- Canada

- /

- Metals and Mining

- /

- TSX:NGEX

NGEx Minerals (TSX:NGEX): Assessing Valuation After Steep Q2 Losses and Surging Share Price

Reviewed by Simply Wall St

NGEx Minerals (TSX:NGEX) just released its second quarter and half-year results, and the numbers caught investors’ eyes. The company reported a jump in net loss to CA$21.39 million for Q2, almost three times last year’s figure. With losses deepening faster than many anticipated, those watching NGEx are left sifting through the new data to judge what has really changed about its future.

The market’s reaction has been anything but dull. Even with expanding losses, NGEx Minerals’ share price has climbed nearly 9% over the past month and has risen more than 40% in the past three months. The one-year total return now approaches 99%, and anyone holding since 2020 has seen the kind of long-term momentum that few mining companies can match. While the past week brought only a slight uptick, the longer-term rally appears to have survived this latest earnings headline, at least for now.

After the big run this year despite deeper losses, is NGEx Minerals trading below its true value, or is the market already factoring in a big growth story? Let’s dig into the details.

Price-to-Book of 30.1x: Is it justified?

By traditional valuation, NGEx Minerals trades at a price-to-book (P/B) ratio of 30.1x, which is well above both its industry and peer averages. This indicates the company’s shares appear expensive compared to typical Canadian metals and mining firms, where the average P/B is about 2x.

The price-to-book ratio compares a company’s market value to its book value, and is often used for capital-intensive sectors like mining where tangible assets play a significant role in valuation. A high P/B suggests that investors are factoring in elements beyond current asset values such as future discovery success or long-term growth prospects.

This premium multiple indicates that the market is anticipating significant future performance well beyond NGEx’s current financials. Unless the company achieves exceptional results or discovers substantial new mineral resources, maintaining such a high ratio may be difficult over time.

Result: Fair Value of $22.25 (OVERVALUED)

See our latest analysis for NGEx Minerals.However, continued net losses and the absence of recurring revenue could quickly temper the bullish momentum if expectations for major discoveries are not met.

Find out about the key risks to this NGEx Minerals narrative.Another View: Discounted Cash Flow Tells a Different Story

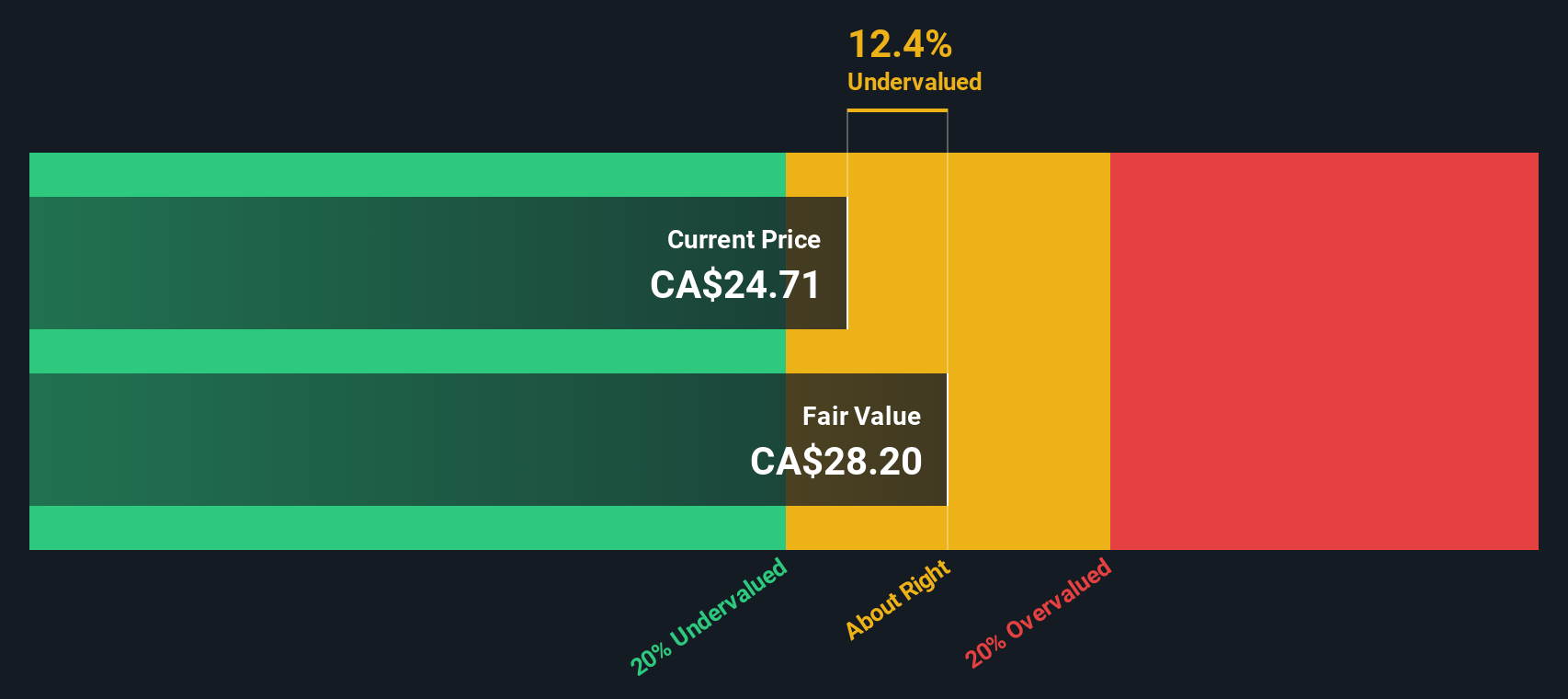

While market comparisons suggest NGEx Minerals looks expensive, the SWS DCF model actually points to the shares being undervalued. This alternative method suggests the market may be missing something. Which perspective should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NGEx Minerals Narrative

If you think there is more to the story or want to form your own conclusions, you can create a personalized narrative in just a few minutes. So why not do it your way?

A great starting point for your NGEx Minerals research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss out on other exciting opportunities that could take your portfolio further. The Simply Wall Street Screener puts powerful, unconventional ideas at your fingertips. Bold moves start with fresh information. Act now and see what you could be missing:

- Unlock higher income with stocks offering impressive yields by tracking dividend stocks with yields > 3% and see which companies stand out for reliable dividends above 3%.

- Get ahead of the curve by tapping into AI penny stocks to find emerging businesses at the forefront of artificial intelligence innovation and smart automation.

- Accelerate your search for value by scouting undervalued stocks based on cash flows companies trading below their intrinsic worth, and position yourself for outsized future returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NGEx Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NGEX

NGEx Minerals

Engages in the acquisition, exploration, and development of mineral properties in South America.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion