Why Investors Shouldn't Be Surprised By Verde AgriTech Limited's (TSE:NPK) 43% Share Price Surge

Verde AgriTech Limited (TSE:NPK) shareholders would be excited to see that the share price has had a great month, posting a 43% gain and recovering from prior weakness. But the last month did very little to improve the 68% share price decline over the last year.

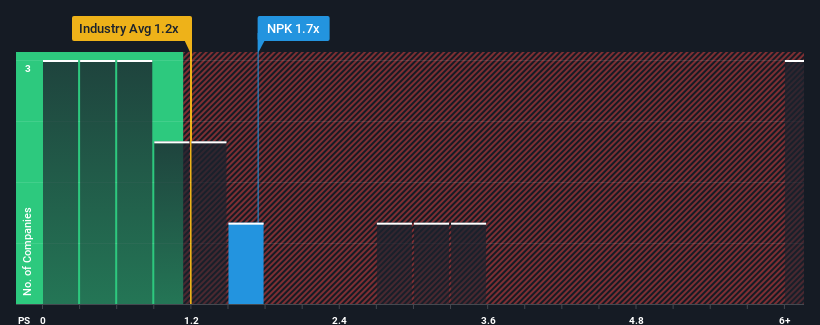

After such a large jump in price, when almost half of the companies in Canada's Chemicals industry have price-to-sales ratios (or "P/S") below 1.2x, you may consider Verde AgriTech as a stock probably not worth researching with its 1.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Verde AgriTech

What Does Verde AgriTech's Recent Performance Look Like?

With revenue that's retreating more than the industry's average of late, Verde AgriTech has been very sluggish. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Verde AgriTech will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Verde AgriTech's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 36% decrease to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 7.5% as estimated by the one analyst watching the company. With the rest of the industry predicted to shrink by 5.7%, that would be a fantastic result.

With this in consideration, we understand why Verde AgriTech's P/S is a cut above its industry peers. At this time, shareholders aren't keen to offload something that is potentially eyeing a much more prosperous future.

The Key Takeaway

The large bounce in Verde AgriTech's shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We can see that Verde AgriTech maintains its high P/S on the strength of its forecast growth potentially beating a struggling industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Although, if the company's prospects don't change they will continue to provide strong support to the share price.

You need to take note of risks, for example - Verde AgriTech has 3 warning signs (and 1 which is significant) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:NPK

Verde AgriTech

An agricultural technology company, produces and sells potassium fertilizers in Brazil and internationally.

Slight risk with imperfect balance sheet.

Market Insights

Community Narratives