- Canada

- /

- Healthcare Services

- /

- TSX:WELL

TSX Growth Companies With Up To 23% Insider Ownership

Reviewed by Simply Wall St

As the Canadian market navigates a landscape marked by potential volatility, driven by factors such as trade uncertainties and emerging credit concerns, investors are encouraged to view pullbacks as opportunities for strategic portfolio adjustments. In this context, growth companies with high insider ownership can be particularly appealing due to their potential for alignment between management and shareholder interests, making them noteworthy considerations in today's market environment.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| West Red Lake Gold Mines (TSXV:WRLG) | 11.2% | 78% |

| Robex Resources (TSXV:RBX) | 23.1% | 90.3% |

| Propel Holdings (TSX:PRL) | 30.6% | 34% |

| Orla Mining (TSX:OLA) | 10.7% | 64.7% |

| NTG Clarity Networks (TSXV:NCI) | 36.4% | 29.9% |

| Heliostar Metals (TSXV:HSTR) | 16.4% | 41% |

| Enterprise Group (TSX:E) | 32.1% | 30.4% |

| Colliers International Group (TSX:CIGI) | 14.0% | 27.2% |

| CEMATRIX (TSX:CEMX) | 10.5% | 77.8% |

| Almonty Industries (TSX:AII) | 12.5% | 65% |

We'll examine a selection from our screener results.

Orla Mining (TSX:OLA)

Simply Wall St Growth Rating: ★★★★★★

Overview: Orla Mining Ltd. is engaged in the acquisition, exploration, development, and exploitation of mineral properties with a market cap of CA$4.94 billion.

Operations: Revenue Segments (in millions of $): null

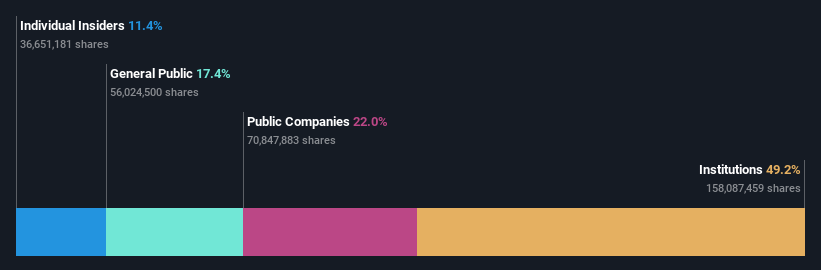

Insider Ownership: 10.7%

Orla Mining is poised for substantial growth, with earnings forecasted to grow significantly faster than the Canadian market. Recent exploration success at Musselwhite Mine indicates potential for increased production and extended mine life. Despite significant insider selling over the past three months, more shares have been bought than sold by insiders in this period. The company's strategic expansion efforts, including the South Railroad Project in Nevada, align with its organic growth strategy toward annual gold production of 500,000 ounces.

- Click here and access our complete growth analysis report to understand the dynamics of Orla Mining.

- The valuation report we've compiled suggests that Orla Mining's current price could be inflated.

Robex Resources (TSXV:RBX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Robex Resources Inc. is involved in the exploration, development, and production of gold in West Africa with a market cap of CA$1.12 billion.

Operations: The company's revenue segment is derived from its mining operations at the Nampala gold project, generating CA$189.36 million.

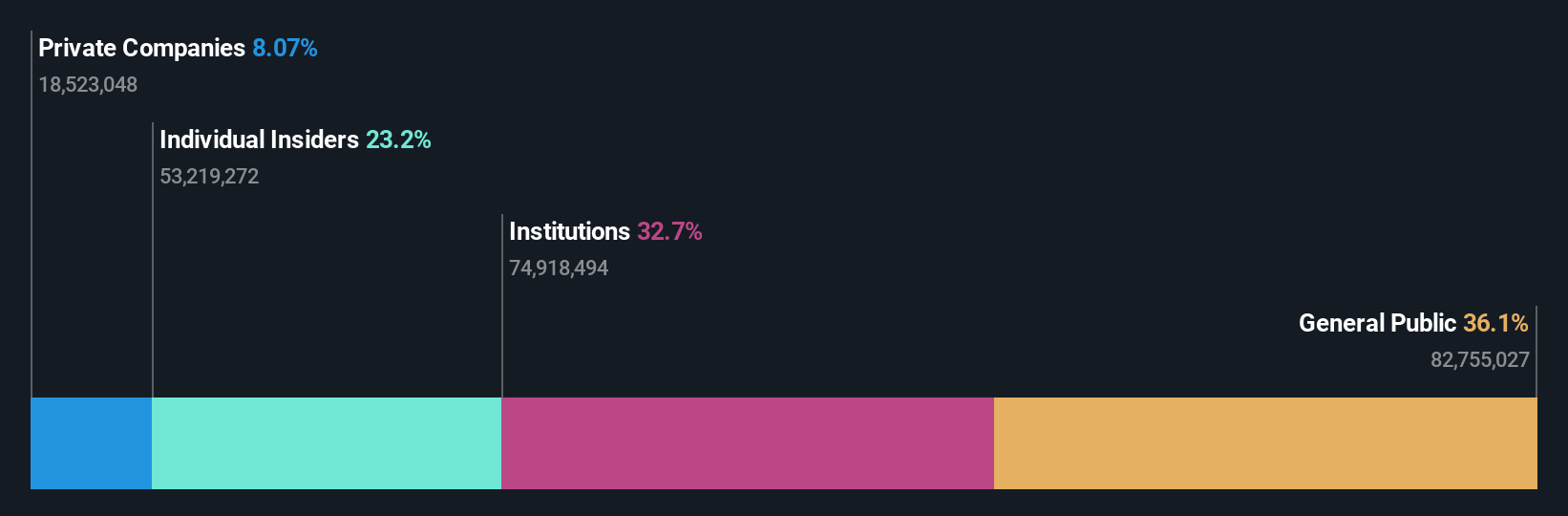

Insider Ownership: 23.1%

Robex Resources is set for robust growth, with forecasts indicating revenue expansion at 55.7% annually, surpassing the Canadian market average. The Kiniero Gold Project in Guinea remains on schedule for its first gold pour by late 2025. Insider activity shows substantial buying over recent months, reflecting confidence in the company's trajectory. Despite a significant net loss reported recently, Robex's strategic merger with Predictive Discovery valued at approximately C$880 million could enhance operational synergies and market presence.

- Get an in-depth perspective on Robex Resources' performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Robex Resources' share price might be too pessimistic.

WELL Health Technologies (TSX:WELL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: WELL Health Technologies Corp. is a digital healthcare company focused on supporting practitioners in Canada, the United States, and internationally, with a market cap of CA$1.24 billion.

