Verde AgriTech Limited (TSE:NPK) Might Not Be As Mispriced As It Looks

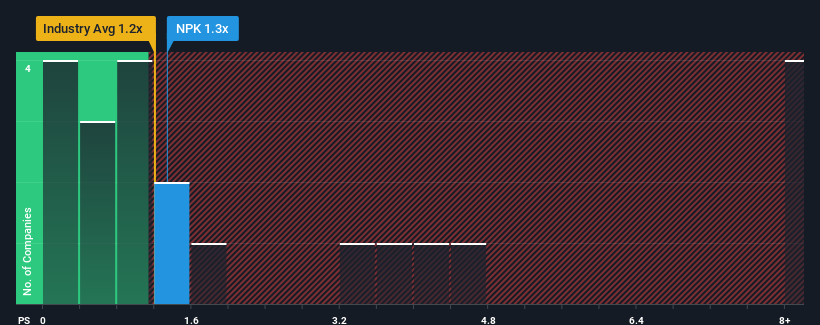

It's not a stretch to say that Verde AgriTech Limited's (TSE:NPK) price-to-sales (or "P/S") ratio of 1.3x right now seems quite "middle-of-the-road" for companies in the Chemicals industry in Canada, where the median P/S ratio is around 1.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Verde AgriTech

How Verde AgriTech Has Been Performing

Recent times haven't been great for Verde AgriTech as its revenue has been falling quicker than most other companies. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think Verde AgriTech's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Verde AgriTech's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 53% decrease to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 18% during the coming year according to the only analyst following the company. With the rest of the industry predicted to shrink by 2.9%, that would be a fantastic result.

With this in mind, we find it intriguing that Verde AgriTech's P/S trades in-line with its industry peers. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Verde AgriTech currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. There could be some unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. The market could be pricing in the event that tough industry conditions will impact future revenues. It appears some are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

It is also worth noting that we have found 2 warning signs for Verde AgriTech (1 shouldn't be ignored!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:NPK

Verde AgriTech

An agricultural technology company, produces and sells potassium fertilizers in Brazil and internationally.

Low risk with imperfect balance sheet.

Market Insights

Community Narratives