- Canada

- /

- Metals and Mining

- /

- TSX:DSV

Discovery Silver And 2 Other Penny Stocks To Watch On The TSX

Reviewed by Simply Wall St

The Canadian stock market has experienced a recent pullback amidst political uncertainties, yet it remains buoyed by strong economic growth and easing inflation. In such a climate, identifying stocks with solid financial health becomes crucial for investors seeking stability and potential upside. While the term "penny stocks" may seem outdated, these smaller or newer companies continue to offer intriguing opportunities for growth when backed by robust fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.19 | CA$393.48M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.75M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$116.52M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.36 | CA$948.57M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.54 | CA$492.49M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.31 | CA$227.38M | ★★★★★☆ |

| Vox Royalty (TSX:VOXR) | CA$3.31 | CA$167.46M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.25 | CA$33.58M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$1.88 | CA$115.72M | ★★★★☆☆ |

Click here to see the full list of 958 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Discovery Silver (TSX:DSV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Discovery Silver Corp. is a mineral exploration company focused on the exploration and development of polymetallic mineral deposits, with a market cap of CA$288.33 million.

Operations: Discovery Silver Corp. does not report any revenue segments as it is focused on the exploration and development of polymetallic mineral deposits.

Market Cap: CA$288.33M

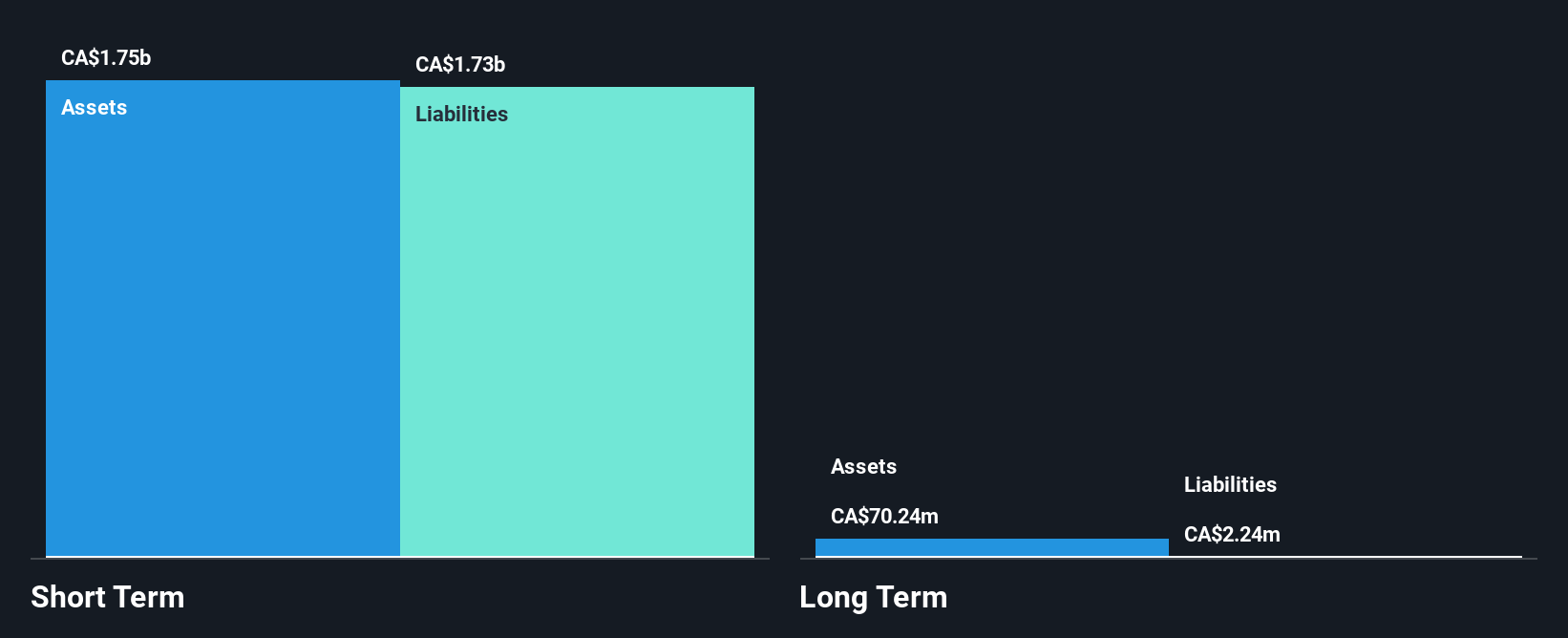

Discovery Silver Corp., with a market cap of CA$288.33 million, remains pre-revenue and unprofitable, reporting increased losses in recent quarters. Despite this, the company benefits from a strong cash position with short-term assets of CA$37.1 million exceeding both short-term and long-term liabilities, suggesting financial stability for over a year if current cash flow trends continue. The company is debt-free but faces challenges with profitability not expected in the near term. Analysts anticipate significant stock price appreciation, though potential investors should consider the inherent volatility and management's relatively short tenure when evaluating its prospects as a penny stock investment.

- Click here to discover the nuances of Discovery Silver with our detailed analytical financial health report.

- Learn about Discovery Silver's future growth trajectory here.

Mandalay Resources (TSX:MND)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mandalay Resources Corporation operates in the acquisition, exploration, extraction, processing, and reclamation of mineral properties across Canada, Australia, Sweden, and Chile with a market cap of CA$393.48 million.

Operations: The company's revenue segment is primarily focused on Metals & Mining, specifically Gold & Other Precious Metals, generating $224.44 million.

