Methanex (TSX:MX) Is Up 6.2% After Return to Profitability and Insider Share Purchases - What's Changed

Reviewed by Simply Wall St

- In recent months, Methanex transitioned from a loss to profitability and saw significant insider share purchases, indicating growing internal confidence in its future outlook.

- This combination of improved financial performance and insider buying activity highlights a material shift in the company's fundamentals that has attracted increased investor interest.

- We'll now explore how Methanex's return to profitability and insider confidence may impact the investment outlook for the company.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Methanex Investment Narrative Recap

To be a shareholder in Methanex, you need conviction in the company’s ability to maintain profitable operations despite its exposure to global energy costs and gas supply constraints. The recent transition to profitability and notable insider buying both suggest growing confidence from management, but the most immediate catalyst, consistent gas supply to operations, remains unaffected by these events, while the biggest risk continues to be production curtailments from supply interruptions.

The most relevant company announcement is the Q2 2025 financial results, showing net income more than doubling year over year despite slightly lower sales. This improvement underscores the positive shift in profitability highlighted by recent insider buying, but doesn’t directly address the ongoing risk of production constraints tied to contracted gas supply.

However, investors should not lose sight of the risk that Methanex's reliance on contracted gas in key regions means...

Read the full narrative on Methanex (it's free!)

Methanex's outlook anticipates $4.6 billion in revenue and $421.9 million in earnings by 2028. This is based on a 6.9% annual revenue growth rate and an increase in earnings of $257.9 million from the current $164.0 million.

Uncover how Methanex's forecasts yield a CA$75.66 fair value, a 52% upside to its current price.

Exploring Other Perspectives

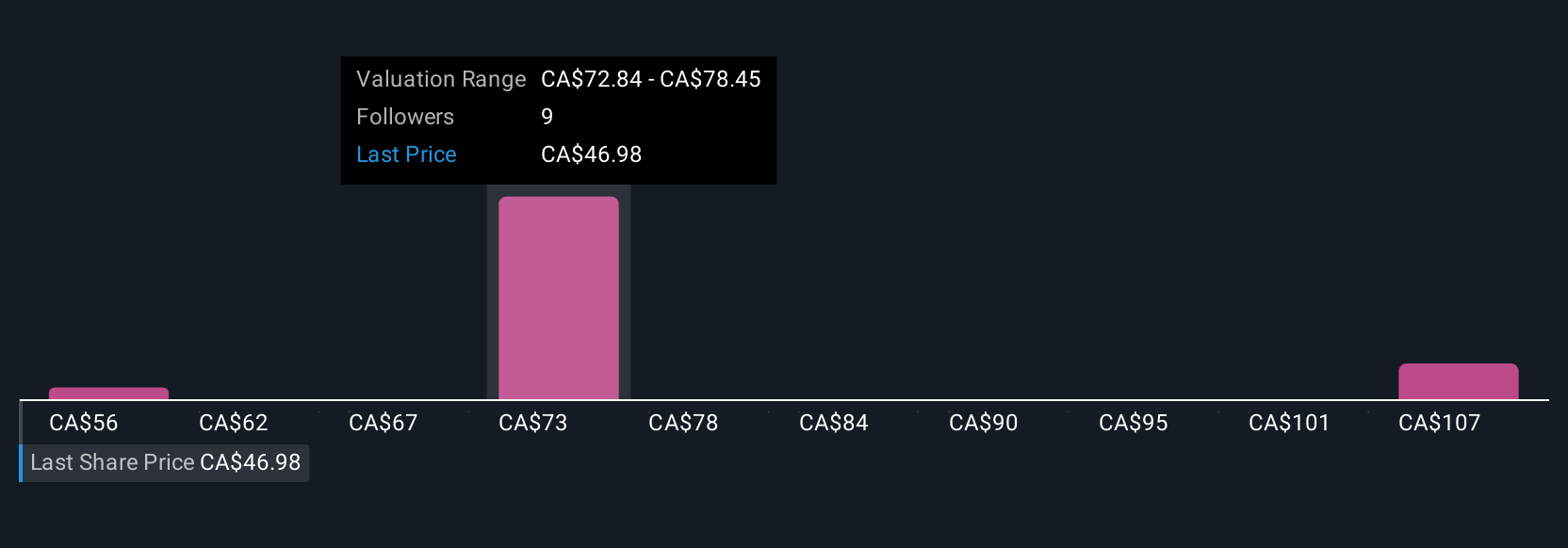

Simply Wall St Community members offered three fair value estimates for Methanex, ranging from CA$56.00 to CA$86.95 per share. With ongoing uncertainty around contracted gas supply impacting future production, it’s clear there are many ways to view Methanex’s prospects, consider a range of perspectives as you weigh the outlook.

Explore 3 other fair value estimates on Methanex - why the stock might be worth as much as 75% more than the current price!

Build Your Own Methanex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Methanex research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Methanex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Methanex's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MX

Methanex

Produces and supplies methanol in Asia Pacific, North America, Europe, and South America.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives