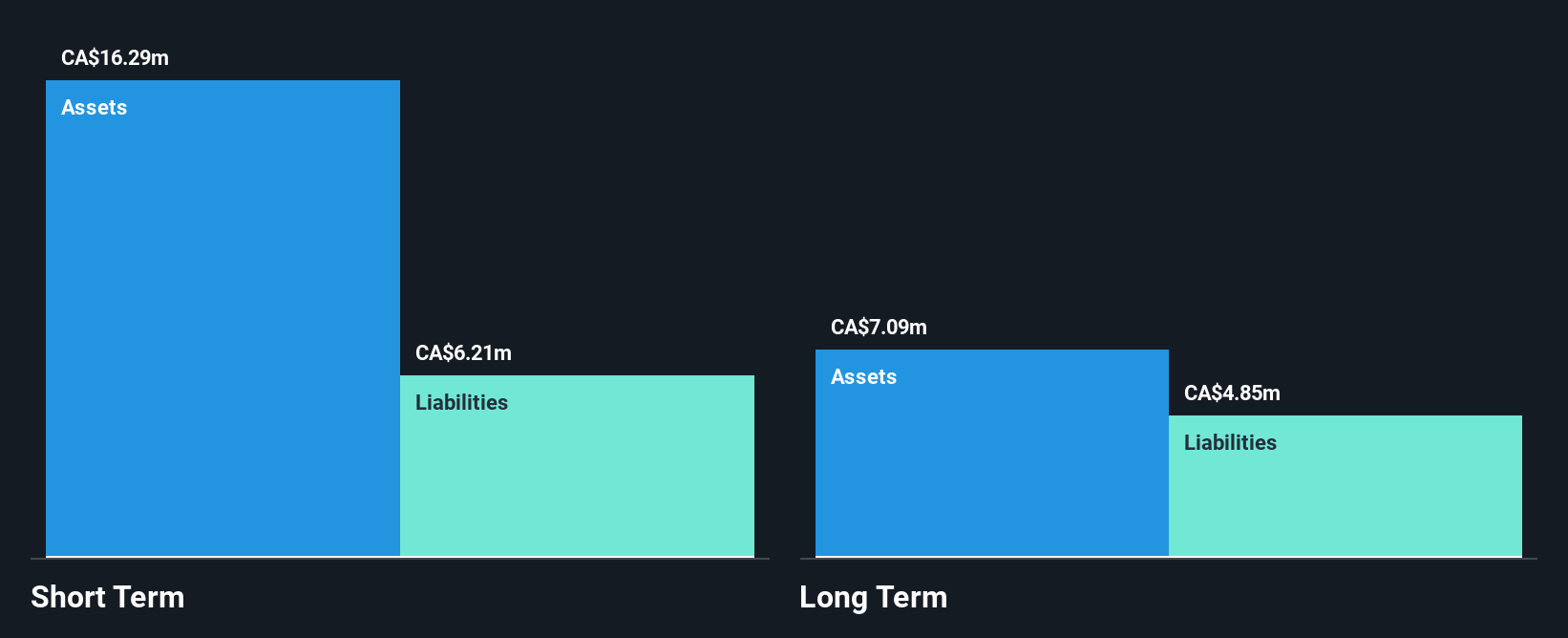

Probe Gold Inc., with a market cap of CA$331.59 million, is a pre-revenue precious metal exploration company focused on Canadian gold properties. Despite being unprofitable and not expected to achieve profitability in the next three years, Probe Gold maintains financial stability with short-term assets exceeding both short-term and long-term liabilities. The company remains debt-free for five years, indicating prudent financial management. Recent drilling results from its Novador project show promising gold intercepts crucial for advancing towards development stages like pre-feasibility studies. Additionally, favorable environmental assessments at Novador could lower future operational costs by simplifying material handling and monitoring processes.

- Click to explore a detailed breakdown of our findings in Probe Gold's financial health report.

- Gain insights into Probe Gold's future direction by reviewing our growth report.

Thinkific Labs (TSX:THNC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thinkific Labs Inc. develops, markets, and manages a cloud-based platform for online course creation and distribution in Canada, the United States, and internationally with a market cap of CA$221.89 million.

