Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Methanex Corporation (TSE:MX) is about to go ex-dividend in just 4 days. This means that investors who purchase shares on or after the 16th of December will not receive the dividend, which will be paid on the 31st of December.

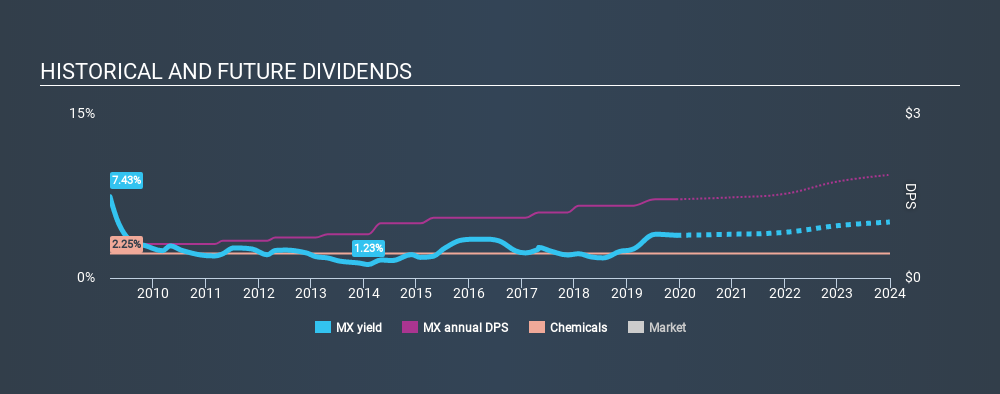

Methanex's upcoming dividend is CA$0.36 a share, following on from the last 12 months, when the company distributed a total of CA$1.44 per share to shareholders. Based on the last year's worth of payments, Methanex stock has a trailing yield of around 3.9% on the current share price of CA$48.77. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for Methanex

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Fortunately Methanex's payout ratio is modest, at just 44% of profit. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. Fortunately, it paid out only 33% of its free cash flow in the past year.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. That's why it's not ideal to see Methanex's earnings per share have been shrinking at 2.0% a year over the previous five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Methanex has delivered an average of 8.8% per year annual increase in its dividend, based on the past ten years of dividend payments.

Final Takeaway

Has Methanex got what it takes to maintain its dividend payments? Earnings per share are down meaningfully, although at least the company is paying out a low and conservative percentage of both its earnings and cash flow. It's definitely not great to see earnings falling, but at least there may be some buffer before the dividend needs to be cut. To summarise, Methanex looks okay on this analysis, although it doesn't appear a stand-out opportunity.

Wondering what the future holds for Methanex? See what the nine analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:MX

Methanex

Produces and supplies methanol in Asia Pacific, North America, Europe, and South America.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026