- Canada

- /

- Metals and Mining

- /

- TSX:NGD

New Gold (TSX:NGD) Is Up 13.8% After Record Q3 Results and Debt Reduction Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- New Gold Inc. recently reported record third-quarter results, with revenue of US$462.5 million, net income of US$142.3 million, and significant production growth driven by the Rainy River mine.

- The company also repaid US$260 million of debt and emphasized a disciplined approach to acquisitions while prioritizing organic growth and shareholder value.

- With record free cash flow reported in the third quarter, we'll evaluate how this operational strength shapes New Gold's investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

New Gold Investment Narrative Recap

To be a New Gold shareholder, you need to believe in the company’s ability to drive sustained production growth from its core Rainy River and New Afton mines, while transforming record operational performance into reliable cash flow. The third-quarter results demonstrated operational momentum, but this does not eliminate the main risk; future earnings remain closely tied to successful ramp-up and reserve replacement efforts at these same legacy assets.

Among recent announcements, the company’s disciplined debt reduction stands out. Management repaid US$260 million in the third quarter alone, reinforcing financial flexibility, an important buffer as New Gold continues to invest in exploration and expansion projects that underpin its key catalysts for growth.

Yet, in contrast to these strong results, investors should be aware of persistent risks around reserve depletion and potential resource replacement shortfalls if...

Read the full narrative on New Gold (it's free!)

New Gold's outlook anticipates $2.5 billion in revenue and $1.1 billion in earnings by 2028. This scenario is based on 33.5% annual revenue growth and a $955.1 million earnings increase from the current earnings of $144.9 million.

Uncover how New Gold's forecasts yield a CA$12.06 fair value, a 17% upside to its current price.

Exploring Other Perspectives

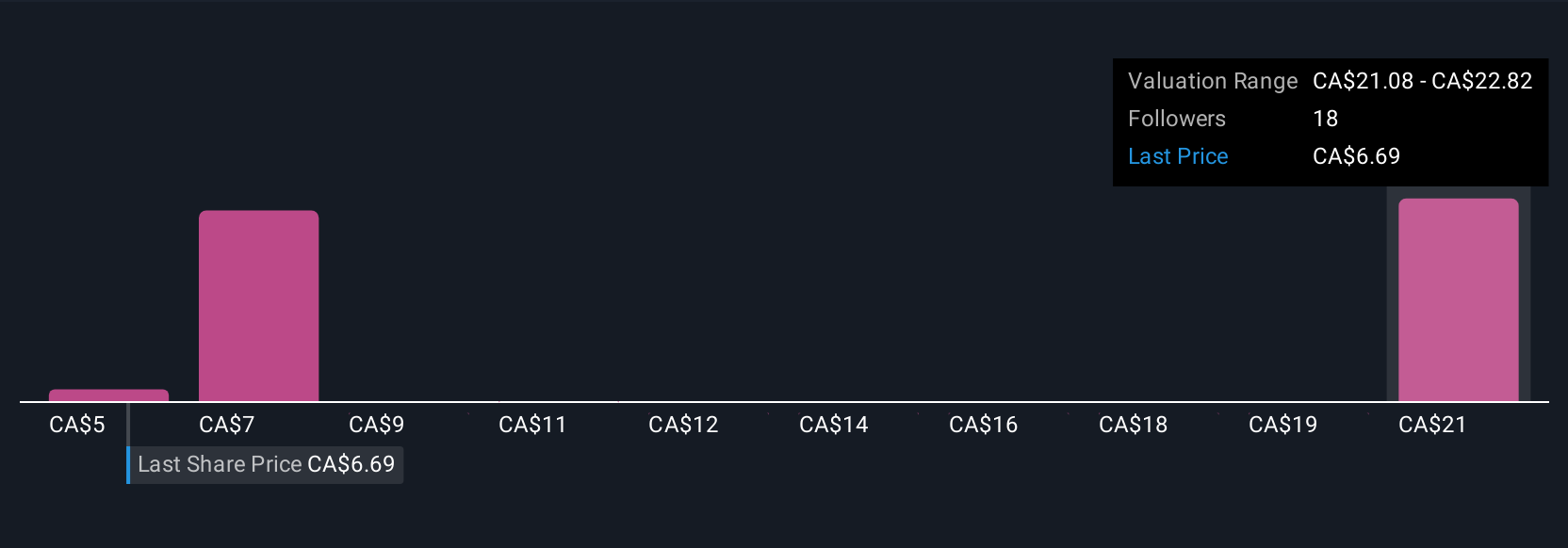

Six individual fair value estimates from the Simply Wall St Community range from US$5.68 to US$33.69, reflecting a wide spectrum of expectations. With ongoing capital needs for exploration and asset life extension, it’s clear that market participants see different paths forward, consider a variety of viewpoints before making your own assessment.

Explore 6 other fair value estimates on New Gold - why the stock might be worth over 3x more than the current price!

Build Your Own New Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your New Gold research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free New Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate New Gold's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NGD

New Gold

An intermediate gold mining company, engages in the development and operation of mineral properties in Canada.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Community Narratives