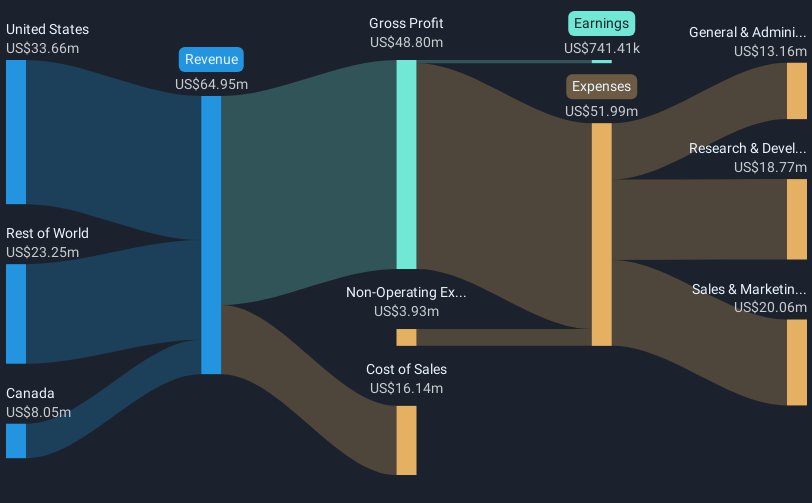

Operations: The company's revenue is primarily generated from the development, marketing, and support management of its cloud-based platform, totaling $64.95 million.

Market Cap: CA$221.89M

Thinkific Labs, with a market cap of CA$221.89 million, has recently become profitable, yet its earnings are forecasted to decline significantly over the next three years. The company reported full-year sales of US$66.94 million for 2024, marking an increase from the previous year despite a net loss of US$0.237 million. Thinkific's short-term assets comfortably exceed its liabilities, and it remains debt-free, ensuring financial stability amidst volatility in earnings forecasts. Recent AI-driven product enhancements aim to streamline course creation and marketing processes for users globally, potentially driving future revenue growth in digital education markets.

- Click here and access our complete financial health analysis report to understand the dynamics of Thinkific Labs.

- Explore Thinkific Labs' analyst forecasts in our growth report.

Zentek (TSXV:ZEN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zentek Ltd. is a Canadian company focused on the research and development of graphene and related nanomaterials, with a market cap of CA$140.77 million.

Operations: The company generates revenue from its Metals & Mining - Miscellaneous segment, amounting to CA$0.06 million.

Market Cap: CA$140.77M

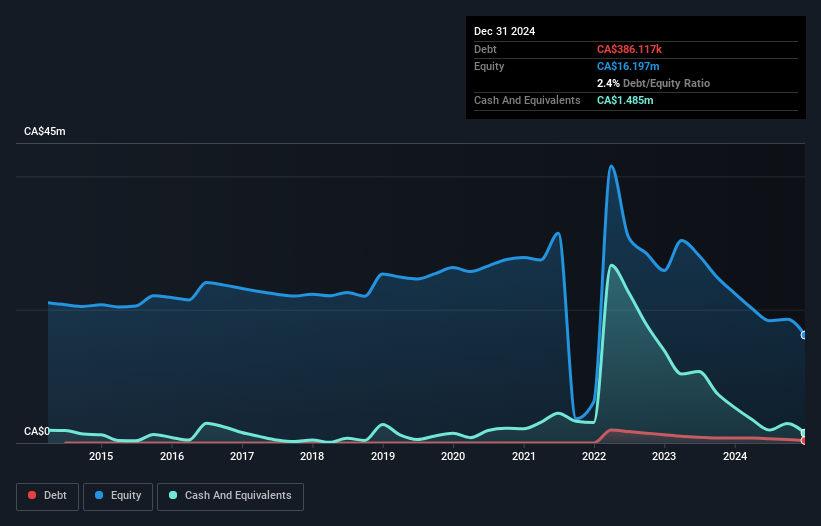

Zentek Ltd., with a market cap of CA$140.77 million, remains pre-revenue, generating minimal income from its Metals & Mining segment. Recent developments include a CA$30 million follow-on equity offering and strategic moves to commercialize ZenGUARD™ Enhanced Air Filters in Canada and potentially the U.S., pending regulatory approval. The company is targeting initial sales by March 2025, leveraging partnerships like the MOU with Al-Ramez International Group for expansion in the MENA region. Despite short-term financial challenges, Zentek's assets surpass liabilities, providing some stability as it navigates growth opportunities in advanced materials and biotechnology sectors.

- Take a closer look at Zentek's potential here in our financial health report.

- Evaluate Zentek's historical performance by accessing our past performance report.

Make It Happen

- Embark on your investment journey to our 932 TSX Penny Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zentek might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ZEN

Zentek

Engages in the research and development of graphene and related nanomaterials in Canada.

Excellent balance sheet very low.

Similar Companies

Market Insights

Community Narratives