- Canada

- /

- Metals and Mining

- /

- TSX:PPTA

New Stibnite Leadership Hires Might Change The Case For Investing In Perpetua Resources (TSX:PPTA)

Reviewed by Sasha Jovanovic

- Perpetua Resources recently expanded its leadership team, appointing Jim Norine as Senior Vice President Projects and Tim Kahl as Senior Vice President Technical Services to support ongoing Early Works construction at the Stibnite Gold Project.

- The addition of two executives with deep mining project delivery and operational readiness experience signals a sharpening focus on moving Stibnite toward potential development decisions.

- We’ll now examine how strengthening Perpetua’s project and technical leadership bench at Stibnite could shape the company’s broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Perpetua Resources' Investment Narrative?

To own Perpetua Resources, you need to believe that the Stibnite Gold Project will progress from an early‑stage asset with no revenue and recurring losses into a fully financed, constructed and operating mine, despite auditor going‑concern flags and recent shareholder dilution to raise more than US$78 million. The key near‑term catalysts still center on Early Works execution and the expected final investment decision in spring 2026, along with any developments on permitting, offtake and project financing. The addition of Jim Norine and Tim Kahl slots directly into this timeline, potentially strengthening Perpetua’s ability to deliver construction and operational readiness at Stibnite, which could modestly improve confidence around those catalysts. That said, the hires do not remove core risks around funding, cost inflation, or the possibility of further dilution if timelines slip.

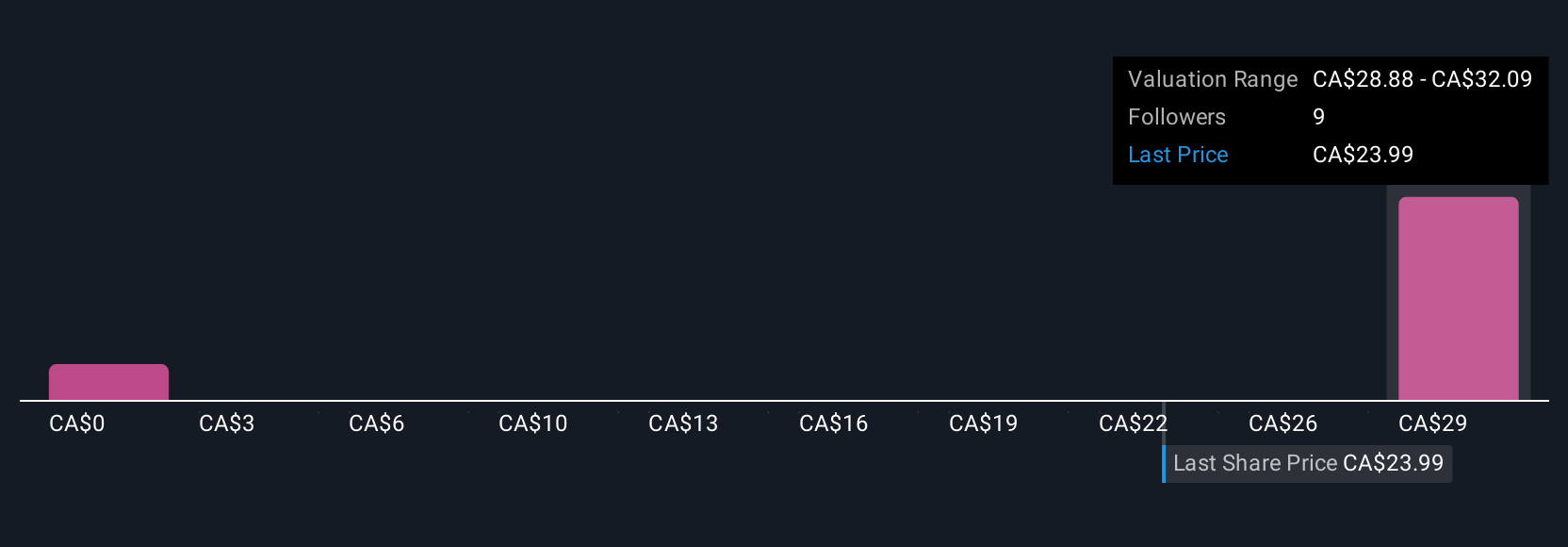

But against that potential, the going‑concern warning is not something investors can ignore. Upon reviewing our latest valuation report, Perpetua Resources' share price might be too optimistic.Exploring Other Perspectives

Explore 7 other fair value estimates on Perpetua Resources - why the stock might be worth as much as 21% more than the current price!

Build Your Own Perpetua Resources Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Perpetua Resources research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Perpetua Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Perpetua Resources' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PPTA

Perpetua Resources

A development-stage company, engages in the acquisition of mining properties in the United States.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026