- Canada

- /

- Metals and Mining

- /

- TSX:NGD

Is New Gold’s 146% Rally Driven by Fundamentals or Hype?

Reviewed by Bailey Pemberton

- Wondering if New Gold’s wild run makes it a hidden gem or a risky bet? You’re not alone if the recent buzz has you curious about what’s driving its value.

- The stock has skyrocketed, boasting a 146.3% climb year-to-date and a staggering 144.4% gain over the past 12 months. It has also seen some short-term dips, such as a 9.1% drop in the last month.

- Recent headlines highlight increased gold production and upbeat analyst upgrades. Both of these have sparked renewed optimism and contributed to the big moves in share price. There has also been interest in management’s ongoing initiatives to cut costs and boost output, which investors are watching closely.

- Based on our standard checks, New Gold earns a 4 out of 6 for undervaluation, but numbers alone rarely give the whole story. Next, we will break down how we arrive at this score, and later, explore a more insightful way to evaluate what New Gold is truly worth.

Approach 1: New Gold Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) valuation estimates the value of a company by projecting its future cash flows and discounting them back to today’s value. This approach helps investors judge what New Gold's shares might truly be worth, using underlying business performance instead of relying solely on market sentiment.

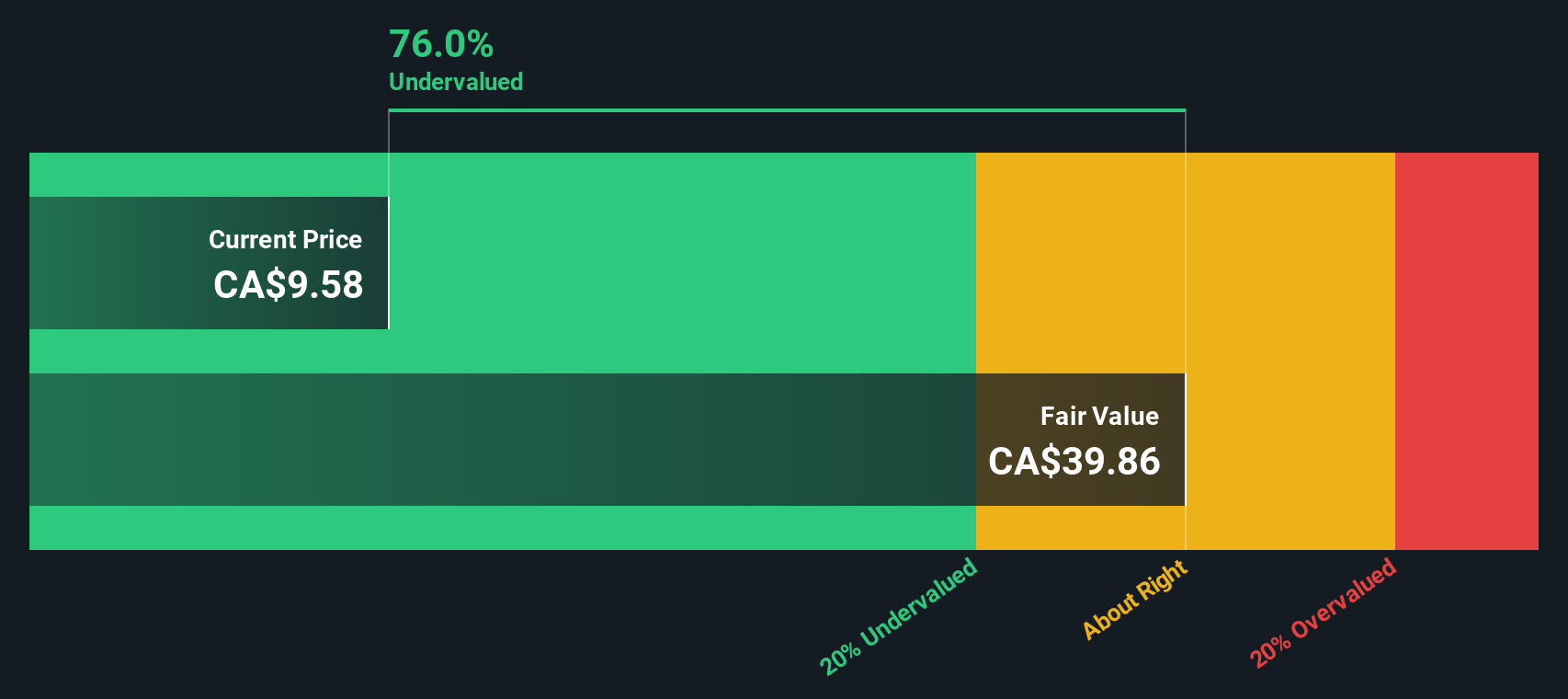

New Gold’s most recent Free Cash Flow stands at $188.5 Million. Analysts see strong growth over the next few years, with projections reaching $1.175 Billion by 2028. These figures are based on a combination of analyst estimates for the first five years and extended forecasts by Simply Wall St for the following years. The model uses a two-stage Free Cash Flow to Equity method for its calculations.

According to this DCF analysis, New Gold’s intrinsic value is estimated at $37.45 per share. This represents a 75.1% discount compared to the current trading price, indicating that the stock appears significantly undervalued relative to its projected performance and cash flow outlook.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests New Gold is undervalued by 75.1%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: New Gold Price vs Earnings

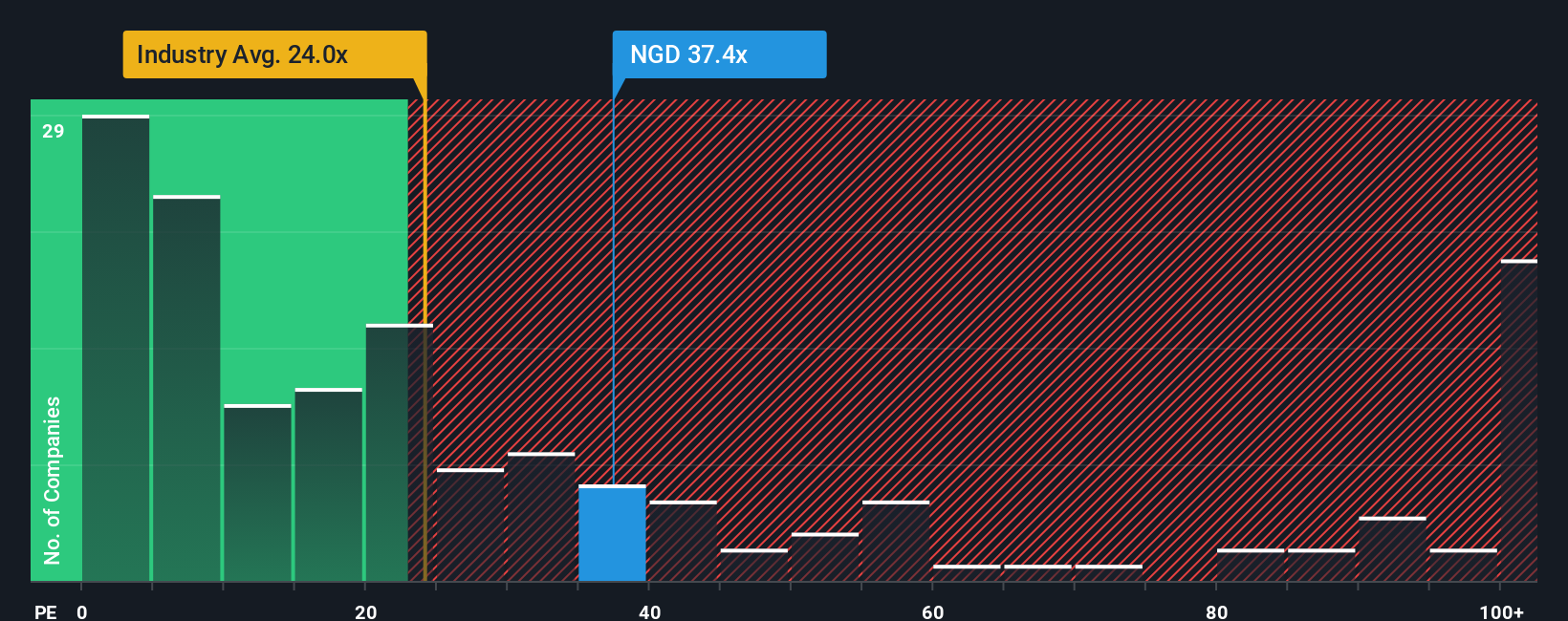

The Price-to-Earnings (PE) ratio is a widely used valuation tool, especially for companies that are already profitable, like New Gold. This metric allows investors to gauge how much the market is willing to pay for each dollar of current earnings, providing a clear lens through which to compare companies across the same industry.

What constitutes a “fair” PE ratio is not set in stone. It is shaped by company-specific factors such as growth potential, risk profile, profit margins, and industry conditions. High-growth, lower-risk companies tend to command higher PE ratios, while slower-growing or riskier ones generally trade at lower multiples.

Currently, New Gold trades at a PE ratio of 21x. This is just above the broader Metals and Mining industry average of 20x and below the 33x median for its peers. To bring further context, Simply Wall St’s proprietary “Fair Ratio” model, which accounts for New Gold’s unique growth prospects, risk level, profitability, and its place in the industry, arrives at a fair multiple of 27.6x.

