Verde AgriTech Limited (TSE:NPK) Stock Rockets 29% But Many Are Still Ignoring The Company

Those holding Verde AgriTech Limited (TSE:NPK) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 55% share price drop in the last twelve months.

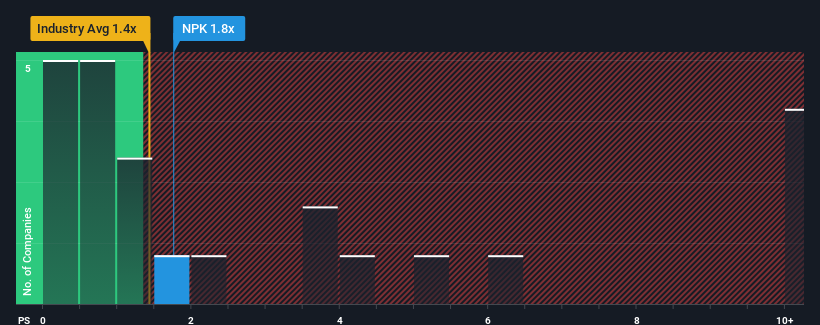

Although its price has surged higher, there still wouldn't be many who think Verde AgriTech's price-to-sales (or "P/S") ratio of 1.8x is worth a mention when the median P/S in Canada's Chemicals industry is similar at about 1.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Verde AgriTech

What Does Verde AgriTech's P/S Mean For Shareholders?

Verde AgriTech hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Verde AgriTech.How Is Verde AgriTech's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Verde AgriTech's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 60%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 235% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 53% during the coming year according to the only analyst following the company. Meanwhile, the broader industry is forecast to contract by 0.07%, which would indicate the company is doing very well.

In light of this, it's peculiar that Verde AgriTech's P/S sits in-line with the majority of other companies. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

The Key Takeaway

Its shares have lifted substantially and now Verde AgriTech's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We note that even though Verde AgriTech trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. There could be some unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. One such risk is that the company may not live up to analysts' revenue trajectories in tough industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Plus, you should also learn about these 2 warning signs we've spotted with Verde AgriTech (including 1 which makes us a bit uncomfortable).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:NPK

Verde AgriTech

An agricultural technology company, produces and sells potassium fertilizers in Brazil and internationally.

Slight risk with imperfect balance sheet.

Market Insights

Community Narratives