- Canada

- /

- Metals and Mining

- /

- TSX:ORE

Exploring Canada's Hidden Stock Gems For December 2025

Reviewed by Simply Wall St

As the Canadian market reaches new record highs, buoyed by dovish signals from the Bank of Canada and supportive measures from the Federal Reserve, investors are increasingly turning their attention to small-cap stocks that have shown resilience amid economic uncertainties. In this favorable environment, identifying hidden gems requires a keen eye for companies with strong fundamentals and growth potential that can capitalize on these supportive market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.62% | 30.86% | ★★★★★★ |

| Itafos | 20.68% | 9.86% | 37.00% | ★★★★★★ |

| Mako Mining | 5.29% | 37.41% | 60.51% | ★★★★★★ |

| Soma Gold | 37.84% | 26.84% | 22.13% | ★★★★★★ |

| Flint | 46.67% | 13.46% | 21.87% | ★★★★★☆ |

| Melcor Developments | 47.67% | 8.75% | 12.05% | ★★★★☆☆ |

| Corby Spirit and Wine | 54.56% | 11.67% | -4.04% | ★★★★☆☆ |

| Dundee | 1.46% | -35.04% | 52.59% | ★★★★☆☆ |

| Hemlo Mining | NA | 26.48% | 134.47% | ★★★★☆☆ |

| Kiwetinohk Energy | 23.09% | 21.68% | 30.98% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Andean Precious Metals (TSX:APM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Andean Precious Metals Corp. is involved in the acquisition, exploration, development, and processing of mineral resource properties in the United States with a market capitalization of CA$1.47 billion.

Operations: Andean Precious Metals generates revenue primarily from its operations in Bolivia ($165.81 million) and the USA ($133.13 million).

Andean Precious Metals, a nimble player in the mining sector, has demonstrated robust financial performance with earnings growing 19% annually over five years. Despite a debt-to-equity ratio rising to 23%, its interest payments are well covered by EBIT at 51 times, indicating solid financial health. Recent sales of US$90 million in Q3 show a jump from last year's US$68 million, while net income soared to US$44 million from US$8 million. However, challenges include geopolitical risks and fluctuating commodity prices. A new credit facility with National Bank of Canada enhances liquidity for strategic growth initiatives.

Orezone Gold (TSX:ORE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Orezone Gold Corporation is involved in the mining, exploration, and development of gold properties with a market cap of CA$1.09 billion.

Operations: Orezone Gold generates revenue primarily from the acquisition, exploration, and potential development of precious metal properties, amounting to $338.01 million. The company's financial performance is influenced by its operational costs and market conditions impacting gold prices.

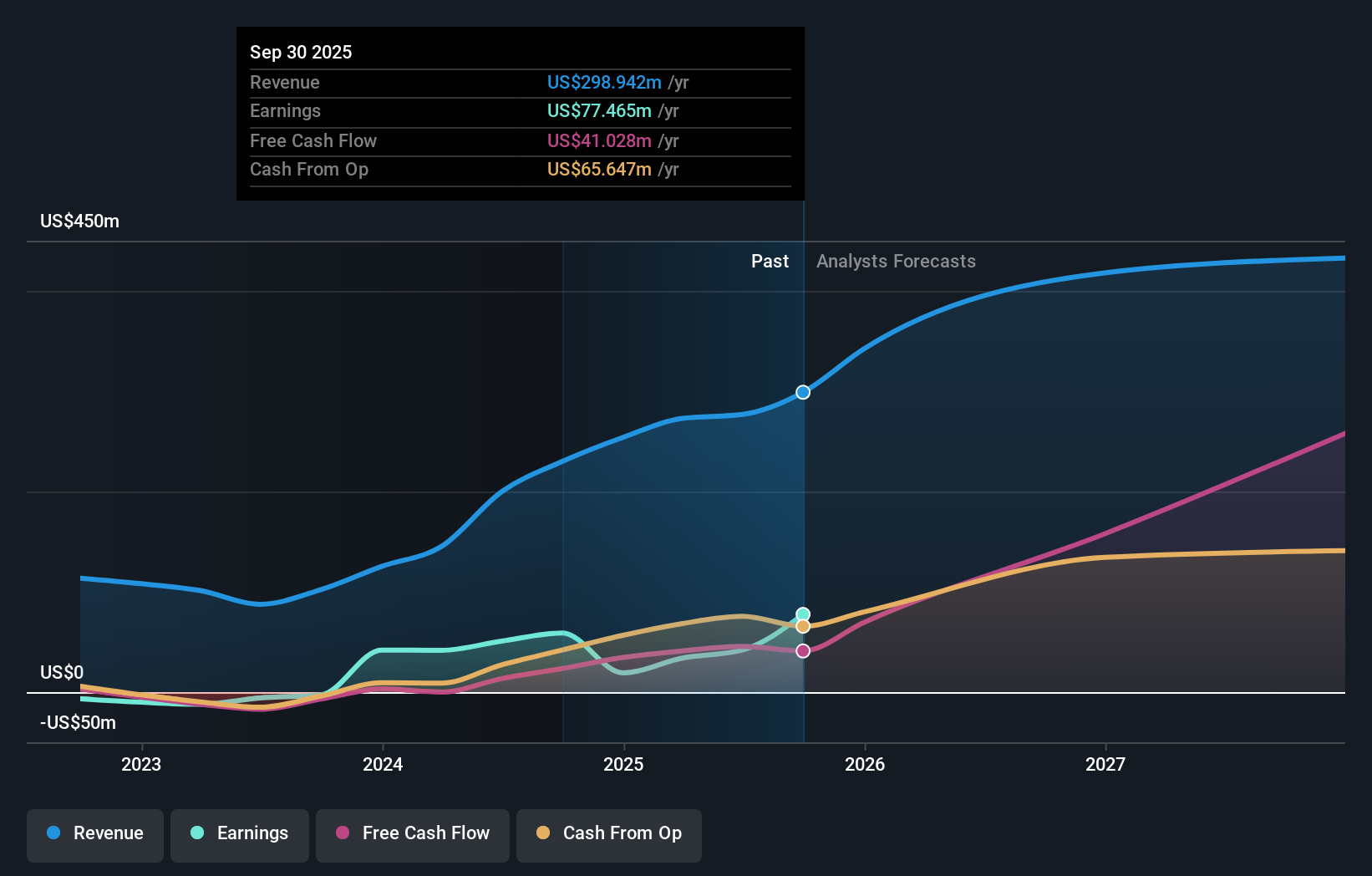

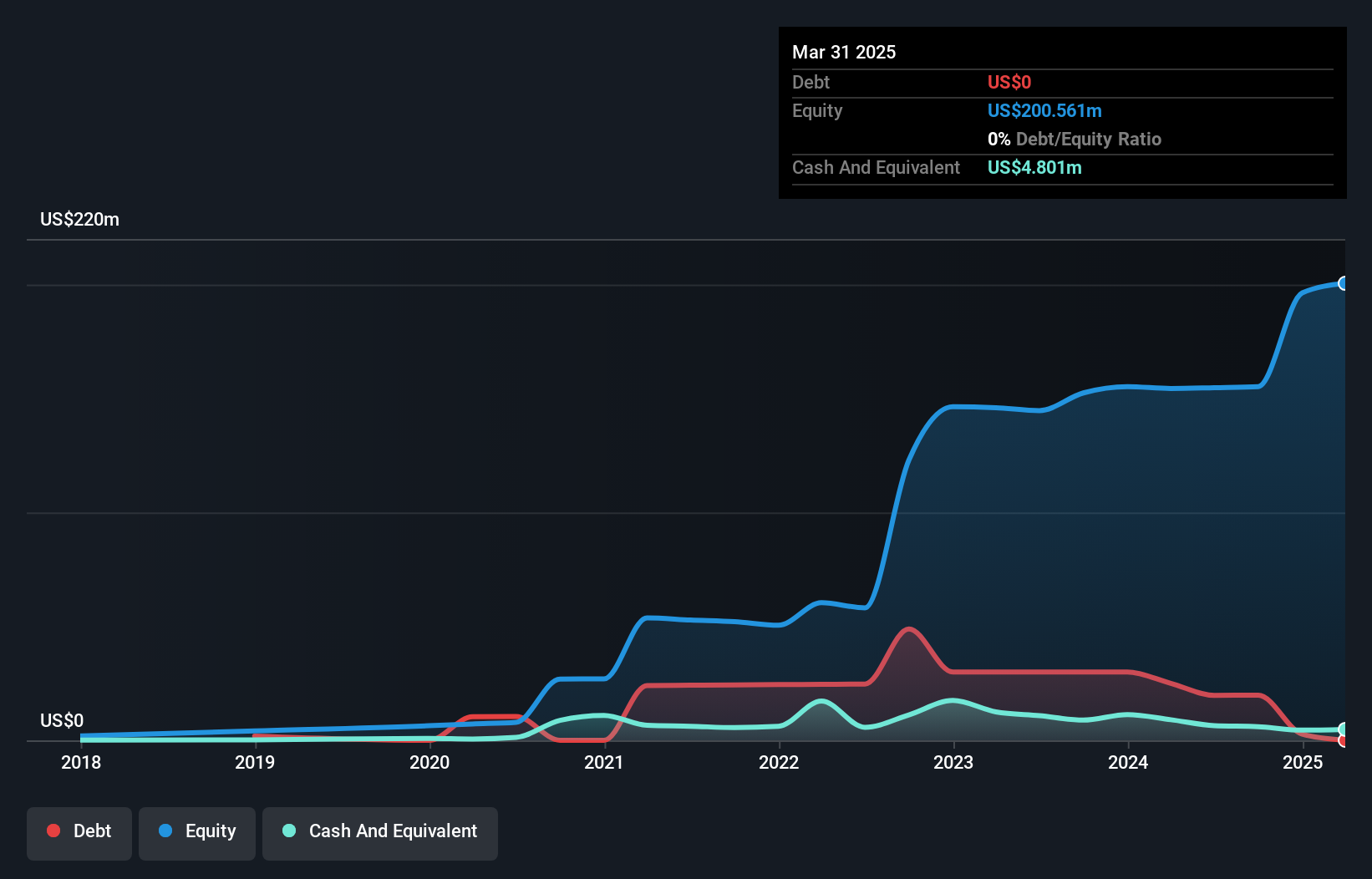

Orezone Gold, a dynamic player in the mining sector, is making waves with its ambitious growth plans. The Bomboré project is on track for Stage 1 commissioning by Q4 2025 and aims to boost production to between 220,000 and 250,000 ounces annually by 2027. Recent earnings show net income at US$5 million for Q3 2025, up from US$4.98 million the previous year. Orezone's debt to equity ratio has increased to a manageable 29.9% over five years, while its interest payments are well covered at nearly fourteen times EBIT. Despite these positives, challenges include reliance on a single asset and rising operational costs amidst geopolitical uncertainties in Burkina Faso.

Elemental Royalty (TSXV:ELE)

Simply Wall St Value Rating: ★★★★★★

Overview: Elemental Royalty Corporation focuses on acquiring and generating precious metal royalties, with a market cap of CA$1.32 billion.

Operations: The company generates revenue primarily through the acquisition of royalties, streams, and similar production-based interests, amounting to $33.12 million. With a market cap of CA$1.32 billion, its business model centers on leveraging these revenue streams in the precious metals sector.

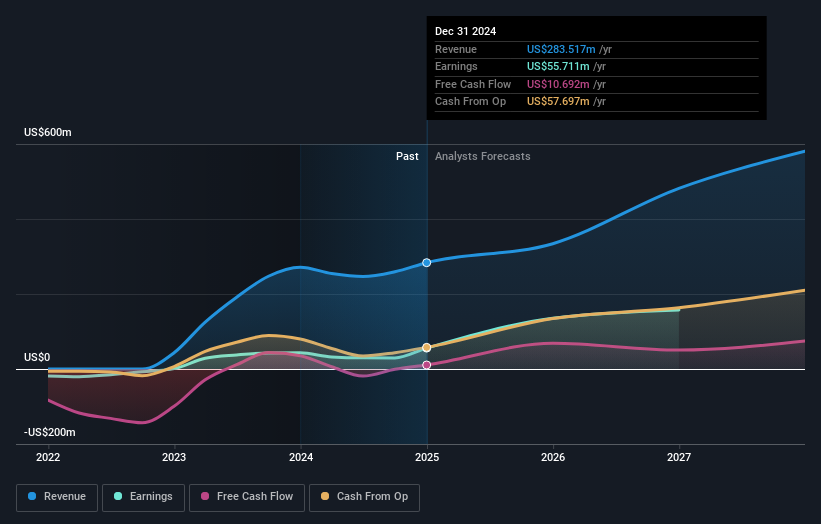

Elemental Royalty, a burgeoning player in the gold streaming and royalty sector, has been making significant strides with its recent merger with EMX Royalty Corporation. This strategic move bolsters its portfolio to over 200 royalties, including 16 producing assets. The company recently reported earnings growth of 184% year-over-year, outpacing the industry average of 63%. Despite a one-off $2.8M loss impacting recent results, Elemental remains debt-free and trades at a substantial discount to its estimated fair value. Its acquisition of key royalties in Australia further strengthens its position as a mid-tier operator with promising prospects.

- Click to explore a detailed breakdown of our findings in Elemental Royalty's health report.

Assess Elemental Royalty's past performance with our detailed historical performance reports.

Key Takeaways

- Explore the 45 names from our TSX Undiscovered Gems With Strong Fundamentals screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ORE

Orezone Gold

Engages in the mining, exploration, and development of gold properties.

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion