- Canada

- /

- Metals and Mining

- /

- TSX:NGEX

The Bull Case For NGEx Minerals (TSX:NGEX) Could Change Following Ultra High-Grade Gold Discovery News - Learn Why

Reviewed by Simply Wall St

- Earlier this month, NGEx Minerals announced final drill results from its Phase 3 program at the 100% owned Lunahuasi copper-gold-silver project in San Juan, Argentina, with highlights including ultra high-grade visible gold discovered in quartz veins in the Saturn zone.

- This marks the identification of a new style of mineralization and introduces a completely new exploration target for the company.

- We'll explore how this discovery of ultra high-grade visible gold in the Saturn zone is shaping NGEx Minerals' investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is NGEx Minerals' Investment Narrative?

For NGEx Minerals, the big picture for shareholders revolves around its ability to unearth and define world-class mineral resources at its flagship projects, especially Lunahuasi. The company’s recent discovery of ultra high-grade visible gold in the Saturn zone could reshape the near-term outlook, introducing a fresh exploration target that might accelerate drilling activity and investor interest. This new style of mineralization could also reposition the company’s short-term catalysts, with geological interpretations and deposit modeling now in sharper focus for the upcoming season. Still, NGEx’s profile remains high-risk: it is unprofitable, running consistent net losses, and has no revenue forecast in the near term. While these latest drill results ignited only a modest share price gain, the potential for a step-change in resource size or quality may start shifting the conversation, even if it hasn’t yet materially moved consensus estimates.

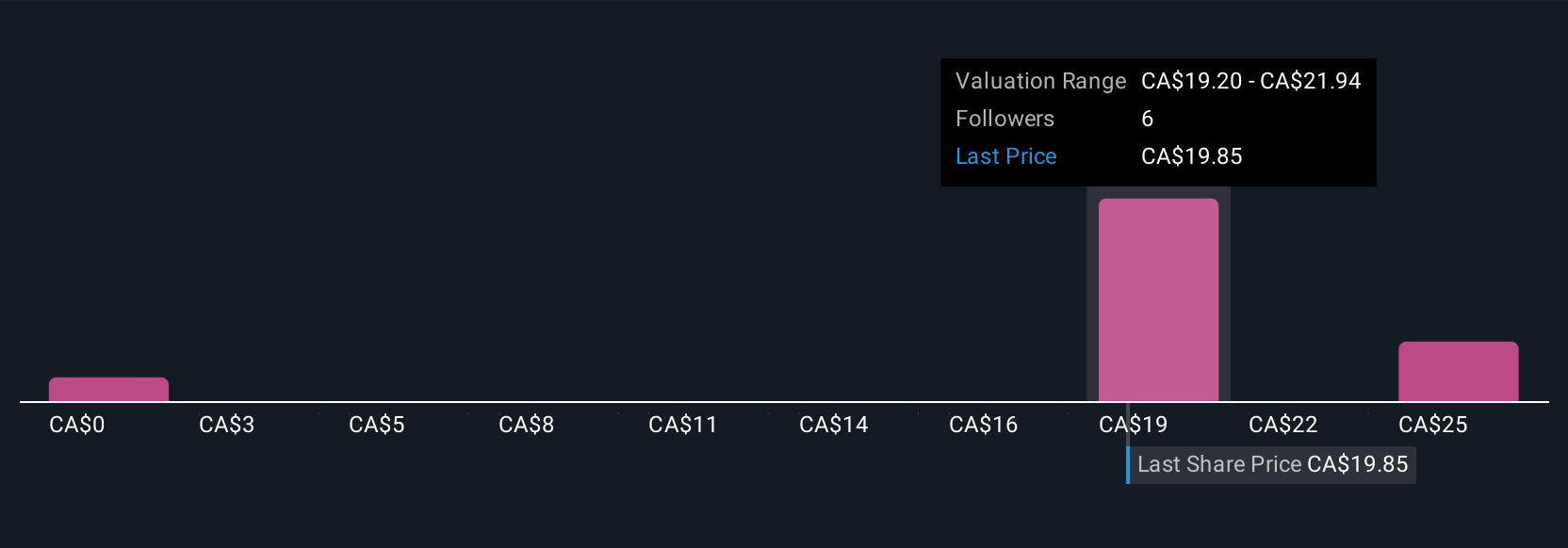

But unlike the excitement around discovery, the risk of ongoing losses and no revenue should not be overlooked. NGEx Minerals' shares have been on the rise but are still potentially undervalued by 36%. Find out what it's worth.Exploring Other Perspectives

Build Your Own NGEx Minerals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NGEx Minerals research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free NGEx Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NGEx Minerals' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NGEx Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NGEX

NGEx Minerals

Engages in the acquisition, exploration, and development of mineral properties in South America.

Flawless balance sheet and fair value.

Market Insights

Community Narratives