Simply Wall St’s Fair Ratio goes beyond surface-level comparisons to peers and industry averages by factoring in the company’s projected earnings growth, overall risk, profit margins, and even its market cap. This bespoke metric provides a more tailored view on what would be considered a fair valuation for New Gold.

Comparing the current PE of 21x to the Fair Ratio of 27.6x suggests that New Gold’s shares are currently undervalued from this perspective, with markets not fully pricing in its potential earnings growth and risk profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your New Gold Narrative

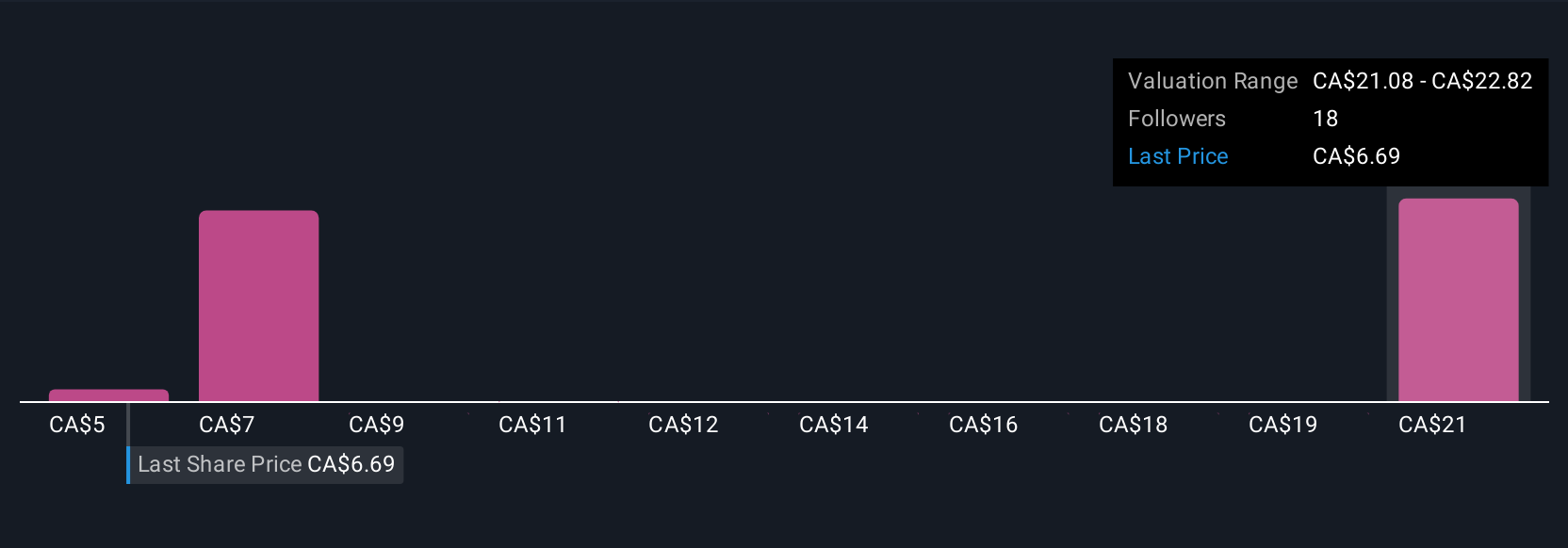

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative connects the story you believe about a company to your outlook on its strategy, risks, industry shifts, and performance, linking these ideas to specific financial forecasts and a fair value for the stock. With Simply Wall St’s easy-to-use Narratives platform, available on the Community page used by millions of investors, you can quickly turn your view of New Gold’s prospects into a tailored financial model and fair value estimate.

Narratives help you bridge the gap between company news and numbers, showing how your assumptions about New Gold’s future earnings, margins, and revenue translate directly to a buy or sell decision by comparing the fair value you calculate to the current share price. These forecasts and valuations dynamically update whenever fresh information hits, so you are always working with the most current insights, whether gold production beats expectations or cost risks emerge.

For example, some investors looking at New Gold might build a bullish Narrative expecting strong copper growth and improved margins, arriving at a fair value near CA$12.34 per share, while others may focus on execution risks and price volatility, landing as low as CA$8.78. Narratives make it easy for every investor to express, share, and refine their view, so you can decide with confidence whether New Gold is a hidden gem or a risky bet based on your own perspective.

Do you think there's more to the story for New Gold? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NGD

New Gold

An intermediate gold mining company, engages in the development and operation of mineral properties in Canada.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Community Narratives