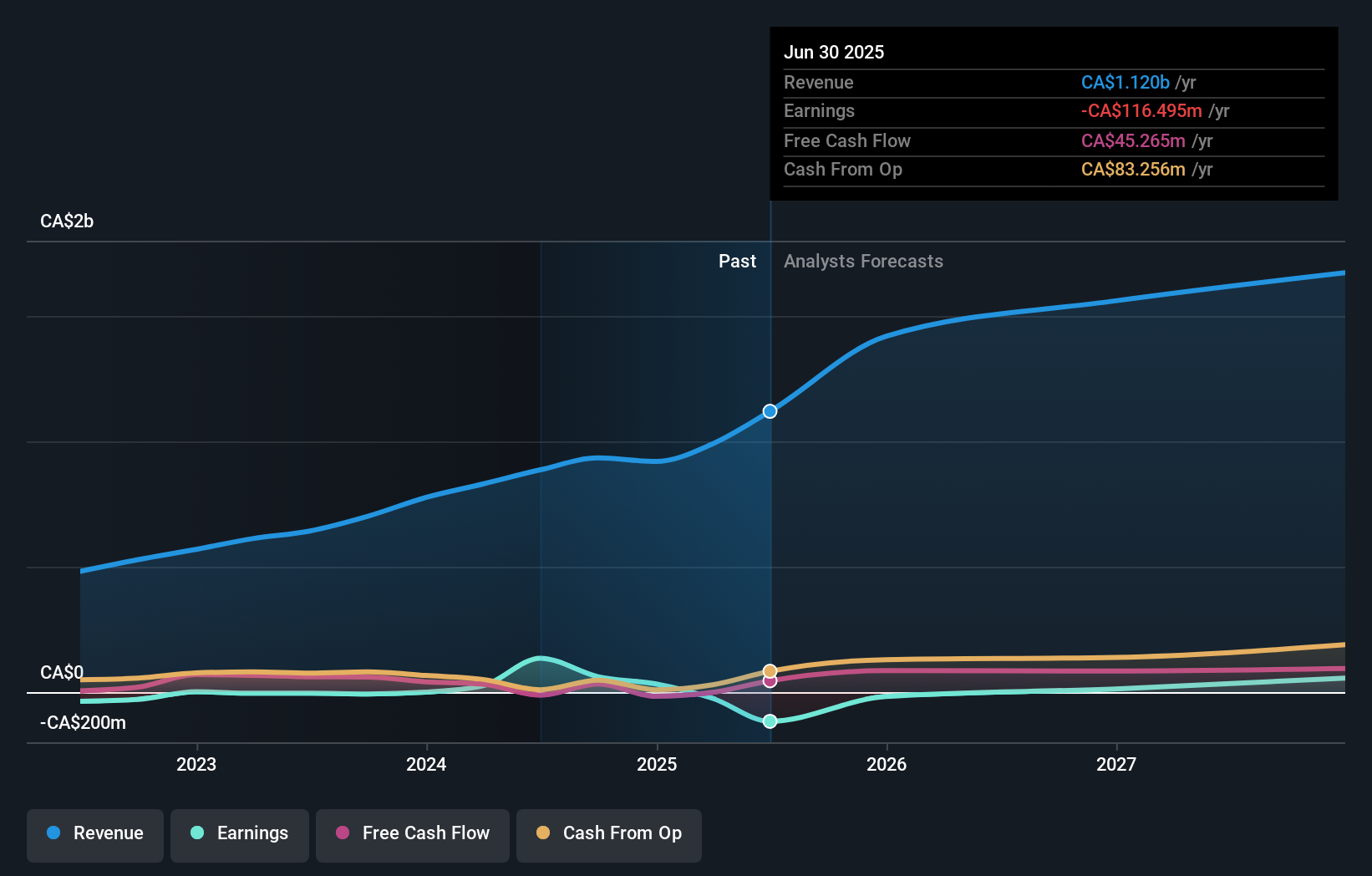

Operations: WELL Health Technologies Corp. generates revenue from various segments, including SaaS and Technology Services (CA$80.89 million), Specialized-provider Staffing (CA$168.94 million), Canadian Patient Services - Primary (CA$229.16 million), WELL Health USA Patient Services - Primary WISP (CA$113.10 million), Canadian Patient Services - Specialized Myhealth (CA$152.50 million), WELL Health USA Patient Services - Primary Circle Medical (CA$103.19 million), and WELL Health USA Patient Services - Specialized CRH Medical (CA$241.55 million).

Insider Ownership: 22.6%

WELL Health Technologies is positioned for growth, with revenue forecasted to increase at 13.7% annually, outpacing the Canadian market average. Despite a recent net loss and reduced earnings per share, insiders have shown confidence by buying more shares than they've sold in the past three months. The company trades at a significant discount to its estimated fair value and analysts expect the stock price to rise substantially, supported by reaffirmed revenue guidance of up to C$1.45 billion for 2025.

- Unlock comprehensive insights into our analysis of WELL Health Technologies stock in this growth report.

- Our expertly prepared valuation report WELL Health Technologies implies its share price may be lower than expected.

Seize The Opportunity

- Unlock our comprehensive list of 39 Fast Growing TSX Companies With High Insider Ownership by clicking here.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if WELL Health Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WELL

WELL Health Technologies

Operates as a practitioner-focused digital healthcare company in Canada, the United States, and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives