- Canada

- /

- Metals and Mining

- /

- TSX:OGC

How Share Buybacks and Nevada Gold Venture Have Changed OceanaGold’s (TSX:OGC) Investment Narrative

Reviewed by Simply Wall St

- In July 2025, OceanaGold authorized a share repurchase plan to buy back up to 23 million shares, while entering into a Letter of Intent with Headwater Gold to fund up to US$65 million in exploration of three Nevada gold projects.

- This dual approach signals a commitment to both shareholder returns and portfolio growth, underscoring management’s confidence in capital allocation and potential resource expansion.

- We’ll examine how the buyback program could strengthen OceanaGold’s investment narrative by highlighting management’s focus on shareholder value.

These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

OceanaGold Investment Narrative Recap

To be an OceanaGold shareholder, you must believe in the company’s ability to convert operational and exploration investments into meaningful production growth while navigating complex mining and market conditions. The recent authorization of a large share buyback and the option to fund Nevada gold exploration do not materially impact OceanaGold's most immediate catalysts, such as ramping up production at Haile, or alleviate the biggest short-term risks around higher costs from ore hardness and operational disruptions at Didipio and Macraes.

The share buyback plan, aiming to repurchase up to 23 million shares (nearly 10% of issued capital), is particularly relevant now, as it spotlights management's focus on enhancing shareholder returns against the backdrop of positive earnings momentum and ongoing cash flow challenges from operational headwinds.

However, investors should not overlook that, while capital allocation initiatives get headlines, risks like sustained ore processing difficulties at Haile could still...

Read the full narrative on OceanaGold (it's free!)

OceanaGold's outlook anticipates $1.7 billion in revenue and $300.5 million in earnings by 2028. This reflects an 8.8% annual revenue growth rate and a $113.1 million increase in earnings from the current $187.4 million.

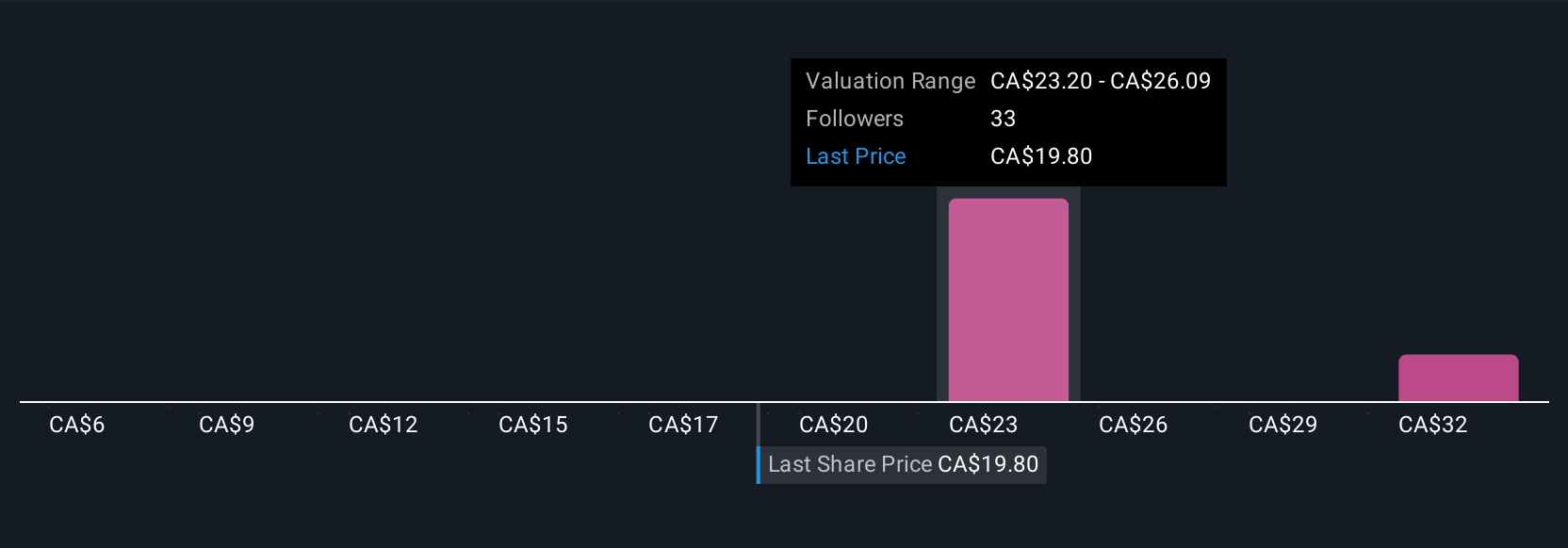

Uncover how OceanaGold's forecasts yield a CA$25.80 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community estimate OceanaGold’s fair value between A$5.87 and A$33.35, showing a wide gap in expectations. Against this diversity, increased production targets remain a key catalyst but come with execution risks that could affect future outcomes; make sure you explore different views to inform your decision.

Explore 5 other fair value estimates on OceanaGold - why the stock might be worth less than half the current price!

Build Your Own OceanaGold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OceanaGold research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free OceanaGold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OceanaGold's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:OGC

OceanaGold

A gold and copper producer, engages in exploration, development, and operation of mineral properties in the United States, the Philippines, and New Zealand.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives