- Canada

- /

- Metals and Mining

- /

- TSX:ORA

Revenues Not Telling The Story For Aura Minerals Inc. (TSE:ORA) After Shares Rise 28%

The Aura Minerals Inc. (TSE:ORA) share price has done very well over the last month, posting an excellent gain of 28%. The last month tops off a massive increase of 212% in the last year.

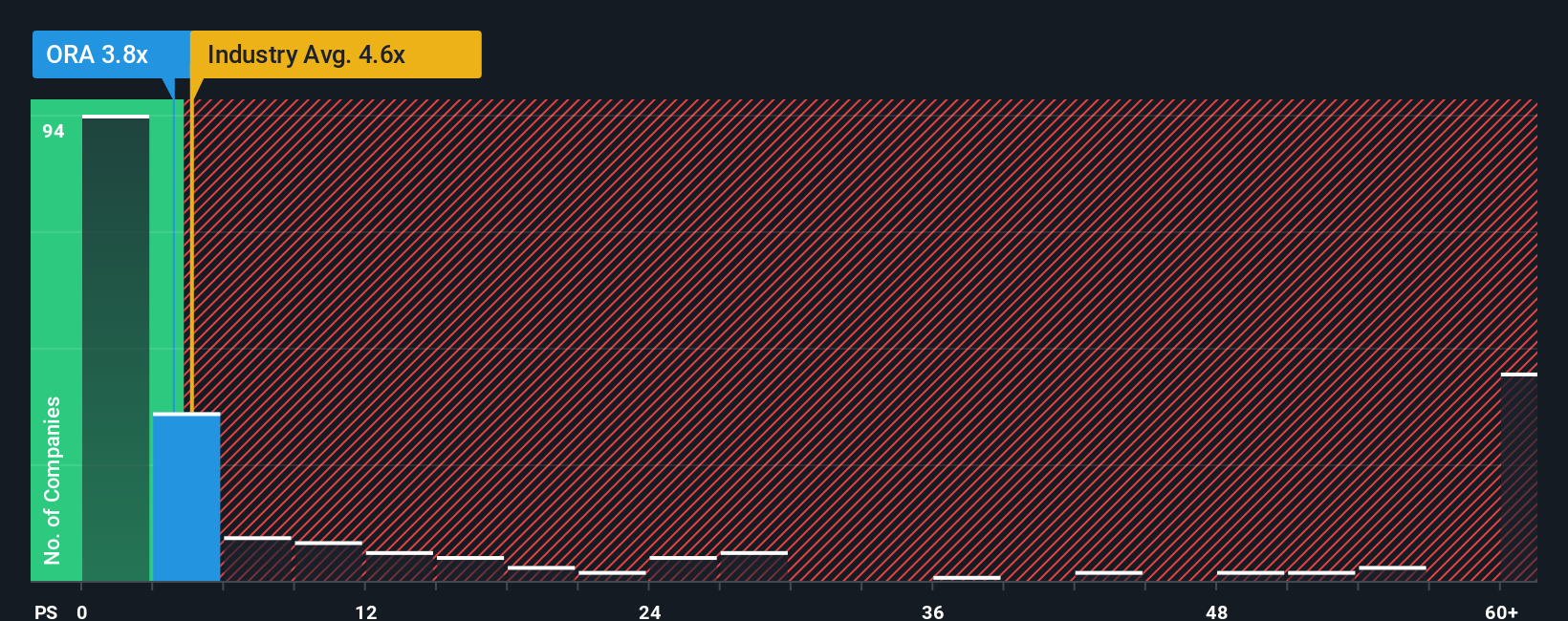

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Aura Minerals' P/S ratio of 3.8x, since the median price-to-sales (or "P/S") ratio for the Metals and Mining industry in Canada is also close to 4.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Aura Minerals

What Does Aura Minerals' Recent Performance Look Like?

Recent revenue growth for Aura Minerals has been in line with the industry. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Want the full picture on analyst estimates for the company? Then our free report on Aura Minerals will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Aura Minerals would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 36% gain to the company's top line. The latest three year period has also seen an excellent 63% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 24% per annum as estimated by the seven analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 50% each year, which is noticeably more attractive.

With this information, we find it interesting that Aura Minerals is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Aura Minerals appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

When you consider that Aura Minerals' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Aura Minerals (1 can't be ignored!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ORA

Aura Minerals

A gold and copper production company, focuses on the development and operation of gold and base metal projects in the Americas.

High growth potential and fair value.

Market Insights

Community Narratives