- Canada

- /

- Metals and Mining

- /

- TSX:ORA

Aura Minerals (TSX:ORA) Is Down 7.4% After Equity Offering and Index Exit What's Changed

Reviewed by Simply Wall St

- In recent days, Aura Minerals Inc. completed a US$196.44 million follow-on equity offering, briefly joined, and then was dropped from, the NASDAQ Composite Index, and introduced its common shares on a new market listing.

- This unusual sequence of index changes combined with a substantial equity raising highlights shifting institutional interest and Aura’s ongoing capital plans for future initiatives.

- We'll explore how Aura’s large follow-on equity offering could shift the company’s growth narrative and financial outlook.

Aura Minerals Investment Narrative Recap

To own Aura Minerals, you need to believe in its ability to convert a heavy investment phase into higher production and improved margins, all while managing the risk of gold price volatility and above-average operating costs. The US$196.44 million follow-on equity offering provides more capital for growth projects, which may help address near-term liquidity concerns; however, the sudden changes in NASDAQ Composite Index inclusion do not materially alter the most critical short-term production and cost catalysts for shareholders. The main risk remains fluctuations in production and gold pricing, both of which could pressure margins if operational improvements take longer than expected.

The recent follow-on equity raise, involving the issue of 8,100,510 common shares at a discount, stands out as the most relevant event for Aura’s near-term outlook. This injection of funds increases financial flexibility at a critical time, as Aura ramps up commercial production at Borborema and continues its capital-intensive investment at Apoena, which is expected to result in higher future outputs once the initial phase is complete. Yet, with lingering volatility in production and operational costs across several mines, the effectiveness of using this new capital to realize those growth catalysts is an immediate focus.

But in contrast to the optimism surrounding new capital, investors should be aware that recurring production inconsistencies and operational cost pressures could still…

Read the full narrative on Aura Minerals (it's free!)

Aura Minerals is projected to reach $1.0 billion in revenue and $282.2 million in earnings by 2028. This outlook is based on analysts’ expectations of 17.3% annual revenue growth and a $376.5 million increase in earnings from the current level of -$94.3 million.

Exploring Other Perspectives

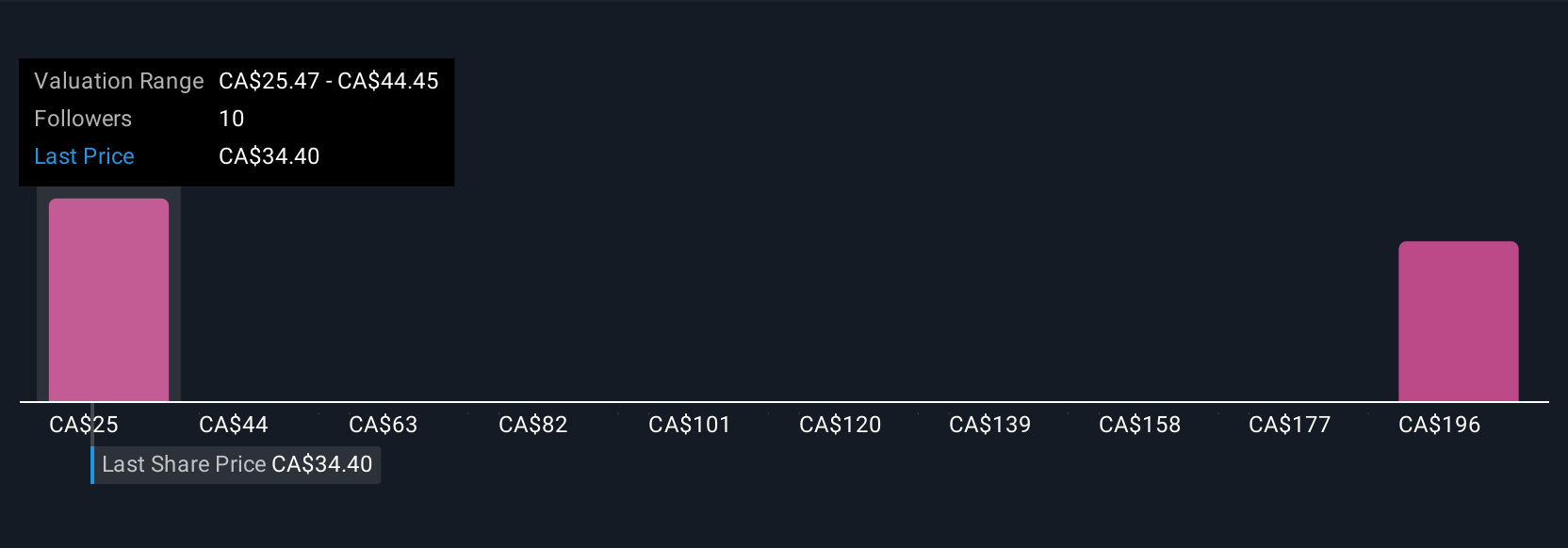

Two community members from Simply Wall St have projected Aura’s fair value between US$25.47 and US$212.63 per share. Yet with the company issuing new equity to address near-term liquidity and fuel mine ramp-up, future returns may depend on how efficiently Aura manages both capital and cost risks. Explore these contrasting viewpoints to inform your own expectations.

Build Your Own Aura Minerals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aura Minerals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Aura Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aura Minerals' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ORA

Aura Minerals

A gold and copper production company, focuses on the development and operation of gold and base metal projects in the Americas.

High growth potential and good value.

Market Insights

Community Narratives