Market Cap: CA$393.48M

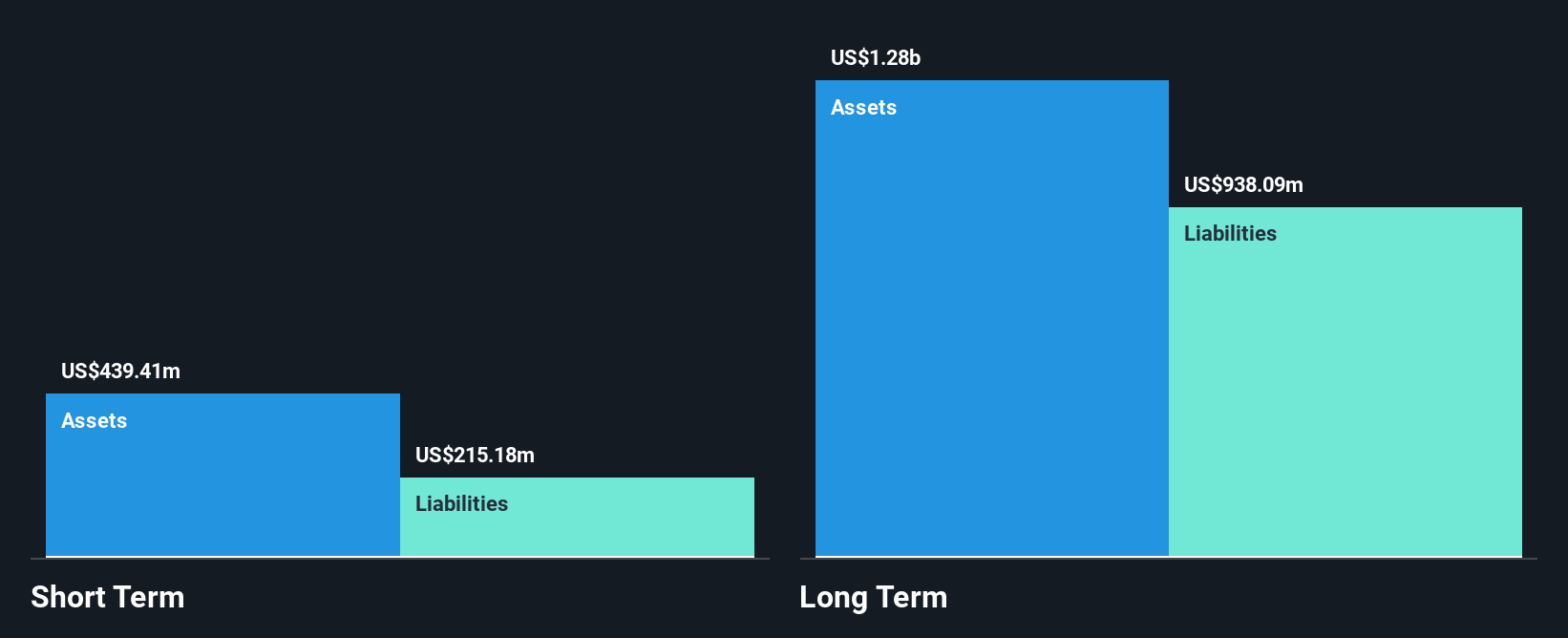

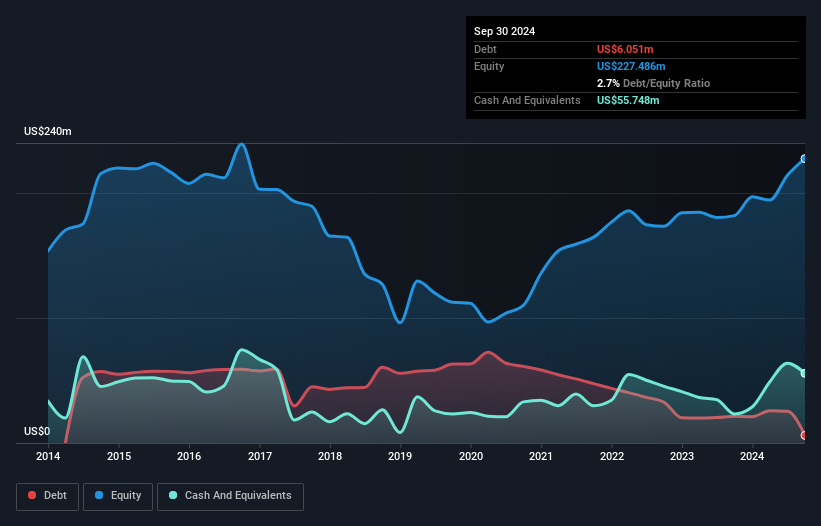

Mandalay Resources Corporation, with a market cap of CA$393.48 million, demonstrates financial robustness in the penny stock realm through strong short-term assets surpassing liabilities and substantial operating cash flow coverage of debt. Recent exploration successes at Björkdal, Sweden highlight potential for extended mine life and resource growth. The company's earnings have surged by 381.7% over the past year, outpacing industry averages, while maintaining high-quality earnings and improved profit margins. Despite recent insider selling and a relatively new management team, Mandalay's strategic focus on enhancing production capacity could bolster its position within the metals and mining sector.

- Click to explore a detailed breakdown of our findings in Mandalay Resources' financial health report.

- Review our growth performance report to gain insights into Mandalay Resources' future.

WonderFi Technologies (TSX:WNDR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: WonderFi Technologies Inc. develops and acquires technology platforms to support investments in digital assets, with a market cap of CA$197.22 million.

Operations: The company's revenue is derived from two main segments: Trading, which generated CA$46.69 million, and Payments, contributing CA$3.95 million.

Market Cap: CA$197.22M

WonderFi Technologies Inc., with a market cap of CA$197.22 million, showcases potential in the penny stock sector through its diversified revenue streams from Trading and Payments segments, generating CA$46.69 million and CA$3.95 million respectively. The company has turned profitable recently, reporting a reduced net loss of CA$2.17 million for the first nine months of 2024 compared to CA$21.51 million previously, although its high volatility remains a concern for investors seeking stability. Despite having more cash than debt, negative operating cash flow indicates challenges in covering liabilities without external financing or improved operational efficiency.

- Dive into the specifics of WonderFi Technologies here with our thorough balance sheet health report.

- Examine WonderFi Technologies' earnings growth report to understand how analysts expect it to perform.

Where To Now?

- Explore the 958 names from our TSX Penny Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DSV

Discovery Silver

A mineral exploration company, engages in the exploration and development of polymetallic mineral deposits.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives